简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EURUSD Searches for Support as Fed Tames Bets for Rate Easing Cycle

Abstract:EURUSD searches for support ahead of the US Non-Farm Payrolls (NFP) report as the Federal Reserve tames speculation for a rate easing cycle.

EUR/USD Rate Talking Points

EURUSD trades to a fresh monthly low (1.1060) following the Federal Reserve interest rate decision, and the exchange rate may continue to search for support over the coming days as the US Non-Farm Payrolls (NFP) report is anticipated to highlight a robust labor market.

EURUSD Searches for Support as Fed Tames Bets for Rate Easing Cycle

EURUSD snaps the range bound price action from earlier this week even though the Federal Open Market Committee (FOMC) implements a 25bp reduction in the benchmark interest rate as the central bank tames speculation for a rate easing cycle.

It seems as though the FOMC is in no rush to reverse the four rate hikes from 2018 as Chairman Jerome Powell insists that the rate cut “is intended to insure against downside risks from weak global growth and trade policy uncertainty.”

The comments suggest the Fed will revert back to a wait-and-see approach as “the Committee still sees a favorable baseline outlook,” and updates to the US Non-Farm Payrolls (NFP) report may encourage Chairman Powell and Co. to strike a more balanced tone as the economy is anticipated to add another 165K jobs in July.

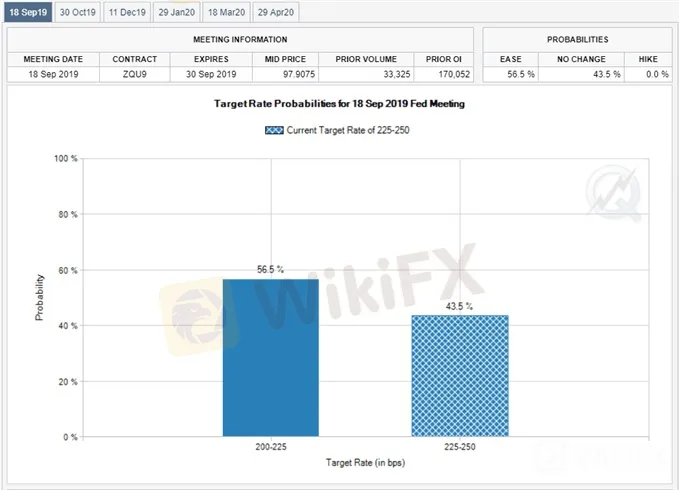

Little signs of a looming recession should push the FOMC to the sidelines, with Fed Fund futures now showing a greater than 40% probability that the FOMC will keep the benchmark interest rate in its current range of 2.25% to 2.50% at the next interest rate decision on September 18.

However, the Fed may come under increased pressure to adopt a more accommodative stance as President Donald Trump favors “a lengthy and aggressive rate-cutting cycle,” and it remains to be seen if the FOMC will further adjust the forward guidance for monetary policy as the central bank pledges to “act as appropriate to sustain the expansion.”

Nevertheless, waning expectations for back-to-back rate cuts may keep EURUSD under pressure, with recent price action raising the risk for a further decline in the exchange rate as it fails to preserve the range from earlier this week.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss key themes and potential trade setups surrounding foreign exchange markets.

EUR/USD Rate Daily Chart

The reaction to the Fed rate cut brings the downside targets back on the radar for EURUSD as the exchange rate snaps the range-bound price action from earlier this week.

Recent developments in the Relative Strength Index (RSI) highlights a similar dynamic as the oscillator fails to retain the bullish formation from earlier this year.

The break/close below the 1.1100 (78.6% expansion) handle opens up the 1.1040 (61.8% expansion) region, with the next area of interest coming in around 1.0950 (100% expansion) to 1.0980 (78.6% retracement).

Will keep a close eye on the RSI as it approaches oversold territory, with a break below 30 raising the risk for a further decline in the exchange rate as the bearish momentum gathers pace.

For more in-depth analysis, check out the 3Q 2019 Forecast for Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other markets the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

USDCAD Rebound to Benefit from Sticky US Consumer Price Index (CPI)

Updates to the US Consumer Price Index (CPI) may keep USDCAD afloat as the figures are anticipated to highlight sticky inflation.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

What Impact on Investors as Oil Prices Decline?

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

Currency Calculator