简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Prices Boosted, EUR/USD Suffers Ahead of ECB - US Market Open

Abstract:Crude Oil Prices Boosted, EUR/USD Suffers Ahead of ECB - US Market Open

MARKET DEVELOPMENT –Crude Oil Prices Boosted, EUR/USD Suffers Ahead of ECB

市场发展 - 原油价格飙升,欧元/美元在欧洲央行面前飙升

DailyFX 2019 FX Trading Forecasts

DailyFX 2019外汇交易预测

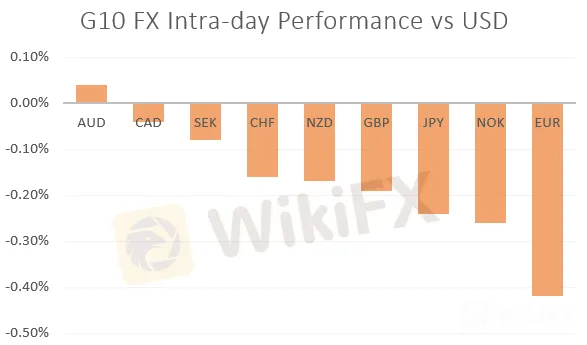

EUR: The Euro is underperforming ahead of tomorrow‘s ECB decision with EUR/USD dipping below 1.10. Price action has been somewhat calm as market participants await from tomorrow’s outcome. Expectation are the ECB to unveil a new stimulus package in order to lift inflation and boost the Eurozone, particularly that of Germany where a German thinktank (IFW) expects that the country slipped into a technical recession in Q3.

EUR:欧元明天表现不佳欧洲央行决定欧元/美元跌破1.10。由于市场参与者等待明天的结果,价格行动有些平静。市场预期欧洲央行将推出新的经济刺激计划,以提振通胀并推动欧元区,尤其是德国,德国智库(IFW)预计该国将在第三季度陷入技术性衰退。

USD: A lift in US yields, alongside the pullback in the greenbacks major counterparts has aided the US Dollar throughout the session with the index back above 98.5. However, the aforementioned ECB rate decision will be key for the near-term direction for the greenback.

美元:美元收益率上升以及美元主要货币的回调伴随美元整个交易日回升至98.5以上。然而,上述欧洲央行利率决定将是美元近期走势的关键。

Crude Oil: Despite yesterday‘s decision by President Trump to fire John Bolton (Iran hawk), oil prices have eeked out modest gains as yesterday’s API crude stockpiles showed a large 7.2mln barrel drawdown, as such, eyes will be on the DoE crude inventory report for confirmation, in which expecations are for a 2.686mln barrel drop.

原油:尽管昨天特朗普总统决定解雇约翰博尔顿(伊朗)由于昨天的API原油库存显示出720万桶的大幅下跌,油价已经温和上涨,因此,目前将关注美国能源部原油库存报告以确认,其中预计下跌26.66亿桶。 / p>

Source: DailyFX

资料来源:DailyFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Should You Beware of Forex Trading Gurus?

Exposed by SC: The Latest Investment Scams Targeting Malaysian Investors

Currency Calculator