简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBPUSD Rate Vulnerable to Dovish BoE Forward Guidance

Abstract:Fresh updates from the Bank of England (BoE) may produce headwinds for the British Pound if the central bank alters the forward guidance for monetary policy.

British Pound Talking Points

英镑谈话要点

GBPUSD holds above the monthly-low (1.2382) ahead of the Bank of England (BoE) meeting, but fresh projections coming out of the central bank may produce headwinds for the British Pound if Governor Mark Carney and Co. alter the forward guidance for monetary policy.

在英国央行(BoE)会议召开之前,英镑兑美元维持在月度低点(1.2382)之上,但新的预测出现在如果州长马克卡尼和公司改变货币政策的前瞻指引,中央银行可能会为英镑产生逆风。

GBPUSD Rate Vulnerable to Dovish BoE Forward Guidance

英镑兑美元汇率易受英国央行前瞻指引的影响

The British Pound appears to be stuck in a narrow range following change in UK leadership, but headlines surrounding Brexit may continue to shake up the near-term outlook for GBPUSD as Prime Minister Boris Johnson pledges to meet the October 31 regardless of the outcome.

在英国领导层发生变化后,英镑似乎陷入窄幅区间,但围绕英国脱欧的头条新闻可能会继续改变英镑兑美元的近期前景,因为总理鲍里斯·约翰逊承诺会面10月31日不管结果如何。

It seems as though the first speech by PM Johnson have eased concerns of a no-deal Brexit as the new leader insists that “we will do a new deal,a better deal that will maximise the opportunities of Brexit while allowing us to develop a new and exciting partnership with the rest of Europe, based on free trade and mutual support.”

似乎约翰逊总统的第一次演讲缓解了对无贸易脱欧的担忧,因为新领导人坚称“我们会这样做一项新协议,一项更好的协议,将最大化英国脱欧的机会,同时允许我们在贸易和互助的基础上与欧洲其他国家建立新的令人兴奋的伙伴关系港口。”

In turn, the Monetary Policy Committee (MPC) may stick to the sidelines as the next meeting on August 1, and the central bank may reiterate that in the event of “a smooth Brexit, an ongoing tightening of monetary policy over the forecast period, at a gradual pace and to a limited extent, would be appropriate to return inflation sustainably to the 2% target at a conventional horizon.”

反过来,货币政策委员会(MPC)可能会在8月1日的下一次会议上坚持观望,并且央行可能会重申,如果“平稳的英国退欧,在预测期内持续收紧货币政策,以逐步的速度和有限的程度,将可持续地将通货膨胀率恢复到2%的目标一个传统的视野。”

More of the same from Governor Carney and Co. may heighten the appeal of the British Pound as the central bank appears to be on track to endorse a wait-and-see approach until the MPC meets again in November.

更多相同的州长卡尼和公司可能会提高英镑的吸引力,因为中央银行似乎有望支持等待 - 并且看看方法直到MPC在11月再次会面。

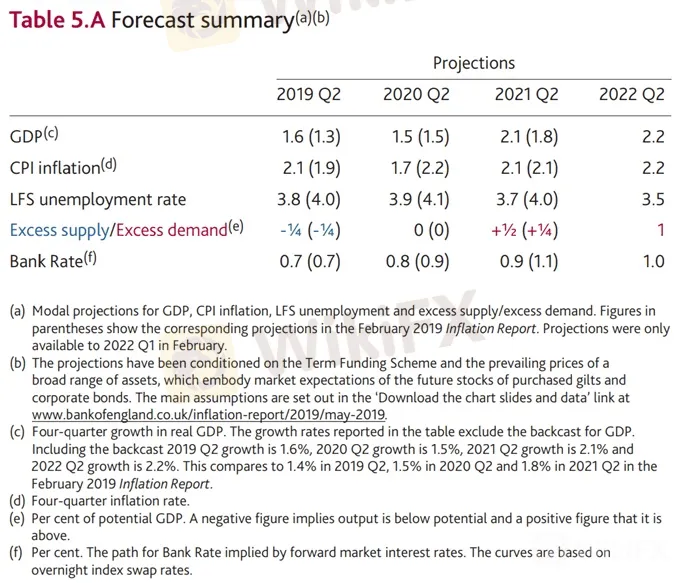

However, the updates to the BoEs quarterly inflation report (QIR) may hint at a looming shift in monetary policy as “GDP is now expected to be flat in Q2.”

然而,BoEs季度通胀报告(QIR)的更新可能暗示货币政策正在转变为“现在预计GDP将会如此在第二季度持平。”

As a result, a downward revision in the economic projections along with a material shift in the MPCs forward guidance may produce headwinds for the British Pound, but retail sentiment remains skewed even though GBPUSD falls back towards the monthly-low (1.2382).

因此,向下修订在经济预测中,随着MPC的重大转变,前瞻性指引可能会对英镑造成逆风,但即使英镑兑美元回落至月度低位(1.2382),零售情绪仍然存在偏差。

{10}

The IG Client Sentiment Report shows 78.0% of traders are still net-long GBPUSD compared to 75.8% earlier this week, with the ratio of traders long to short at 3.54 to 1.

{10}{11}

In fact, traders have remained net-long since May 6 when GBPUSD traded near the 1.3100 handle even though price has moved 5.0% lower since then. The number of traders net-long is 0.5% higher than yesterday and 11.5% higher from last week, while the number of traders net-short is 10.7% lower than yesterday and 5.6% lower from last week.

{11}

The recent decline in net-short interest points to profit-taking behavior as GBP/USD trades near the monthly-low (1.2382), but the ongoing tilt in net-long position offers a contrarian view to crowd sentiment as the exchange rate tracks a bearish trend, with the Relative Strength Index (RSI) highlighting a similar dynamic.

由于英镑/美元交易于月度低位(1.2382)附近,近期净空头利息下降指向获利了结行为,但净多头头寸的持续倾斜提供了对人群情绪的逆向观点由于汇率跟踪看跌趋势,相对强弱指数(RSI)突显了类似的动态。

GBP/USD Rate Daily Chart

英镑/美元汇率每日图表

Keep in mind, the broader outlook for GBP/USD is no longer constructive as the exchange rate snaps the upward trend from late last year after failing to close above the Fibonacci overlap around 1.3310 (100% expansion) to 1.3370 (78.6% expansion).

请记住,英镑/美元的更广阔前景是n由于汇率在未能收于斐波那契重叠点1.3310(100%扩大)至1.3370(扩大78.6%)之上,汇率从去年年底开始回升,因此汇率更具建设性。

The rebound from the monthly-low (1.2382) may continue unravel amid the failed attempts to test the Fibonacci overlap around 1.2610 (23.6% retracement) to 1.2640 (38.2% expansion), with the lack of momentum to hold above the 1.2440 (50% expansion) region raising the risk for a move towards 1.2370 (50% expansion).

月度低点(1.2382)的反弹可能继续在尝试测试斐波纳契重叠1.2610(23.6%回撤位)至1.2640(38.2%扩张)的失败尝试失败,缺乏动力以维持在1.2440(50%扩张)区域上方,提升向1.2370移动的风险( 50%扩张)。

Next region of interest comes in around 1.2240 (61.8% expansion) followed by the 1.2100 (61.8% expansion) handle.

下一个感兴趣的区域大约在1.2240(扩张61.8%),然后是1.2100(扩大61.8%)。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Sterling (GBP) Turnaround on Data Beat and Brexit Commentary - Webinar

After opening the session in negative territory, GBPUSD performed a quick U-turn after UK manufacturing, industrial production and monthly GDP data all beat expectations. And over in Ireland, UK PM Boris Johnson was in a more conciliatory mood.

Sterling (GBP) Price Drifts Lower on Brexit Uncertainty, Hard Data Flow Next

GBPUSD opens the week on the backfoot as Brexit rumours and news flow continue to keep traders on the sidelines. UK data on deck with a look at monthly GDP.

Sterling (GBP) Price Outlook Rattled by Brexit Confusion, PMI Weakness

Sterling remains under pressure with little scope for a sustained upside move as Brexit continues to weigh on market sentiment, while the latest batch of PMIs point to the UK economy contracting in Q3.

GBPUSD Price Outlook Fragile as Boris Johnson Heads to Europe

UK PM Boris Johnson is off to Europe for meetings with French President Emmanuel Macron and German Chancellor Angela Merkel with Sterling traders watching events closely.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

The One Fear That’s Costing You More Than Just Profits

Currency Calculator