简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

UK regulators take a hard line on outages - Business Insider - Business Insider

Abstract:Major UK financial regulatory bodies have put out a shared policy summary aimed at preventing prolonged tech problems in the banking sector

This story was delivered to Business Insider Intelligence Banking subscribers earlier this morning. To get this story plus others to your inbox each day, hours before they're published on Business Insider, click here. Major UK financial regulatory bodies — The Bank of England, Prudential Regulation Authority, and Financial Conduct Authority — have put out a shared policy summary aimed at preventing prolonged tech problems in the banking sector, Finextra reports.

Business Insider Intelligence

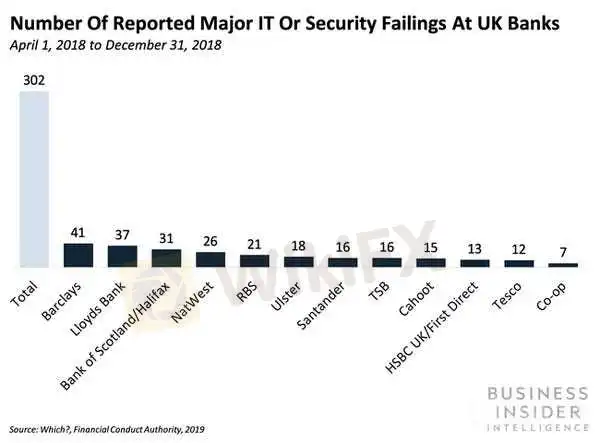

The proposals state that companies and Financial Market Infrastructures (FMIs) “are expected to take ownership of their operational resilience and that they will need to prioritize plans and investment choices based on their impacts on the public interest.”The policies outline four clear requirements firms and FMIs must follow to strengthen their IT resilience:Identify critical services. Financial institutions (FIs) must take note of which services would cause harm to consumers or to market integrity, threaten the viability of firms, or cause instability in the financial system if they were to be interrupted.Set tolerances. For each critical service FIs identify, they have to set limits that quantify the maximum level of disruption that those services could feasibly tolerate.Identify supporting entities. FIs also have to outline the people, processes, technology, and information that support their designated critical services.Act to remain within tolerances. FIs will be held responsible for taking action to stay within the tolerances they set through a range of severe but plausible disruption scenarios.The regulators' push comes at a time when outages are a persistent issue for banks. UK banks collectively experience five IT failures a week, per analysis from Which? cited by Finextra. A recent high-profile example was the one NatWest and RBS suffered on Black Friday, which disabled access to accounts and made customers unable to complete transactions. And in August, an event beyond banks' control — an outage at US payments company TSYS — left customers of several UK banks, including RBS and Tesco Bank, unable to pay bills or access their account information.As regulators pay more attention to outages and hold FI's more responsible, the consequences of suffering an outage may become even graver. Outages — especially ones that occur at critical times like Black Friday — are already serious problems for banks. A critical consequence is that they anger customers — who may become more amenable to switching banks — which can damage brands and require resources to fix. And for neobanks that lack a physical branch presence, outages can cause even more damage, because customers have little recourse if they lose access to their accounts.However, now that regulatory bodies are stepping in, things may get more severe, as regulators could decide that failure to abide by the guidelines they have laid down should be punishable by fines and greater governmental scrutiny, adding new punitive dimensions to an already harrowing problem.Want to read more stories like this one? Here's how to get access: Sign up for Banking Pro, Business Insider Intelligence's expert product suite tailored for today's (and tomorrow's) decision-makers in the financial services industry, delivered to your inbox 6x a week. /> /> Get StartedJoin thousands of top companies worldwide who trust Business Insider Intelligence for their competitive research needs. /> /> Inquire About Our Enterprise MembershipsExplore related topics in more depth. /> /> Visit Our Report StoreCurrent subscribers can log in to read the briefing here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

AUS GLOBAL partners with the United Nations to promote Global Sustainable Development

We are honored to share that AUS GLOBAL, as an invited guest of the United Nations forum on Science, Technology and Innovation (UNSTI), successfully completed the important mission of this event on June 20, 2024 at the Palais des Nations in Geneva, Switzerland.The forum brought together dignitaries and renowned business people from around the world to discuss important topics such as global fintech development and environmental protection.

Bank of America hires Citi exec Diane Daley for AI governance role - Business Insider

Diane Daley spent over two decades at Citigroup, eventually serving as a managing director and the head of finance and risk management infrastructure.

Outlook for real estate markets, jobs, and opportunities - Business Insider

Flex-office firms are struggling, and companies are rethinking leases for offices. Here's how real-estate markets, jobs, and deals are being impacted.

Warren Buffett's lack of stock purchases worries Leon Cooperman - Business Insider

The hedge fund boss said the restraint shown by the "greatest investor in my generation" is a red flag for investors.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator