简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Euro Decline Eyed, NZD too as Manufacturing Shrinks Most Since 2012

Abstract:The Euro downtrend is in focus after the ECB dialed up stimulus expectations. NZD/USD is also at risk after New Zealand manufacturing PMI contracted by the most since 2012.

Asia Pacific Market Open Talking Points

Euro depreciated after ECBs Olli Rehn dialed up stimulus expectations

EUR/USD downtrend extended towards 2019 lows after resistance held

NZD/USD at risk after manufacturing PMI contracts by most since 2012

Find out what the #1 mistake that traders make is and how you can fix it!

Euro Sinks as ECB Dials Up Stimulus Hopes

The Euro underperformed over the past 24 hours as ECB Governing Council Member Olli Rehn said that the central bank should come up with a “significant and impactful policy package” come September. German and Eurozone government bond yields declined, signaling the markets were pricing in more aggressive easing from the worlds second-largest central bank.

Back in July, the ECB hinted at further quantitative easing along with interest rate cuts deeper into negative territory. However, markets were left underwhelmed as President Mario Draghi expressed the different nuances of views regarding parts of further stimulus packages. As such, markets were left waiting for the specifics of what the ECB could deliver next month. Today seemed like a build in anticipation of what may come.

EUR/USD Technical Analysis

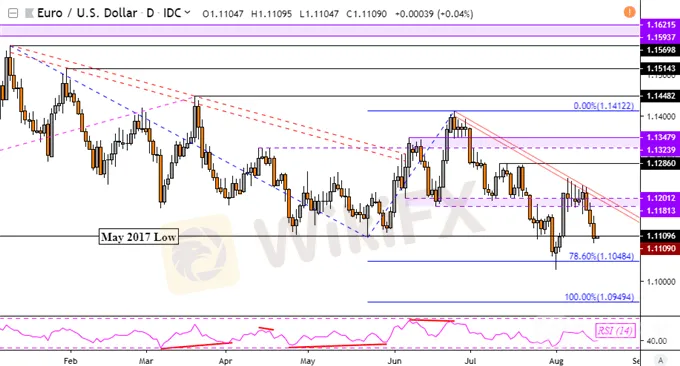

As such, we saw EUR/USD extend its near-term downtrend after testing descending channel resistance from June on the chart below. This also followed a false breakout above former support at 1.1201. The Euro is thus now approaching former 2019 lows with near-term support as the 78.6% Fibonacci extension at 1.1048. Downtrend resumption would eventually pace the way to targeting lows from April 2017.

EUR/USD Daily Chart

Chart Created in TradingView

Fridays Asia Pacific Trading Session

Early into Fridays session, the New Zealand Dollar is under selling pressure after local July business manufacturing PMI clocked in at 48.2 (a reading above 50 indicates expansion and vice versa). This means that the manufacturing sector contracted for the first since 2012. We also saw local 10-year government bond yields slip below 1% for the first time on record as markets priced in more RBNZ rate cut bets.

Over the past 24 hours, we saw the pro-risk Australian and New Zealand Dollars cautiously rise as Wall Street partially trimmed deep losses from Wednesdays session. Markets shrugged off news overnight that China is readying to retaliate against additional US tariff threats. This seemed to have been offset by rising bets that the Fed could deliver an aggressive 50-basis point rate cut in September as local bond yields fell.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

KVB Market Analysis | 21 August: USD/JPY Stalls Near 145.50 Amid Diverging Economic Indicators

USD/JPY holds near 145.50, recovering from 144.95 lows. The Yen strengthens on strong GDP, boosting rate hike expectations for the Bank of Japan. However, gains may be limited by potential US Fed rate cuts in September.

KVB Market Analysis | 20 August: Gold Prices Remain Near Record High Amid US Rate Cut Expectations

Gold prices remain near record highs, driven by expectations of a US interest rate cut and a weakening US Dollar. Investors are focusing on the upcoming Jackson Hole Symposium, where Fed Chair Jerome Powell's speech will be closely watched for clues on the Fed's stance. Additionally, the release of US manufacturing data (PMIs) is expected to influence gold's direction.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Should You Beware of Forex Trading Gurus?

Vanuatu Passes VASP Act to Regulate Crypto and Digital Assets

Currency Calculator