简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Gains Kept Afloat by Robust ETF Holdings and Demand

Abstract:Gold price gains have stalled over the last two weeks, but continuous demand for gold exposure in the ETF market could look to assist the trend higher.

Gold Price Outlook:

黄金价格展望:

XAUUSD is up 10.5% in the year-to-date as upcoming Fed rate cuts look to stoke inflation

今年迄今XAUUSD上涨10.5%因为即将到来的美联储降息会引发通货膨胀

Similarly, investors have expressed growing concern of the US economy and stock market which could be partially responsible for increased gold holdings

同样,投资者也表达了对美国经济和股市的担忧,这可能是增加的部分原因。黄金持有

Conversely, the high-yielding HYG and JNK ETFs have recorded net inflows for the year, signaling that not all investors share the same concerns

相反,高收益的HYG和JNK ETF已录得全年净流入,表明并非所有投资者都有同样的担忧

Gold Price Gains Kept Afloat by Robust ETF Holdings and Demand

强劲的ETF控股和需求保持黄金价格上涨

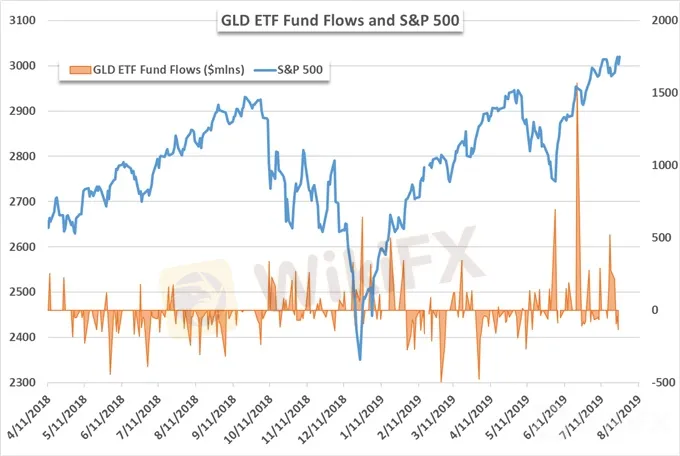

Gold has climbed 10.5% in the year-to-date after its spot price surged in June. Since then, gains have been meager but continued demand reflected in ETF fund flow data suggests investors are still optimistic the precious metal will continue its journey higher. Since its June rally, the gold-tracking GLD ETF has registered 3.4 billion in net inflows.

在6月份现货价格飙升之后,今年迄今为止黄金价格已经上涨了10.5%。此后,收益微弱,但ETF基金流量数据反映的持续需求表明投资者仍然乐观地认为贵金属将继续走高。自6月份反弹以来,跟踪黄金的GLD ETF净流入量已达34亿。

Source: Bloomberg

资料来源:Bloomberg

Gold‘s price spike in June saw investors clamor for exposure to the yellow metal as they aimed, or perhaps hoped, to latch onto an extension of the breakout. This resulted in GLD’s largest intraday inflow ever on June 21, with nearly $1.6 billion entering the fund. The recent demand has pushed the total to almost $1.6 billion in net inflows for the year-to-date. It is worth noting this data does not include flows to the gold “mini” ETF, GLDM. That said, total ETF holdings of gold remain near their 2019 high of 75 million ounces according to data from Bloomberg.

6月份黄金价格飙升,投资者吵着接触黄金,因为他们瞄准或者希望锁定黄金的延伸爆发。这导致GLD在6月21日有史以来最大的盘中流入,有近16亿美元进入该基金。最近的需求使得今年迄今为止净流入的总额已接近16亿美元。值得注意的是,这一数据不包括流向黄金“迷你”ETF,GLDM。尽管如此,根据彭博社的数据,ETF持有的黄金总量仍接近其2019年的7500万盎司高位。

Source: Bloomberg

资料来源:Bloomberg

Golds price climb has been fanned by the likelihood that the Federal Reserve will cut the Federal Funds rate at its July FOMC meeting next week. A potentially lower Fed Funds rate has stoked inflation expectations – allowing gold to enjoy some demand as a hedge against inflation.

黄金价格攀升受到了可能性的影响美联储将在下周的7月FOMC会议上削减联邦基金利率。可能较低的联邦基金利率已经引发通胀预期 - 允许黄金作为对冲通胀的一些需求。

Elevated concern regarding the health of the US economy and the stock market could also give rise to safe haven demand, another key characteristic of the precious metal. While concern in some areas of the economy is merited, not all investors are convinced as some continue to pile funds into the high-risk, high-reward HYG and JNK ETFs.

对美国经济和股市健康状况的担忧加剧也可能导致避险需求,这是贵金属的另一个关键特征。虽然一些经济领域的担忧是值得的,但并非所有投资者都相信,因为有些人继续将资金投入高风险,高回报的HYG和JNK ETF。

Source: Bloomberg

资料来源:Bloomberg

The HYG ETF offers exposure to high-yield corporate debt which is expectedly risky. With the potential for looser monetary policy, the fund flows suggest investors are betting cheaper credit will allow the underlying distressed companies to remain afloat while investors grasp for yield in a lower-for-longer interest rate environment. The aptly named JNK ETF, because it offers exposure to largely junk bonds, has seen a similar trend in recent weeks but with more frequent outflows.

HYG ETF提供高收益公司债务,预计存在风险。由于可能出现宽松的货币政策,基金流量表明投资者认为较低的信贷将允许潜在的陷入困境的公司维持运营,同时投资者在较低的利率环境中掌握收益率。恰如其名的JNK ETF,因为它提供了大部分垃圾债券,近几周出现了类似的趋势,但流出的频率更高。

Source: Bloomberg

Despite noteworthy outflows, JNK has seen a net inflow of $1.7 billion in the year-to-date. The demand for both gold and high-yield debt illustrates the divergent nature which the market is currently experiencing. Concern regarding the lofty valuation of the S&P 500 is widespread, but many are unwilling to miss out on a continuation rally. Still, it could be argued the build up in gold holdings is indicative of larger themes at play – beyond mere price action.

尽管有值得注意的资金流出,但JNK今年迄今已净流入17亿美元。对黄金和高收益债券的需求说明了市场目前正在经历的不同性质。关注t标准普尔500指数的高估值普遍存在,但许多人不愿意错过持续的反弹。尽管如此,可以认为黄金持有量的增加表明了更大的主题 - 仅仅是价格行为。

Gold Price Chart (XAUUSD): Daily Time Frame (August 2018 – July 2019)

黄金价格走势图(XAUUSD):每日时间表(2018年8月 - 2019年7月)

That said, next week‘s FOMC meeting could play a critical role in the outlook for gold’s price through the latter half of 2019. While the outlook appears tilted to the topside at present, a pivot in monetary policy could quickly shift the economic landscape. While such a pivot is unlikely, market participants should be cognizant of all possibilities. In the interim, traders can look to gold technicals for shorter-term guidance.

这就是说,下周的FOMC会议可能会发挥关键作用在2019年下半年黄金价格前景展望中。虽然目前看来上行倾向于上行,但货币政策的一个支点可能会迅速改变经济格局。虽然这种支点不太可能,但市场参与者应该认识到所有可能性。在此期间,交易者可以查看黄金技术指标以获得短期指导。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The U.S. dollar index and U.S. Treasury yields rebounded at the same time; gold fell by more than 1%!

The initial value of the US S&P Global Manufacturing PMI in August was 48, which was lower than expected and the lowest in 8 months; the service PMI was 55.2, which exceeded the expected 54. The number of initial jobless claims in the week ending August 17 was 232,000, slightly higher than expected, and the previous value was revised from 227,000 to 228,000. Existing home sales in July increased for the first time in five months. The PMI data was lower than expected, which was bad for the US eco

The U.S. dollar index returned to the 103 mark; gold once plunged nearly $40 from its intraday high!

The monthly rate of retail sales in the United States in July was 1%, far exceeding expectations; the number of initial claims last week was slightly lower than expected, falling to the lowest level since July; traders cut their expectations of a rate cut by the Federal Reserve, and interest rate futures priced that the Federal Reserve would reduce the rate cut to 93 basis points this year. The probability of a 50 basis point rate cut in September fell to 27%. The data broke the expectation of a

Gold Price Stimulates by Geopolitical Tension

Gold prices experienced their largest gain in three weeks, driven by escalating tensions in the Middle East and the easing of the U.S. dollar as markets await the crucial CPI reading due on Wednesday. Gold has surged to an all-time high above $2,460, as uncertainties surrounding developments in both the Middle East and Eastern Europe persist push the demand for safe-haven assets higher.

KVB Today's Analysis: USD/JPY Eyes Volatility Ahead of BoJ Policy Meeting and US Data

The USD/JPY pair rises to 154.35 during the Asian session as the Yen strengthens against the Dollar for the fourth consecutive session, nearing a 12-week high. This is due to traders unwinding carry trades ahead of the Bank of Japan's expected rate hike and bond purchase tapering. Recent strong US PMI data supports the Federal Reserve's restrictive policy. Investors await US GDP and PCE inflation data, indicating potential volatility ahead of key central bank events.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator