简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Soaring HKD Hit Strong-side Convertibility Undertaking

Abstract:Recently, the Hong Kong dollar's strong momentum has drawn special attention from the market.

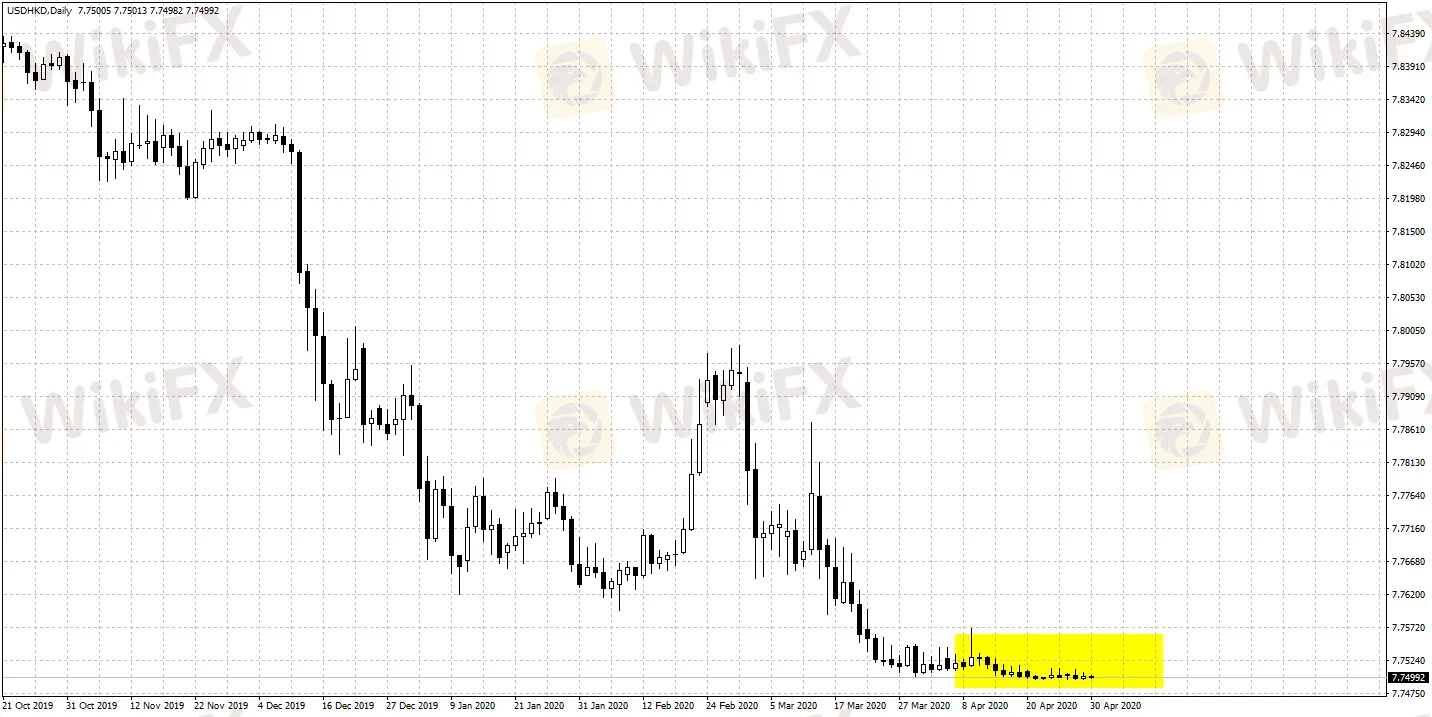

Recently, the Hong Kong dollar's strong momentum has drawn special attention from the market. The USD/HKD has hit the strong-side convertibility undertaking of 7.75 several times and hovers around this level, which led to the Hong Kong Monetary Authority's intervention on several occasions.

Views attributed this to the fact that mainland China and Hong Kong, being the first to effectively contain the virus amid global pandemic, may become "safe havens"that continue to attract international capital flow. But the most convincing argument is the situation of interest rate market. Previously, as the Hong Kong dollar interest rate was significantly lower than the US dollar, traders conducted carry trade by funding US dollar-denominated assets with Hong Kong dollar. But in facing narrowing spreads and asset sell-off, carry traders will be forced to close their positions and in order to do so, they need to buy Hong Kong dollars in the spot market. It's expected that HKMA will continue to implement moderate intervention to stabilize the financial market.

Hong Kong’s linked exchange rate system requires the Hong Kong dollar to be pegged to the US dollar within a certain range. Since 2005, the HKMA has adopted a strong-side convertibility undertaking of 7.75 and a weak-side convertibility undertaking of 7.85; once HKD/USD exchange rate reach the given range, market intervention will be delivered through buying or selling US dollar.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

Currency Calculator