Score

Blue Ocean

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://blueocex.com

Website

Rating Index

Contact

Licenses

Licenses

Licensed Entity:Blue Ocean Financials Limited

License No. MB/21/0071

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Blue Ocean also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Taurex

- 5-10 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

Website

blueocex.com

Website Domain Name

blueocex.com

Server IP

104.21.10.247

Company Summary

| Basic | Information |

| Registered Countries | Saint Vincent and the Grenadines |

| Regulation | No License |

| Company Name | Blue Ocean Financials Limited |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:5000 |

| Minimum Spread | From 0.0 pips |

| Trading Platform | MT5, cTrader |

| Trading Assets | Shares, Indices, Precious Metals, Energies, Cryptocurrencies, Forex, Spot Commodities |

| Payment Methods | N/A |

| Customer Support | Email Phone, Online Chat Support |

General Information

Blue Ocean is a regulated financial institution headquartered in Labuan, Malaysia, offering traders access to global markets through various market instruments. They are licensed by the Labuan Financial Services Authority (LFSA) and operate under the license number MB/21/0071.

Blue Ocean offers a diverse range of market instruments to meet the needs of different traders. These instruments include Forex, Shares, Indices, Precious Metals, Energies, Soft Commodities, and Cryptocurrencies. Traders can take advantage of leveraged trading, allowing them to control larger positions in the market with a smaller amount of capital. The company provides multiple account types, including Classic and Premium accounts, catering to traders of all levels of experience.

Traders can access the MetaTrader 5 (MT5) and cTrader platforms, which offer advanced features and tools for trading. Blue Ocean also provides various trading tools, such as exclusive technical indicators, trading calculators, an economic calendar, and customizable widgets. These tools aim to enhance traders' decision-making processes and improve their trading strategies.

Pros and Cons

Blue Ocean Financials Limited offers a wide range of market instruments and account types, catering to both novice and experienced traders. With access to global markets and the availability of leveraged trading, Blue Ocean provides opportunities for diversification and profit in rising and falling markets. The trading platforms, MetaTrader 5 (MT5) and cTrader, offer advanced features and tools for trading. However, it is important to note the lack of detailed spreads information, and poor customer support. While Blue Ocean presents potential advantages for traders, it is crucial to consider the associated risks and limitations before engaging in trading activities.

| Pros | Cons |

| Access to a wide range of global markets | Weak information |

| Availability of leveraged trading | Average spreads level |

| Multiple payment options | Poor customer support |

| MT5 and cTrader trading platforms | Deposit fees (4.00%) |

| Islamic trading available | Withdrawal fees (1.00%) |

| Limited withdrawal fee details | |

| Demo account not mentioned |

Is Blue Ocean Legit?

Blue Ocean is holding two “ Suspcious Clone ” licenses from LFSA in Malaysia and ASIC in Australia, respectively, which means this broker is operating without any legitimate regulation. Therefore, trading with this broker contains a high level of risks.

Market Instruments

Blue Ocean offers a range of market instruments to provide traders with access to global markets. Here is a brief description of each market instrument:

Forex: The Foreign Exchange market, known as Forex, is the largest and most liquid market globally, with daily trading volumes exceeding $6.5 trillion. It operates 24 hours a day, five days a week, making it accessible to traders from around the world. Forex trading allows participants to speculate on the fluctuations in exchange rates between different currency pairs.

Shares: Blue Ocean provides access to over 100+ shares across the world's largest markets. Trading Contracts for Difference (CFDs) on shares allows traders to gain exposure to stock price movements with a small initial deposit. CFDs on shares offer the potential to profit from both rising and falling stock prices.

Indices: Trading CFDs on indices enables traders to speculate on the performance of various stock markets worldwide. By trading indices, traders can gain exposure to the overall stock market performance of a particular country or region. It allows for diversification and the opportunity to capitalize on market trends.

Precious Metals: Trading precious metals, such as gold and silver, is a popular way to diversify investment portfolios. Precious metals are often considered “safe-haven” assets that investors turn to during uncertain and volatile market conditions. With Blue Ocean, traders can speculate on the price movements of these precious metals.

Energies: Blue Ocean offers trading opportunities in energy markets, such as oil and gas. Trading energy products allows traders to diversify their portfolios without having to physically purchase the underlying commodities. This provides exposure to energy market fluctuations and the potential to profit from price movements.

Soft Commodities: Soft commodities refer to perishable products, primarily agricultural products. Blue Ocean allows traders to participate in trading soft commodities like cocoa, coffee, cotton, and sugar. Trading soft commodities provides exposure to the agricultural sector and allows traders to speculate on price movements in these markets.

Cryptocurrencies: Blue Ocean facilitates trading in popular cryptocurrencies on margin. This means traders can trade cryptocurrencies without needing to own the digital assets themselves. It provides an opportunity to benefit from the price volatility of cryptocurrencies without the need for a separate digital wallet.

Account Types

Blue Ocean offers two types of trading accounts: Classic and Premium. These account options cater to both novice and experienced traders.

CLASSIC:

The Classic account offered by Blue Ocean requires a minimum deposit of $100. Traders with this account type have access to the MT5 trading platform. The spreads for this account start from 1.5 pips, and there are no commissions charged per lot. The minimum lot size is 0.01 lot. Traders can enjoy a maximum leverage of 1:5000. The account is denominated in USD, and there are no funding or withdrawal fees associated with it. The stop out level is set at 50%. This account type allows trading in all available markets, and traders can use Expert Advisors (EAs), engage in scalping, and participate in news trading. Additionally, Blue Ocean offers a swap-free Islamic account option for those who require it.

PREMIUM:

The Premium account is designed for more experienced traders and requires a minimum deposit of $5000. Like the Classic account, it provides access to the MT5 trading platform. The spreads for the Premium account start from 1.0 pip, and there are no commissions charged per lot. The minimum lot size is 0.01 lot. The maximum leverage for this account is 1:500. Similar to the Classic account, it is denominated in USD, and there are no funding or withdrawal fees. The stop out level is also set at 50%. Traders with the Premium account have access to all available markets and can utilize EAs, scalping strategies, and news trading. A swap-free Islamic account option is available for those who require it.

How to Open an Account?

To open an account with Blue Ocean, you need to follow these steps:

Visit the Blue Ocean website: Go to the Blue Ocean website to start the account opening process. The website address may vary, so ensure you are on the official Blue Ocean website.

Select Open Account: ‘Register’ or similar option on the website. It is usually located prominently on the homepage or in the main menu.

3. Fill in the login information: Provide the necessary login information. This includes entering your desired username, email address, phone number, and password. Make sure to fill in all the required fields accurately.

4. Review and accept terms and policies: Read and understand the Terms of Business, Risk Disclosure, and Order Execution Policy provided by Blue Ocean. These documents outline important information and responsibilities as a customer. It's essential to review them carefully. Once you have read and understood the terms, check the box or provide consent to indicate your acceptance.

5. Provide personal information: Enter your personal information, including your full name and country of residence. Ensure that the information provided is accurate and matches your official identification documents.

6. Review and confirm: Review all the information you have provided for accuracy. Make any necessary corrections before proceeding.

7. Submit the application: Once you are satisfied with the information entered, submit your account application. Blue Ocean may require additional verification steps to complete the account opening process. They may contact you for further documentation or verification if necessary.

Demo Accounts

With Blue Ocean 's demo account, prospective traders can test out different trading strategies to trading without putting their own money at danger, resulting in a more relaxed trading experience.

Spreads & Commissions

Blue Ocean offers two types of trading accounts: Classic and Premium. The Classic account has spreads starting from 1.5 pips and no commissions per lot. The Premium account provides spreads starting from 1.0 pip and no commissions per lot.

Leverage

Maximum leverage for major forex is 1:30 in Europe and Australia, and 1:50 in the U.S. and Canada, while Blue Ocean enables its clients to use leverage of up to 1:5000. This is crazily higher than the proper amount considered appropriate by most regulators.

Since leverage can amplify both gains and losses, it can result in devastating losses for investors who lack experience. If you're just starting out in the trading world, it's best to stick with the lower size.

Trading Platform

Blue Ocean Financials offers two trading platforms, MetaTrader 5 (MT5) and cTrader. Both platforms provide traders with advanced features and tools for trading. Now let's take a look at the pros and cons of these platforms:

MetaTrader 5 (MT5):

MetaTrader 5 is the successor to the popular MetaTrader 4 and offers enhanced features, flexibility, and speed for traders. It provides additional trading timeframes, order flexibility, and improved strategy testing speeds. The platform is available for desktop and mobile devices, allowing traders to access their accounts and trade from anywhere. MT5 also includes features like Depth of Market (DoM) for greater market liquidity visibility, 21 different timeframes for increased market perspective, and greater order flexibility with additional pending order methods.

cTrader:

The cTrader platform offered by Blue Ocean Financials provides a comprehensive and innovative trading experience. It offers lower spreads and commissions, market execution, and advanced technical features. The platform is available in desktop, mobile, and web versions, allowing traders to access their accounts and trade across various devices. cTrader comes with a wide range of features, including pre-installed technical indicators, multiple chart types and timeframes, Depth of Market (DoM), advanced order protection, customizable charts and interface, news feed, economic calendar, market sentiment, and more.

| Pros | Cons |

| Improved strategy testing speeds in MT5. | Lack of MT4 trading platform |

| Availability of MetaTrader 5 (MT5) and cTrader platforms. | |

| Additional trading timeframes in MT5. | |

| Availability of desktop, mobile, and web versions | |

| Depth of Market (DoM) tool for market liquidity visibility in MT5. |

Payment Methods

Blue Ocean provides multiple options for depositing and withdrawing funds. The minimum deposit amount is $100, and the supported currencies for deposits include USD, EUR, GBP, and NZD. Traders can choose from various payment methods, including FPX, 9PAY, Bitcoin, Ethereum, Tether, PayBNB, VISA, MASTERCARD, PAYU, IDEAL, and more.

Deposit Fees: When making deposits using VISA, MASTERCARD, or JCB, a fee of 4.00% is charged.

Withdrawal Fees: For withdrawals, fees are applicable depending on the chosen method. Withdrawals through 9Pay, Tether, PayBNB, and credit cards are subject to a fee of 1.00%. Withdrawals involving USDT.TRC20 are charged a fee of 1.00% plus USDT.TRC2010. Withdrawals in VND currency are subject to a fee of 1.00% plus VND5500.

| Pros | Cons |

| Multiple payment options | Deposit fees (4.00%) |

| Instant processing | Withdrawal fees (1.00%) |

| Multiple currency options | Limited withdrawal fee details |

Trading Tools

Blue Ocean provides traders with a range of trading tools to enhance their trading experience and decision-making processes. These tools include: Exclusive Technical Indicators: Blue Ocean offers powerful technical indicators that assist traders in analyzing market trends, identifying potential entry and exit points, and making informed trading decisions.

Trading Calculators: Blue Ocean provides trading calculators that help traders calculate essential trading parameters such as pip value, position size, and risk management parameters. These calculators enable traders to plan their trades effectively and manage their risk.

Economic Calendar: Blue Ocean's economic calendar provides traders with up-to-date information on important market-moving events, including their dates, times, relevant currencies, and estimated volatility. This tool helps traders stay informed about key economic releases and announcements that can impact the financial markets.

Widgets: Blue Ocean offers free financial widgets that traders and website owners can integrate into their websites. These widgets are professionally designed and can enhance the functionality and visual appeal of the website. They provide real-time market data, charts, and other relevant information, attracting more visitors and potentially increasing revenue for Blue Ocean partners.

Education: Blue Ocean recognizes the importance of knowledge and education in trading. They offer educational resources where traders can learn the basics of trading, including topics like price fluctuation, reading price charts, and making profits through CFDs trading. These educational materials aim to empower traders and help them take their first steps in their investing careers.

Overall, the trading tools provided by Blue Ocean aim to enhance the trading experience of their clients, offering them valuable insights, technical analysis capabilities, risk management tools, and educational resources to improve their trading strategies and decision-making.

| Pros | Cons |

| Exclusive technical indicators to analyze market trends | Limited customization options for trading calculators |

| Trading calculators for effective trade planning | Economic calendar may lack comprehensive event coverage |

| Up-to-date economic calendar for market information | Limited variety of widgets available |

| Free financial widgets to enhance website functionality | Educational resources may lack in-depth content and advanced topics |

| Educational resources to empower traders | Limited interactivity or personalization in educational materials |

| Focus on improving trading strategies and decision-making | Potential dependency on Blue Ocean's tools for market information |

Customer Support

Blue Ocean provides customer support through multiple channels. Traders can contact their customer support team via email at Support@blueocex.com. Additionally, there is a live chat option available on their website, where traders can directly interact with their customer support representatives. The customer support is described as professional and prompt, and they are available 24/5 to assist with any questions or issues related to trading.

Location:

Blue Ocean is located at Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St. Vincent and the Grenadines. This address serves as their physical location for contacting them or sending any correspondence.

Email:

Traders can reach out to Blue Ocean's customer support team via email at Support@blueocex.com. They can address any inquiries, concerns, or comments by sending an email to this address. There may also be a form available on their website that traders can fill out to contact customer support.

Website:

Blue Ocean's official website is www.blueocex.com. Traders can visit the website to access information about their services, trading accounts, trading platform, and other relevant details. The website serves as a hub of information and may also provide additional resources or educational materials.

Conclusion

In conclusion, Blue Ocean offers traders access to a wide range of global markets. The platform provides various market instruments, including forex, shares, indices, precious metals, energies, soft commodities, and cryptocurrencies, allowing for potential diversification and profit opportunities. With account options catering to both novice and experienced traders, Blue Ocean offers flexibility and accessibility. The availability of leveraged trading, multiple payment options, and trading platforms like MetaTrader 5 and cTrader further enhance the trading experience. However, there are certain disadvantages, such as the lack of detailed spreads information, limited trading assets and poor customer support. Additionally, deposit and withdrawal fees may apply. Traders should carefully consider these pros and cons before engaging with Blue Ocean.

FAQs

Q: What market instruments does Blue Ocean offer?

A: Blue Ocean offers a variety of market instruments, including Forex (foreign exchange), shares, indices, precious metals, energies, soft commodities, and cryptocurrencies.

Q: What are the pros of trading with Blue Ocean?

A: Some advantages of trading with Blue Ocean include access to a wide range of global markets, potential for diversification in investments, availability of leveraged trading, and the ability to trade popular assets without ownership.

Q: What are the cons of trading with Blue Ocean?

A: Some disadvantages of trading with Blue Ocean include a lack of detailed spreads information, limited trading assets, poor customer support, and a lack of transparent regulation.

Q: What types of trading accounts does Blue Ocean offer?

A: Blue Ocean offers two types of trading accounts: Classic and Premium. The Classic account is accessible with a minimum deposit of $100, while the Premium account requires a minimum deposit of $5000.

Q: What leverage options are available with Blue Ocean?

A: Blue Ocean offers different leverage options for traders. The Classic account provides a maximum leverage of 1:5000, while the Premium account offers a maximum leverage of 1:500.

Q: What are the deposit and withdrawal options with Blue Ocean?

A: Blue Ocean provides multiple options for depositing and withdrawing funds, including FPX, 9PAY, Bitcoin, Ethereum, Tether, PayBNB, VISA, MASTERCARD, PAYU, IDEAL, and more. Fees may apply for certain payment methods.

Q: What trading platforms are offered by Blue Ocean?

A: Blue Ocean offers two trading platforms: MetaTrader 5 (MT5) and cTrader. These platforms provide advanced features and tools for trading.

Q: What trading tools are available with Blue Ocean?

A: Blue Ocean provides traders with exclusive technical indicators, trading calculators, an economic calendar, widgets for website integration, and educational resources to enhance their trading experience.

Q: How can I contact Blue Ocean's customer support?

A: Blue Ocean's customer support can be reached via email at Support@blueocex.com or through the live chat option on their website. They are available 24/5 to assist with any trading-related inquiries or concerns.

Q: Where is Blue Ocean located?

A: Blue Ocean is located at Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St. Vincent and the Grenadines.

Keywords

- 2-5 years

- Suspicious Regulatory License

- cTrader

- Suspicious Scope of Business

- High potential risk

Comment 5

Content you want to comment

Please enter...

Comment 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

-MY-

Malaysia

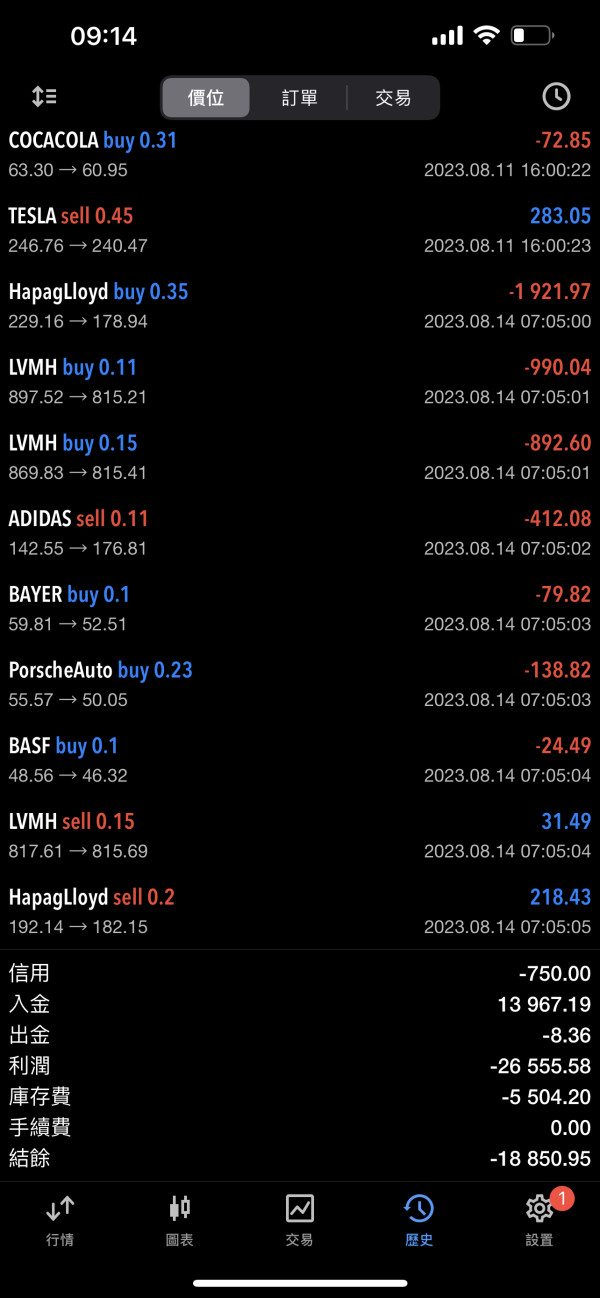

I started trading with an account of US$1,000, and while making profits, my principal was recharged to US$5,000. However, due to excessive trading, I needed to cover my position to cover overnight fees and finally took out a loan of US$10,000. Later, I told the fund manager (Hayd) that I needed to trade safely to withdraw money. The result was that I entered the market at constant high points. Finally, it exploded when I woke up one day. During this period, everyone told me not to trade privately and that they would help me. Analyze how supports can play safely...but there were almost no supports in the last week of the explosion. I felt more at ease at that time. But every time you recharge, it is a different third-party bank account. Bank accounts in other industries have come out. The fund manager didn't say anything after the liquidation, which was equivalent to a direct disconnection. Today I am still paying off my loan. Not sleeping well every night. I feel hopeless in life The three-party bank account names are FEYNMAN TRADING INFINITY FRESH’s KOKSENG ELECTRICAL etc.

Exposure

2023-09-19

安静的小韭菜

Cyprus

It is a nice platform to invest in. The user interface is nice as well. A demo account is worth using. However, I don't know why they keep on asking to invest more money. Like now, if I want to withdraw, I don't know how to! Apart from that, It is recommended.

Neutral

2023-02-23

FX1167061492

Netherlands

Everything presented is seemingly attractive, but when you dive deep, you would find this broker is totally a scam, without any regulation. I would not recommend this useless broker to anyone else.

Neutral

2022-12-19

囡囡

Malaysia

I traded well on it, and made some profits. My friend suddenly told this platform to be a black platform, and one of his friends was cheated. I immediately contacted the customer service to withdraw funds, but the result has not responded to me yet.

Neutral

2022-12-15

Danny Low

Malaysia

I have personally tried their platform and services since the review on this company is quite negative. So far their services is very consistent and responsive whenever I need help. I didn't invest much USD into it but, so far I have used their service for 5 months now, results are pretty okay. I even tried to withdraw my profit a couple time, the withdrawal process is very fast compared to other platform and there is no charges implement. Overall good

Positive

2023-01-02