简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Job Growth Reduced Chances of the Fed’s Rate Cut

Abstract:Statistics from the US Department of Labour show that US Nonfarm Payroll increased by 225,000 in January, 2020, exceeding the market’s estimation of 165,000 and December’s 147,000 after revision while being significantly higher than the 175,000 of the same period last year.

Statistics from the US Department of Labour show that US Nonfarm Payroll increased by 225,000 in January, 2020, exceeding the market’s estimation of 165,000 and December’s 147,000 after revision while being significantly higher than the 175,000 of the same period last year.

Among these, private sector saw an increase of 206,000 jobs, higher than market estimation of 150,000 and the 139,000 of previous month after revision. Labour force participation rate also rose from 63.2% in December, 2019 to 63.4% in January, 2020.

The better-than-expected employment data suggests the US job market remains robust. Government’s survey on businesses shows building and construction job growth in January has been the highest in a year, while recruitment in transportation and logistics also boost strong growth.

We conclude that a steady situation employment supports the opinions of the Fed’s policymakers that the job market is strong, and the employment figures backed the decision of Federal Reserve Board to hold interest rate at current level. The Fed’s Chairman Jerome Powell also noted that the current monetary policy is on the right track, while the optimistic data also offers positive support to US dollar’s exchange rate.

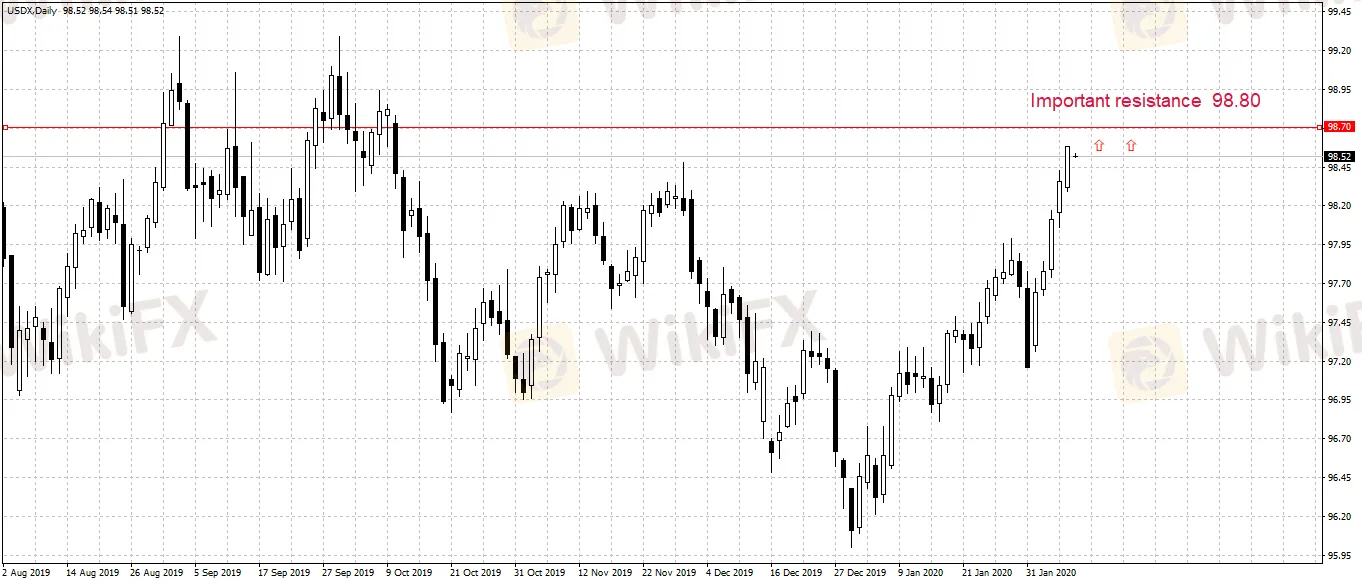

USDX daily pivot points 98.44-98.52

S1: 98.38 R1: 98.67

S2: 98.18 R2: 98.78

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Rate Cut Hopes on the Line: NFP Set to Steal the Spotlight!

The US ISM Manufacturing PMI came in at 48.7 for May, below the forecast of 49.8 and the previous reading of 49.2. The main reasons for this stagnant reading are ongoing weak demand, which affects supplier orders, inventories, capital investments, and employment. In May, ADP Nonfarm Employment Change have increased 152,000 jobs, which was below the forecast of 173,000 and down from the previous month's 188,000. The US ISM Non-Manufacturing PMI for May exceeded expectations, registering 53.8...

Global stocks are rallying as traders see Fed comments as 'central banks to the rescue'

Asian and European stocks and US futures climbed on Wednesday after Fed Chairman Jerome Powell hinted a rate cut could be coming.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Stock Market Trading Volume Drops by 97.58 Billion Naira This Month

Why does your mood hinder you from getting the maximum return from an investment?

Currency Calculator