简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

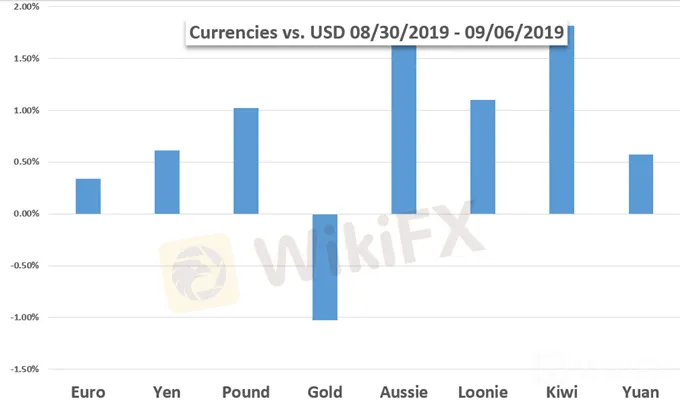

Dow Rises and Gold Falls on Trade War Enthusiasm, ECB Decision Top Event Ahead

Abstract:Though tentative, market participants latched on to nascent signs that trade war conditions may improve and the threat of recession is not as imminent as many fear. This would be the perfect opportunity for monetary policy to further leverage the uneven swell in sentiment. The ECB will start a run

Though tentative, market participants latched on to nascent signs that trade war conditions may improve and the threat of recession is not as imminent as many fear. This would be the perfect opportunity for monetary policy to further leverage the uneven swell in sentiment. The ECB will start a run of key policy meetings, but its decision in particular will echo through the markets.

虽然暂时性,市场参与者仍然接受了新的迹象,即贸易战可能会有所改善,经济衰退的威胁并不像许多人担心的那样迫在眉睫。这将是货币政策进一步利用情绪不均衡膨胀的绝佳机会。欧洲央行将启动一系列关键政策会议,但其决定尤其将通过市场回应。

{2}

GBP Braces for Brexit Volatility: General Election Still Possible

{2}

British Pound traders will likely experience nauseating volatility next week as Brexit negotiations continue to wrap traders in a web of uncertainty as the October 31 deadline approaches.

随着10月31日截止日期临近,英国脱欧谈判继续将交易者包裹在不确定的网络中,英镑交易者可能会在下周遭遇恶心波动。

Australian Dollar Lifted By Risk Appetite Shift But Still Vulnerable

澳大利亚元因风险偏好情绪转变但仍然处于弱势状态

Last week was a good one for Australian Dollar bulls but, as nothing fundamental has changed, gains must be regarded as fragile.

上周对于澳元兑美元多头来说是个好消息但是,由于基本没有任何改变,收益必须被视为脆弱。

Oil Prices Hold August Range Ahead of World Energy Council Congress

油价在世界能源理事会大会召开前维持8月份的范围 p>

Developments coming out of the World Energy Council may influence crude prices as OPEC and its allies remain committed in balancing the energy market.

世界能源理事会的发展可能会影响原油价格,因为石油输出国组织及其盟国仍在致力于平衡能源市场。

Gold Price Forecast: Positive Outlook But Downside Risks Remain

价格预测:积极展望,但下行风险仍然存在

A volatile week for gold, hitting a fresh six year+ high before dropping over 3% in one day as risk sentiment swings sharply.

黄金周波动,由于风险情绪剧烈波动,在一天内下跌超过3%之前触及新的六年+高位。

Dow Jones, Nasdaq 100, DAX 30, FTSE 100 Forecasts for the Week

道琼斯指数,纳斯达克100指数,DAX 30指数,本周100点的富时100预测

The Dow Jones, Nasdaq 100, DAX 30 and FTSE 100 have all regained their footing alongside an improvement , but can the indices hold recent gains?

道琼斯,纳斯达克100指数,DAX 30指数和富时100指数均在有所改善的情况下重新站稳脚跟,但指数近期能否上涨?

US Dollar Uptrend May Return on Haven Demand, Dovish ECB, CPI Rise

美元上涨趋势可能会回归避险需求,支撑欧洲央行,CPI上升

The US Dollar may be back on offense after last weeks retreat, buoyed by haven demand as well as a dovish ECB and a fourth month of gains in core inflation.

美元可能会在上周震荡后重回进攻,受到避险需求以及温和的欧洲央行和第四轮的推动核心通胀上升一个月。

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Breakthrough again! Gold breaks through $2530 to set a new record high!

Spot gold continued its record-breaking rally as investors gained confidence that the Federal Reserve might cut interest rates in September and gold ETF purchases improved. The U.S. market hit a record high of $2,531.6 per ounce

Historic Moment: Gold Surges Above $2,500 Mark, Forging Glory!

Boosted by the weakening of the US dollar and the expectation of an imminent rate cut by the Federal Reserve, spot gold broke through $2,500/ounce, setting a new record high. It finally closed up 2.08% at $2,507.7/ounce. Spot silver finally closed up 2.31% at $29.02/ounce.

Weekly Analysis: XAU/USD Gold Insights

Gold prices have been highly volatile, trading near record highs due to various economic and geopolitical factors. Last week's weak US employment data, with only 114,000 jobs added and an unexpected rise in the unemployment rate to 4.3%, has increased the likelihood of the Federal Reserve implementing rate cuts, boosting gold's appeal. Tensions in the Middle East further support gold as a safe-haven asset. Technical analysis suggests that gold prices might break above $2,477, potentially reachin

【MACRO Insight】Monetary Policy and Geopolitics - Shaping the Future of Gold and Oil Markets!?

In the ever-evolving global economy, the intertwining influences of monetary policy and geopolitical factors are reshaping the future of the gold and crude oil markets. This spring, the gold market saw a significant uptrend unexpectedly, while Brent crude oil prices displayed surprising stability. These market dynamics not only reflect the complexity of the global economy but also reveal investors' reassessment of various asset classes.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

The Growing Threat of Fake Emails and Phishing Scams

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator