简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Eyes 2019 High, GBPUSD Plummets Through 1.2300 - US Market Open

Abstract:US Dollar Eyes 2019 High, GBPUSD Plummets Through 1.2300 - US Market Open

MARKET DEVELOPMENT –US Dollar Eyes 2019 High, GBPUSD Breaks Down

市场发展 - 美元关注2019年高点,英镑兑美元下跌

DailyFX 2019 FX Trading Forecasts

DailyFX 2019外汇交易预测

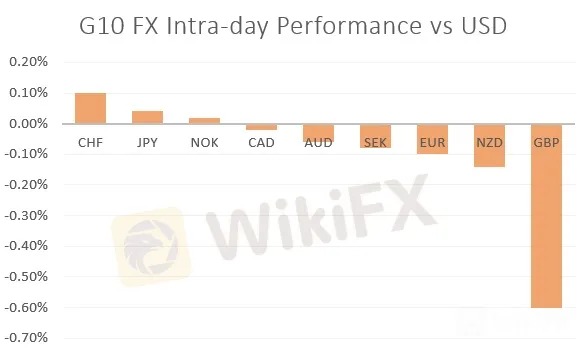

USD: The US Dollar is gaining across the board with the exception of the safe-haven JPY and CHF. Much of the gains in the greenback have been attributed to the drop in the Pound, which trades at fresh 28-month lows. With little on the economic calendar throughout the rest of the session, eyes will be firmly fixed on the upcoming FOMC meeting, in which the central bank is expected to lower interest rates for the first time in over a decade. On the technical front, YTD highs reside at 98.37.

美元:美元全线上涨避险日元和瑞士法郎除外。美元的大部分涨幅都归因于英镑的下跌,英镑在28个月的新低中交易。在整个会议剩余时间里,经济日历上几乎没有什么,将在未来的联邦公开市场委员会(FOMC)会议上牢牢确定,中央银行预计将在十多年来首次降低利率。在技术方面,年初至今的高点位于98.37。

GBP: No-deal Brexit risks continue to rise as Boris Johnsons key cabinet members vocalise their step up in no-deal Brexit preparation. Over the weekend, Michael Gove stated that the government are working on the assumption that the EU would not strike a fresh Brexit agreement, while Foreign Secretary Raab noted that the change must come from the EU. Consequently, GBPUSD is breaking down with the pair testing 1.2300 as it trades at its lowest level in 28-months, while EURGBP once again hits key trendline resistance. That said, speculators have also increased their bearish sentiment on the currency with net shorts at extreme levels.

英镑:无交易脱欧风险继续上涨,因为鲍里斯约翰逊的关键内阁成员们在无交易脱欧准备中加入了他们的步伐。上周末,迈克尔戈夫表示,政府正在假设欧盟不会达成新的英国退欧协议,而外交大臣拉布则指出,这一变化必须来自欧盟。因此,英镑兑美元正在突破该货币对测试1.2300,因为它在28个月内处于最低水平,而欧元兑英镑再次触及关键的趋势线阻力位。也就是说,投机者也增加了对该货币的看跌情绪,净空头处于极端水平。

EUR: A big week for the Euro with key data in the form of Eurozone GDP and CPI, which will likely reaffirm the message put forward by the ECB last week, that a fresh stimulus package is needed. The drop in the Euro throughout the morning has largely followed the breakdown observed in the Pound. However, 1.1100 barriers that had spurred a bounce post ECB are at risk of being tested once again.

欧元:欧元区的重要数据,以欧元区GDP形式出现关键数据和CPI可能会重申欧洲央行上周提出的信息,即需要一揽子新的刺激计划。整个上午欧元的下跌主要跟随英镑的崩溃。然而,刺激欧洲央行反弹的1.1100障碍有可能再次受到考验。

{7}

Source: DailyFX, Thomson Reuters

{7}

IG Client Sentiment

IG客户端情绪

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Economic and Political Shifts Impact Global Markets Part 2

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

Economic and Political Shifts Impact Global Markets Part 1

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

GEMFOREX - weekly analysis

The week ahead: 5 things to watch

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

New SEC Chair Paul Atkins Targets Crypto Regulation Reform

ED Exposed US Warned Crypto Scam ”Bit Connect”

Currency Calculator