简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Pushes Higher, EURUSD and GBPUSD Suffers - US Market Open

Abstract:US Dollar Pushes Higher, EURUSD and GBPUSD Suffers - US Market Open

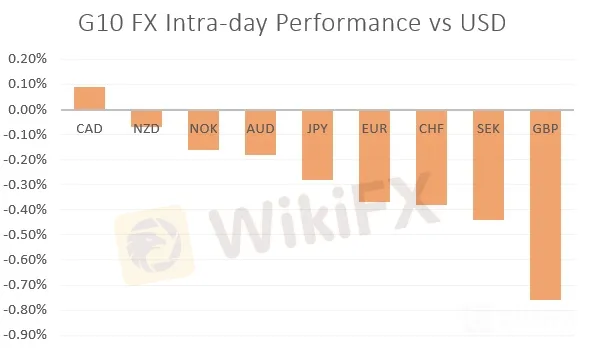

MARKET DEVELOPMENT – USD Pushes Higher, EUR and GBP Suffers

市场发展 - 美元推高,欧元和英镑受损

DailyFX 2019 FX Trading Forecasts

DailyFX 2019外汇交易预测

GBP: Bad to worse for the Pound, which printed a fresh 27-month low at 1.2409 with EURGBP at a 6-month high. The UK jobs report had been relatively mixed with the slowing jobs growth matched with the better than expected wage data (highest in 11yrs), as such, while GBP continued to head lower, the jobs report re-emphasises the likelihood that the BoE will remain on the side-lines for the remainder of the year, unless there is a Brexit shock. Elsewhere, no-deal Brexit worries continued to build as UK Conservative Lawmaker Grieve noted that it may be difficult for parliament to block a no-deal Brexit, while he also stated that a Brexit compromise is increasingly not possible. 1.24 is the line in the sand for GBPUSD, alongside 0.9040 in EURGBP a break through these levels are likely to exacerbate for GBP selling.

英镑:对于英镑而言更糟糕27个月低点1.2409,EURGBP创6个月新高。英国就业报告相对复杂,就业增长放缓与好于预期的工资数据(11年来最高)相符,而英镑继续走低,就业报告再次强调英国央行将保持这种可能性除非出现英国退欧冲击,否则在今年余下时间的边线上。英国保守党立法委员格里夫指出,议会可能很难阻止一项无交易的英国退欧,而他还表示英国脱欧的妥协越来越不可能。英镑兑美元汇率为1.24,而欧元兑英镑汇率为0.9040,突破这些水平可能会加剧英镑卖盘。

EUR: The Euro has also been on the backfoot against the greenback with the latest ZEW Survey further highlighting weak outlook for the Eurozone economy. ECB stimulus looks to be on the way, given that few improvements have been seen ahead of next weeks ECB meeting. EURUSD support at 1.12 level.

欧元:欧元兑美元一直走在后脚,最新的ZEW调查进一步突显欧元区经济前景疲软。由于在下周欧洲央行会议之前几乎没有看到任何改善,欧洲央行的刺激措施似乎即将到来。欧元兑美元支撑位于1.12水平。

USD: While we expect the Federal Reserve to cut interest rates at the July 31st meeting by 25bps, the argument in doing so is beginning to get harder for the Fed after today‘s retail sales figures (following last week’s core inflation figure). The consumer continues to be the silver lining for the US economy after a notable beat in todays report, particularly to retail sales control group at 0.7%. Expect revisions higher in the US GDP trackers throughout the session.

美元:虽然我们预计美联储将在7月31日的会议上将利率降低25个基点,但这样做的争论开始变得更加艰难。美联储在今天的零售销售数据之后(继上周的核心通胀数据之后)。在今天的报告中,消费者继续成为美国经济的一线亮点,尤其是零售销售对照组的0.7%。预计整个交易日美国GDP跟踪器的修正值将更高。

NZD: NZ CPI rose to 1.7%, in line with analyst estimates, while the RBNZs preferred measure also held at 1.7%. Consequently, the NZD has held relatively firm against its major counterparts, however, this data is unlikely to discourage those anticipating further loosening of monetary policy at the August meeting. NZDUSD continues to hover around the 200DMA situated at 0.6715.

新西兰元:新西兰元消费物价指数升至1.7%,与分析师预估一致,而新西兰联储的首选措施也维持在1.7% 。因此,新西兰元对其主要同行保持相对坚定的态度r,这些数据不太可能阻止那些预期在8月会议上进一步放松货币政策的人士。新西兰元兑美元继续徘徊在位于0.6715的200日均线附近。

Source: DailyFX, Thomson Reuters

来源:DailyFX,汤森路透

IG Client Sentiment

IG客户端情绪

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Economic and Political Shifts Impact Global Markets Part 2

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

Economic and Political Shifts Impact Global Markets Part 1

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

GEMFOREX - weekly analysis

The week ahead: 5 things to watch

WikiFX Broker

Latest News

eToro Adds ADX Stocks to Platform for Global Investors

Why Do You Keep Blowing Accounts or Making Losses?

B2BROKER Launches PrimeXM XCore Support for Brokers

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Checkout FCA Warning List of 21 FEB 2025

Google Bitcoin Integration: A Game-Changer or Risky Move?

IG 2025 Most Comprehensive Review

Why Should Women Join FX Market?

ED Exposed US Warned Crypto Scam ”Bit Connect”

Currency Calculator