简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EXPLAINER: How much does Tesla CEO Elon Musk get paid? And why? - Business Insider

Abstract:The pay calculation comes from SEC rules on CEO compensation reporting, as opposed to the actual value realized by executives in any given year.

Recent filings from a lawsuit against Elon Musk suggest that he testified that he is “financially illiquid,” despite an estimated $23.7 billion net worth.Top corporate executives like Musk often receive most or even all of their compensation in the form of potentially illiquid stock or options in the companies they lead, rather than in cash.A May report from The New York Times indicated that Tesla CEO Elon Musk received stock options worth nearly $2.3 billion in 2018 — but the electric-car maker disputed that claim, saying Musk “actually earned $0 in total compensation from Tesla in 2018.”The discrepancy comes from the pay being calculated in accordance with Securities and Exchange Commission rules on CEO compensation reporting, as opposed to the actual value realized by executives in any given year.The structure of Musk's compensation plan is also a factor, and the Tesla CEO won't personally realize any value until the company hits some extremely ambitious performance goals, including revenue and profitability targets that could be updated after Wednesday's earnings filing.Visit Business Insider's homepage for more stories.Elon Musk is reportedly low on cash, despite his multi-billionaire status. And one reason for that dichotomy is the way top executives often get paid.Musk is currently facing a defamation lawsuit from a British diver who he referred to as a “pedo guy” on Twitter last year. A Bloomberg report pointed out that filings in the suit indicate that Musk told the diver's lawyers he is “financially illiquid,” or short on cash or easily sold assets.Even though Musk has a $23.7 billion net worth according to Bloomberg, most of that wealth is tied up in Musk's massive holdings in Tesla and SpaceX stock. Those holdings may be difficult or even impossible for Musk to quickly sell for cash, meaning it's quite possible that he could face a liquidity crunch.It's not uncommon for top executives like Musk to be paid largely in potentially illiquid stock or options in the companies they lead. Indeed, Musk has refused his cash salaries from Tesla, and has received nearly all of his compensation from that company in the form of stock.Musk's situation is even more complicated than a typical CEO's. A May report in The New York Times indicated that Elon Musk made $2.3 billion in 2018 as CEO of Tesla, but according to the company, he actually earned $0 that year.Under the terms of Musk's current compensation agreement with the electric-car maker, the CEO will earn a massive payday once the company achieves some stunning stock-price and financial goals. Some of those financial milestones have been achieved, but the stock-price objectives remain miles away.Wednesday's earnings results will provide an update on how far Tesla needs to go to hit the next set of revenue and earnings milestones Musk needs to achieve before benefiting from the compensation package.Confused yet? The intricacies of Musk's compensation package with Tesla is an illustration of the surprisingly difficult task of figuring out how much CEOs get paid.The key to the discrepancy between the eye-popping 2018 compensation figure and Musk's actual earnings of $0 comes from how pay is calculated according to the Securities and Exchange Commission's rules for reporting CEO compensation, as opposed to what top executives actually gain in a particular year.Many CEOs receive most of their compensation in the form of shares or stock options to buy shares at a given price and time. Often, those stock or option grants don't vest or become available to the chief executive until some amount of time has passed. Or, as in Tesla's case, some set of performance goals are met.That makes measuring exactly how much a given CEO makes in a given year surprisingly hard to quantify.Getting technical about executive compensationThe Times published a ranking of compensation for 200 CEOs of major companies in 2018, based on an analysis by the executive-compensation consulting firm Equilar.One of the most stunning results was the reported compensation for Musk. According to The Times and Equilar, the Tesla CEO received stock options estimated to be worth nearly $2.3 billion in 2018. Musk's reported compensation was more than 17 times that of the next-highest executive on the list, Discovery Communications CEO David Zaslav.However, after Business Insider highlighted Musk's eye-popping compensation, Tesla reached out to us through a spokesperson and disputed this characterization.Here's Tesla's statement:Elon actually earned $0 in total compensation from Tesla in 2018, and any reporting otherwise is incorrect and misleading. Unlike other CEOs, Elon receives no salary, no cash bonuses, and no equity that simply vests by the passage of time. His only compensation is a completely at-risk performance award that was specifically designed with ambitious milestones, such as doubling Tesla's current market capitalization from approximately $40 billion to $100 billion. As a result, Elon's entire compensation is directly tied to the long-term success of Tesla and its shareholders, and none of the equity from his 2018 performance package has vested.According to the proxy statement, under the terms of the company's 2018 compensation plan for Musk, the CEO would receive a “10-year maximum term stock option to purchase 20,264,042 shares of Tesla's common stock, divided equally among 12 separate tranches that are each equivalent to 1% of the issued and outstanding shares of Tesla's common stock,” that would vest only if the company hit a combination of market-capitalization, revenue, and profitability milestones, and Musk remained at the helm of the company.The first of those milestones would be a combination of Tesla reaching a market capitalization of $100 billion and either revenues of $20 billion or earnings of $1.5 billion (formally, adjusted earnings before interest, taxes, depreciation, and amortization, or EBITDA).According to the company's earnings report for the first quarter of 2019, those two milestones have been successfully hit. The next two potential operational milestones would be annualized revenues of $35 billion or earnings of $3 billion, and Wednesday's second quarter earnings report could shed light on how far Tesla has to go to hit those marks.However, as the first market-capitalization goal is more than double Tesla's market capitalization as of July 23, the company has not hit these goals, and so none of Musk's stock options under the compensation plan have yet vested.The New York Times wrote that the compensation plan was intended to ensure Musk's long-term dedication to Tesla's growth and profitability, quoting the company's announcement of the plan that said it would “incentivize and motivate Mr. Musk to continue to not only lead Tesla over the long-term, but particularly in light of his other business interests, to devote his time and energy in doing so.”Several commentators at the time noted the unusual nature of the compensation package. Business Insider's Troy Wolverton reported that Musk already controls a large amount of Tesla's stock, so he already has strong incentives to boost the company's market cap.Read more: 5 reasons why Tesla is probably poised for a reboundAccording to Tesla's 2019 proxy statement filed with the SEC in 2018, the company compensated Musk with stock options worth an estimated $2,283,988,504 as part of the 2018 compensation plan. That value, noted on page 55 of the statement, was calculated in line with SEC accounting rules for equity-based compensation.The reported $2.3 billion value of the stock options is based on Tesla's estimates of what the options could potentially be worth, based on how the company's stock price evolves over time. According to the proxy statement, that estimate does “not necessarily correspond to the actual value that may be recognized by the named executive officers, which depends, among other things, on the market value of our common stock.”Tesla wrote in the proxy statement, “We are required to report pursuant to applicable SEC rules any stock option grants to Mr. Musk at values determined as of their respective grant dates and which are driven by certain assumptions” laid out in Financial Accounting Standards Board guidelines.That is, SEC rules require Tesla to report a measure of the market value of the unvested options from Musk's compensation plan, following standard accounting rules for CEO pay.But the company said that, under the terms of the compensation plan and as pointed out above, none of those shares have yet vested, with the first tranche vesting only if Tesla first hits a market capitalization of $100 billion and one of the revenue and profitability goals is achieved.In addition to the unvested stock option compensation, the proxy letter also includes a $56,380 salary, following California's minimum-wage law. Tesla pointed out in the letter that “Mr. Musk has not accepted his salary in the amounts of $56,380, $49,920 and $45,936 for 2018, 2017 and 2016, respectively.” Musk has traditionally refused his annual paychecks from Tesla.What gets reported can be different from what practically happensIn the proxy statement, Tesla pointed out the difference between the compensation level reported and Musk's actual financial gain: “As a result, there may be a significant disconnect between what is reported as compensation for Mr. Musk in a given year in such sections and the value actually realized as compensation in that year or over a period of time.”The company also reiterated the long-term, performance-based nature of Musk's compensation:Moreover, the vast majority of compensation in respect of past stock option grants to Mr. Musk, including the 2012 CEO Performance Award and the 2018 CEO Performance Award, were incentives for future performance and their value is realizable only if Tesla's stock price appreciates compared to the dates of the grants, and the Company achieves applicable vesting requirements.To put that all together: Tesla reported to the SEC that they awarded stock options worth an estimated $2.3 billion to Musk in 2018 as part of the long-term compensation plan. But he cannot actually benefit from those options until the company hits at least one of its ambitious goals.Courtney Yu, the director of research at Equilar, the executive-compensation and corporate-governance data firm that worked with The Times on its ranking of CEO pay, explained the situation in an email to Business Insider.“While the SEC requires a certain calculation, such as using the grant date fair value of unvested equity awards granted, this often doesn't reflect what the executive actually receives once stock awards are vested or options are exercised,” Yu wrote.Yu emphasized the contingent nature of the reported CEO pay. “When it's all said and done, Elon Musk could realize all $2.3 billion of that option award, or he could realize nothing because the company doesn't meet performance goals,” he said.Yu also said a compensation measure including the grant-date value of unvested equity, as reported to the SEC, is still a useful metric for comparing CEO pay between companies “because it's a standardized calculation across the board.”Companies often publish other measures of CEO pay alongside the compensation reported according to SEC guidelines in order to give a fuller sense of what executives earn. “However, it's also pretty common for companies to provide alternative calculations, such as the value of vested stock awards and exercised options, because they think this provides a better picture into what a CEO really makes,” Yu wrote.This divide is pretty commonAs an example of another company showing both reported compensation under SEC rules and the actual realized compensation for CEOs, Yu directed us to ExxonMobil's 2018 proxy statement, which included a chart showing that the realized value of executive compensation tended to be much lower than the reported compensation:

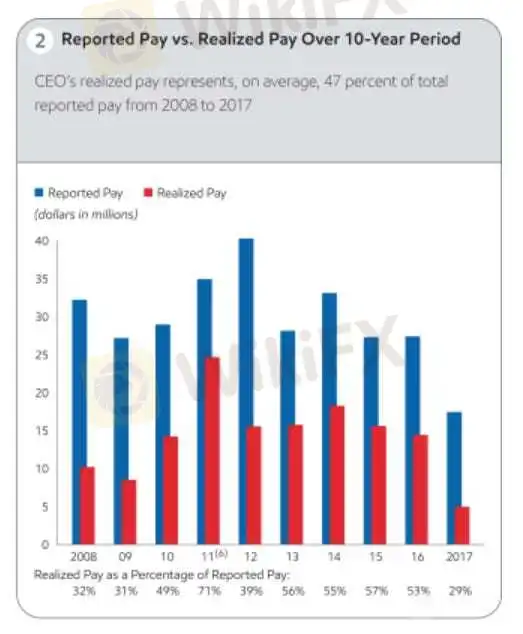

Exxon-Mobil via SEC

The chart illustrates how the reported compensation for ExxonMobil's CEOs over the past decade — roughly analogous to the $2.3 billion reported by Tesla — paints a very different picture than the realized pay that the oil company's CEOs actually received each year. In 2017, CEO Darren Woods actually realized just 29% of his roughly $17 million in reported compensation. Between 2008 and 2017, the average realized pay was just shy of half the average reported pay.Tesla's compensation plan for Musk remains different because of the high potential value for Musk and the extremely ambitious corporate performance goals attached to that compensation. The basic split between what a company is required to report to the SEC and its CEO's actual increase in net worth is not uncommon among big corporations.While the eye-popping reported compensation is stunningly high, the nuances of how corporate CEOs are paid mean that Musk may end up gaining no real value in the form of actual new Tesla shares from those billions of dollars in options.Read more:The 15 US states with the lowest college graduation ratesFrom hair salons to bars, here are 30 industries dominated by millennialsA quarter of non-retired Americans have nothing saved for retirement The most common ancestry in every US state

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Elon Musk’s DOGE Sparks a Wave of Crypto Fraud

Scammers have capitalised on the widespread attention surrounding DOGE by creating fraudulent schemes that promise lucrative returns. Many of these scams falsely associate themselves with Musk or the DOGE initiative and incorporate similar branding, including logos and terminology.

Elon Musk Warns of Imminent US Bankruptcy | Bitcoin Retreats from $100K

Elon Musk has issued a stark warning about the US's financial stability, suggesting that the country is heading toward bankruptcy "super-fast" unless drastic measures are taken. The billionaire's financial commentary comes amid Bitcoin's retreat from its anticipated $100,000 milestone. The cryptocurrency recently fell to just above $95,000, down from a high of $99,000.

Global Market Reactions to Recent Economic, Corporate, and Environmental Developments

The global market reacts to various developments, including Tesla's profit miss, China's interest rate cut, Bernard Arnault's net worth decline, and typhoon Gaemi's impact. The Mt. Gox compensation, Lineage Inc.'s IPO, and Netanyahu's speech in the US Congress also influence market dynamics. European banks' mixed performance, Canada's rate cut, and Russia's sanction issues add to the market fluctuations, along with South Korea's GDP contraction and stable oil prices.

Global Market Reactions to Latest Corporate, Economic, and Political Developments

Tesla faces ongoing struggles with profit misses, impacting its stock and investor confidence. Meanwhile, Alphabet Inc.'s strong Q2 earnings highlight robust demand in cloud services and advertising. Political developments in the US, with Vice President Kamala Harris rallying support, and India's budget aimed at job creation reflect significant economic shifts. Natural disasters and corporate news, such as Boeing's resumed 737 Max deliveries and Citi's upgrade of Coinbase, also influence market

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Should You Beware of Forex Trading Gurus?

Exposed by SC: The Latest Investment Scams Targeting Malaysian Investors

Currency Calculator