简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Prices Heads Higher, Canada Extends Oil Production Cuts - US Market Open

Abstract:Crude Oil Prices Heads Higher, Canada Extends Oil Production Cuts - US Market Open

MARKET DEVELOPMENT – Crude Oil Heads Higher, Canada Extends Oil Cuts, ZAR Firms on Inflation

DailyFX 2019 FX Trading Forecasts

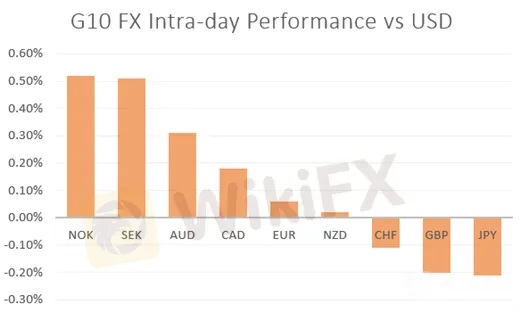

Oil: Brent crude futures are notably firmer this morning, trading higher by over 1.5% as the broad risk on sentiment underpins. Alongside this, yesterday‘s larger than expected API crude inventory decline of 3.5mln barrels has also added to the lift in oil prices, which in turn has seen oil-linked currencies (NOK, CAD) slightly firmer. Focus going forward will be on whether the DoE confirms yesterday’s crude inventory drawdown, while the FOMC minutes will also be eyed by market participants, however, the greater focus should potentially be on the Jackson Hole Symposium speech by Powell on Friday.

Elsewhere, Canada have announced that they will extend their oil production cuts in Alberta by 1yr to the end of 2020. The reason behind the extension had been due to delays in pipeline approvals, which in effect could have seen production outstrip capacity by 150kbpd, resulting in the reemergence of the large price discount of West Canadian Select vs WTI crude that had been seen at the back end of 2018. That said, with the government also looking to raise the exemption limit to 20kbpd from 10kbpd (first 20kbpd exempt from cuts) in order to ease the burden on small producers, oil production is expected to rise slightly to 3.79mbpd from 3.76mbpd.

Emerging Markets

ZAR: The South African Rand is on the front foot following the latest inflation report, which saw the headline rate drop towards the lower end of the SARB‘s inflation range target (3-6%) at 4% from 4.5%. Consequently, this raises the likelihood that the central bank could potentially ease monetary policy (next meeting Sep 19th). Alongside this, the Rand had been given an additional boost as well as other emerging market currencies following dovish commentary from Fed’s Kashkari, who noted that rate cuts should be accompanied by a change in forward guidance.

Source: DailyFX

IG Client Sentiment

WHATS DRIVING MARKETS TODAY

“S&P 500, Crude Oil, Gold Price Technical Outlook & More” by Paul Robinson, Currency Strategist

“Canadian Dollar Price Outlook: USD/CAD Faces Data and Central Bank Risks” by Nick Cawley, Market Analyst

“Gold Price Analysis: FOMC Minutes Ahead, However, Jackson Hole Takes Precedence” by Justin McQueen, Market Analyst

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Crude Oil Futures: Extra gains likely in the short-term

Crude Oil Futures: Extra gains likely in the short-term

Crude Oil May Rebound As Inventory Surges

This Tuesday (June 9th), Saudi announced it will stop cutting oil production beyond OPEC+ agreement, which sent WTI from above US$39 down to US$ 37.07. However, with the surge of crude inventory, oil prices are expected to rebound further.

Crude Oil Demand May See Largest Quarterly Decline in History

Due to the rapid-evolving public health emergency around the globe, the daily demand for crude oil will decrease by 3.8 million barrels year-on-year. Prior to this, Goldman Sachs had been the first among Wall Street's major investment banks to predict a sharp decline in crude oil consumption this quarter. The unprecedented drop of demand came as a sudden shock.

China could be the biggest loser from the Saudi Arabia oil attack

An expert told Business Insider that China has been the largest buyer of Saudi oil since 2009 and could be most impacted by a halt to oil exports.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator