Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

FX2681488600

United States

3 months after my first withdrawal and i still couldn't withdraw the larger part of my profit as well as my invested capital while it's been 10 days I think it is actually difficult to get a withdrawal directly from Top Capital Corporation Limited after the first time, they allow you withdraw once and try to convince you to deposit more, then they abscond.

Exposure

2021-04-02

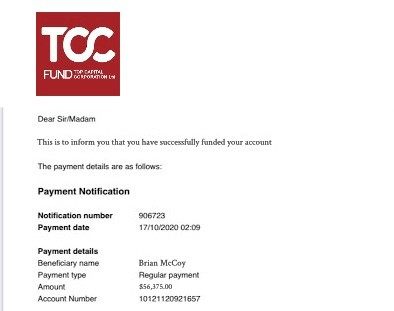

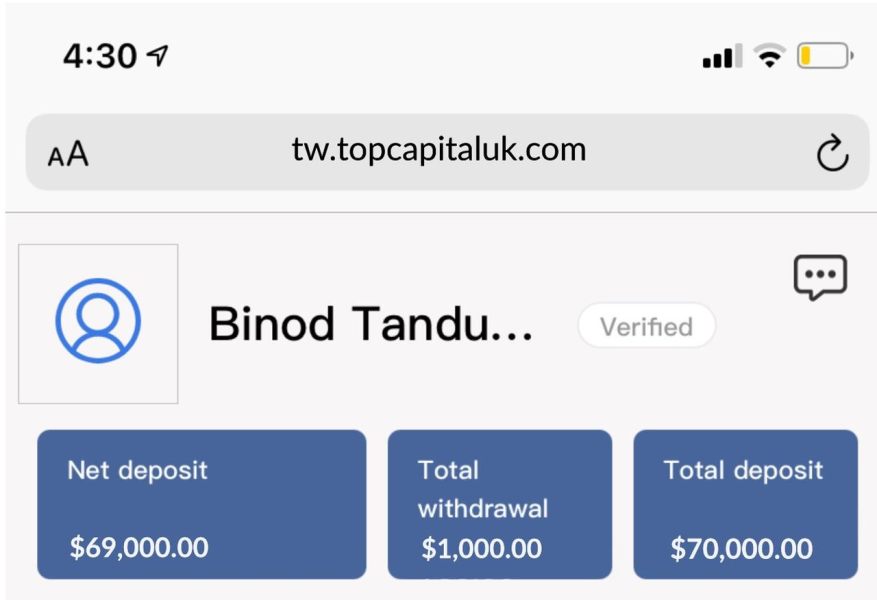

FX3234627962

United States

I made two bank transfers of $70,000 to TCC and was suppose to be used for trade and it wasn't. I requested for withdrawal in my account and i was only able to withdraw a $1000 and my 69,000 in the account is not accessible. TCC wanted to abscond with my money like they did for others.

Exposure

2021-03-30

FX3601601069

United Kingdom

I was introduced to TCC by somebody called Angela. She taught me how to use MT4 and arranged for me to be added to a WhatsApp group run by Professor Jason and his assistant Elsie. After depositing money into my MT4 account via UKEX, I then acted upon trading signals given by Prof. Jason through the WhatsApp groups. Within about 6 weeks of using the group, everybody just disappeared, including Angela. I have been unable to withdraw my money from my account and nobody can be contacted.

Exposure

2021-03-28

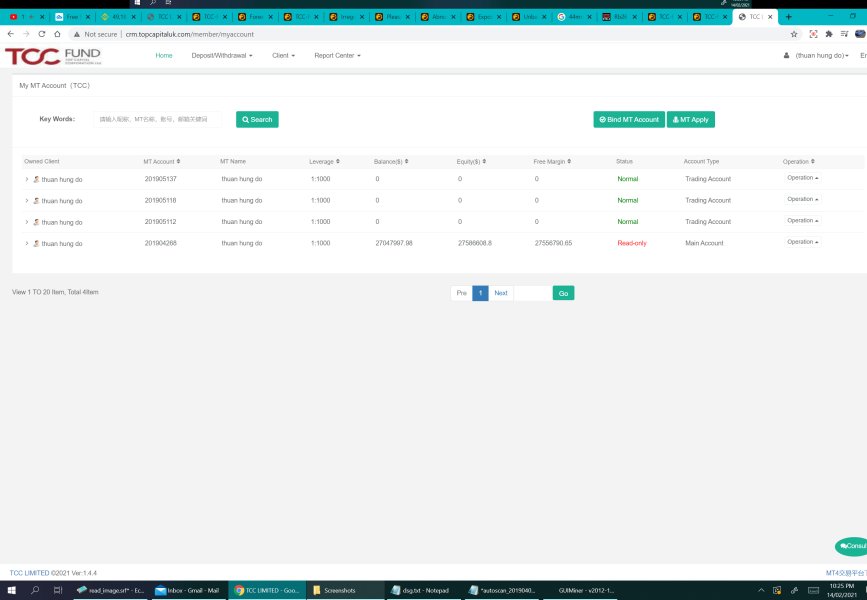

troy

Australia

have $27,000,000 in account but can't withdrawal

Exposure

2021-02-14

YOUNG43485

Hong Kong

This platform is going to bankrupt. The boss embezzled customers’ money

Exposure

2020-12-15

从零开始6371

Hong Kong

TCC has already absconded. The platform was founded by Haoqiang Li from Shenyang. He is in Shenyang now and embezzled lots of money. Let's get together and sue him.

Exposure

2020-12-07

Dennis888

Malaysia

TCC is a scam platform. They manipulated the price movements. Recently under their VIP group, they advised me to key in GBPCHF and followed by 2 rounds to add positions, the price sudden crashed and cause my account wiped up. I did crossed check using tradingview, I noticed no such sharp movement in tradingview. It is definitely a scam to cause clients account to force closed. Beware of TCC.

Exposure

2020-10-29

浅色夏沫

Hong Kong

TCC is a fraud platform. I can't withdraw since March. There is tens of thousands of money in it.

Exposure

2020-09-12

古月云飘

Hong Kong

I withdrew in 111 since March 31. But I do't receive the withdrawals. IS it a fraud platform? Abscond? The customer service is disabled now. My emails are not responded. Account: 201805070、201901055、201804574、201804891

Exposure

2020-09-07

FX2306749122

Hong Kong

111 gave no access to withdrawal. I withdrew in the middle of May and now is September, already four months. But my witdhrawal hasn't been to my account. My emails to 111 were all refused. If there is someone who is the same with me, call the police immediately!!!

Exposure

2020-09-07

一次就好73257

Hong Kong

I withdrew in June and don’t receive the withdrawal yet. Now my account is closed by the platform.

Exposure

2020-09-03

Jinsin Kang

South Korea

line ID-yiran1314-Girlfriend line profile-Anthony-broker was introduced by a girlfriend ID above Be careful I am deaf My precious money lost my life TCC [3c][3c] Has many address sites Steal money Change site address Iterative technique I,'Line' I want to contact you with the victims Please tell me how to contact

Exposure

2020-09-02

欢乐马34625

Hong Kong

Unable to withdraw. The head of LiLuo company in Nanning and customer service don’t respond to my calls or WeChat messages. Absolutely scam!

Exposure

2020-09-02

helen88454

Hong Kong

I applied for the withdrawal of $600 on May 1, while it is yet to be received for 3 months. The platform gave no access to withdrawal of several hundred dollars, let alone 10 million or so. I knew that there must be other victims.

Exposure

2020-08-03

troy

Australia

is there any way to contact other victims to try get money back

Exposure

2020-08-01

欣然33517

Hong Kong

The withdrawal is unavailable. And the service didn’t reply to me. The trusteeship party kept fending me off.

Exposure

2020-07-29

troy

Australia

cannot withdrawal my balance

Exposure

2020-07-28

Yx.

Hong Kong

The website has been shut. All my emails have been rejected. I reckon that there must must other victims. I appeal you to get united and call the police.

Exposure

2020-07-28

Jinsin Kang

South Korea

I applied to withdraw $20,000, while the former 2 staff have been out of contact.

Exposure

2020-07-27

Jinsin Kang

South Korea

I am a deaf. Help me withdraw the fund.

Exposure

2020-07-27