简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What’s Behind the Tumble of US Stocks?

Abstract:With the coronavirus still raging across the world, the consequent global recession seems unlikely to be reversed for a while.

With the coronavirus still raging across the world, the consequent global recession seems unlikely to be reversed for a while. While the outbreak and the previous oil price war have been the last straw triggering US stocks' slump, the root cause should be attributed to corporation's share repurchase, which had helped create the bubbles of over a decade' s bullish US stock market.

Statistics show that since 2009, listed companies in the US have become the largest buyer of their own stocks. In buying back one's own stocks, a company can reduce outstanding shares and drive up the price per share.

And as price goes up, current share holders will be less willing to sell, while more investors will be attracted to buy. The company may then invest the raised funds into further repurchase scheme that boosts the company's stock price.

In usual cases, share repurchase can fuel optimism into the market by signaling that the stock is underpriced, thus increasing the stock's value and boosting capital efficiency of the company. Data from the Wallstreetcn.com shows that after financialization, some American giant companies spend 95% of the profits every year on share repurchase, investing only a small amount of money in innovation and manufacturing.

Repurchase of corporate stocks allows companies to quickly boost their price per share and market value; however, when considering company's state of business operation, repurchase may be risky if the company has been using borrowed money, as this would mean applying leverage on the entire stock market.

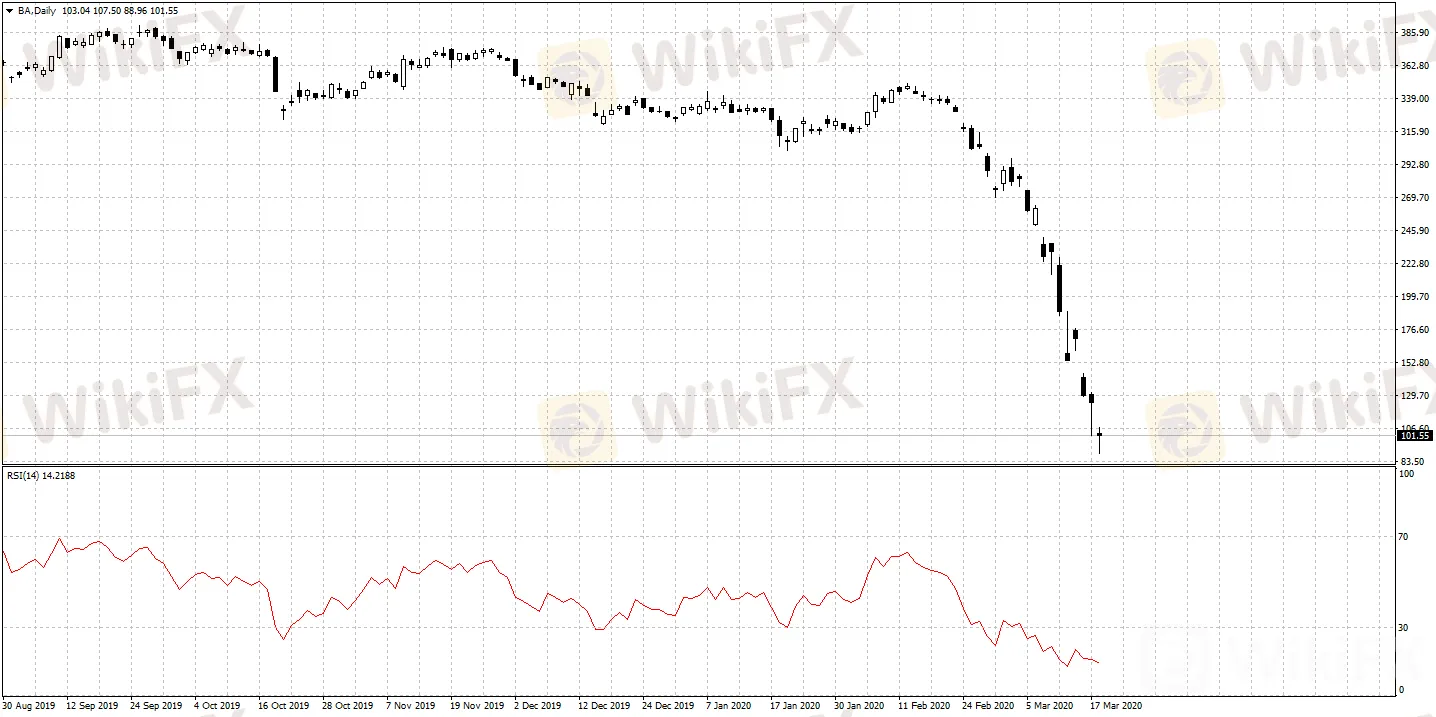

A typical example is the Boeing Company in the US. Boeing's stock price had surged rapidly since 2016 and reached an astonishing US$441 per share at its peak, while its stock price prior to this was only US$75 per share. Behind this surge was Boeing's effort since 2016 to increase its debt level, using the borrowed money for repurchase to prop up the company's share price; but the company's state of operation had in fact been unsatisfactory, getting less than 10 billion dollars of net profit each year. This had been a potential risk factor contributing to Boeing's later slump. For the moment, Boeing's stock price has been slashed in half.

Recent trend of Boeing's stock price

CEO of Bridgewater Associates Dario recently commented the market's high leverage in his article, “During the slump, the market impact on the highly leveraged companies in the most affected economies may be significant, and we will soon show you what it looks like.” Gangdrak, the CEO of Double Line Capital that was dubbed “the new bond king”, also said, “At present, the corporate leverage ratio is very high, and the size of the credit market has also increased significantly. So the corporate bond market will face tremendous troubles when the next recession come about, and we've already seen some signs of that.”

Behind the plunge of US stocks, the market could be facing a debt crisis after the “bubble” created by high leverage bursts.

WikiFX is a leading media in the forex industry. Visit WikiFX official website, App or Facebook page for more market updates.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Chart Of The Day: Twitter Shares May Be Oversold But Stock Still In A Downtrend

Smart money fund managers and investors have become passionate about Twitter (NYSE:TWTR) stock. ARK Invest founder Cathie Wood bought into Twitter's dip after the stock fell to a 52-week low near $41 when co-founder and CEO Jack Dorsey announced in late November that he was stepping down from his leadership role.

The real reason why Elon Musk is selling 10% of Tesla stock

Musk asked his 62.7 million Twitter followers over the weekend whether he should sell 10% of his Tesla holdings.

Stocks at Risk as China-Taiwan Tension Eclipses Xi-Biden Summit

CHINA-US TENSION, TAIWAN, US DOLLAR, S&P 500, FED INTEREST RATE HIKE - TALKING POINTS Xi-Biden summit likely only to achieve surface-level diplomatic breakthroughs Competing global and regional priorities may prevent meaningful cooperation S&P 500 at risk ahead of precarious holiday season, geopolitical uncertainty

Election Years See Weak U.S. Stocks in October

Since the Democratic candidate Biden was reported to be involved in a scandal, he has not yet given a press conference to clarify what happened.

WikiFX Broker

Latest News

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

Singaporean Arrested in Thailand for 22.4 Million Baht Crypto Scam

Trader Turns $27 Into $52M With PEPE Coin, Breaking Records

ASIC Sues HSBC Australia Over $23M Scam Failures

WikiFX Review: Is IQ Option trustworthy?

5 Questions to Ask Yourself Before Taking a Trade

FCA Seeks Input to Shape UK Crypto Market Regulations

Understanding the Impact of Interest Rate Changes on Forex Markets

Currency Calculator