Overview of BX

BX, operated by 8 Bitnex Limited, is an unregulated trading platform based in China. Founded within the past 2-5 years, BX offers a variety of market instruments, including Forex, Precious Metals, Commodities, and Stock Indices. Traders can engage in currency trading with different currency pairs and trade precious metals like gold and silver. The platform also allows trading in commodities such as crude oil and natural gas, as well as stock indices like DE30, HK50, JP225, USTEC, US500, and US30. BX offers multiple account types with maximum leverage of 500:1, but specific details about deposits, withdrawals, and commissions are not provided. Traders can access BX through platforms like MetaTrader 4 (MT4), WebTrader, and mobile trading apps for iOS and Android devices. The platform provides educational tools such as market analysis, educational webinars, video tutorials, and an economic calendar. However, there are concerns and allegations of fraudulent activities associated with BX, with reports of difficulties in accessing the website, contacting customer service, and withdrawing funds. Traders have experienced losses, forced liquidations, manipulated orders, frozen accounts, and slippage issues. It is important to exercise caution when considering BX as a trading platform due to the lack of regulation and negative user experiences.

Pros and Cons

BX presents several advantages and disadvantages. On the positive side, it offers a diverse selection of market instruments for trading and provides high leverage of up to 500:1. Additionally, it boasts spreads starting from 0.1 pips and offers multiple trading platforms, including the popular MetaTrader 4. The broker also supports various payment methods for deposits and withdrawals and provides educational tools like market analysis and webinars. However, it is important to consider the cons as well. BX is not regulated, which raises concerns about potential risks and scams. Negative reviews and allegations of fraud have been reported, and specific information on commissions is lacking. The absence of a demo account, limited details on account types and fees, and the current unavailability of the main website further add to the cons.

Is BX Legit?

Cudrania Capital is not currently regulated, as indicated by the provided information. There is no valid regulation or license from any recognized regulatory agency, including the National Futures Association (NFA) in the United States. The broker's regulatory status is suspicious, and there are warnings about potential scams and risks associated with engaging in trading activities with this unregulated entity. It is important to exercise caution and be aware of the lack of regulation when considering Cudrania Capital as a trading platform.

Market Instruments

BX offers a range of market instruments for traders to participate in various financial markets. These instruments are categorized into different types, including Forex, Precious Metals, Commodities, and Stock Indices.

Forex: BX provides access to a variety of currency pairs, allowing traders to speculate on the exchange rate fluctuations between different currencies. Examples of currency pairs offered may include EUR/USD, GBP/USD, AUD/USD, USD/CAD, and USD/JPY. Traders can take advantage of the dynamic forex market and engage in currency trading.

Precious Metals: BX also offers trading opportunities in precious metals, such as gold and silver. Traders can participate in the market for these valuable metals, taking positions based on their expectations of price movements. Examples of precious metal instruments offered may include XAU (Gold) and XAG (Silver), allowing traders to diversify their portfolios.

Commodities: BX provides trading instruments related to various commodities, enabling traders to speculate on the price movements of commodities such as crude oil, natural gas, and coffee. Examples of commodity instruments offered may include XTIUSD (Crude Oil), XBRUSD (Brent Crude Oil), and XNGUSD (Natural Gas). Traders can take advantage of the volatility in commodity markets and potentially profit from price fluctuations.

Stock Indices: BX offers access to trading stock indices, allowing investors to trade on the performance of a basket of stocks representing specific markets or industries. Examples of stock indices offered may include DE30 (Germany 30), HK50 (Hang Seng Index), JP225 (Nikkei 225 Index), USTEC (Nasdaq 100 Index), US500 (S&P 500 Index), and US30 (Dow Jones Industrial Average). Traders can take positions based on their views on the overall performance of the stock market or specific sectors.

Pros and Cons

Account Types

Standard Account: The Standard account offered by BX Limited provides a maximum leverage of 500:1 and requires a minimum deposit of 100 USD. The minimum spread for this account type is 1.5, and it supports trading of over 100 trading products. The minimum position size is 0.01 lot, and it is compatible with supported Expert Advisors (EA). However, specific information about the currency, depositing method, withdrawal method, and commission is not provided.

Professional Account: The Professional account offered by BX Limited offers a maximum leverage of 500:1, requiring a higher minimum deposit of 5000 USD. The minimum spread for this account type is 1.1, and it supports trading of over 100 trading products. The minimum position size is 0.01 lot, and it is compatible with supported Expert Advisors (EA). Similar to the Standard account, information about the currency, depositing method, withdrawal method, and commission is not specified.

Premium Account: The Premium account offered by BX Limited provides a maximum leverage of 500:1 and requires a higher minimum deposit of 20000 USD. This account type offers a minimum spread of 0.9 and supports trading of over 100 trading products. The minimum position size is 0.01 lot, and it is compatible with supported Expert Advisors (EA). Like the previous account types, details regarding the currency, depositing method, withdrawal method, and commission are not provided.

Pros and Cons

Leverage

BX offers leverage of up to 500:1, allowing traders to amplify their trading positions by up to 500 times. This means that for every unit of capital, traders can potentially control a larger position in the market.

Spreads & Commissions

BX offers spreads and commissions for trading on its platform. The spreads start from as low as 0.1 pips, providing traders with pricing for executing their trades. As for commissions, specific details regarding the commission structure are not provided in the given information.

Minimum Deposit

BX has a minimum deposit requirement that varies based on the account type. For the Standard account, the minimum deposit is set at 100 USD. The Professional account, on the other hand, requires a higher minimum deposit of 5000 USD. Lastly, the Premium account has the highest minimum deposit of 20000 USD. Traders should consider their financial capabilities and trading goals when selecting an account type that aligns with their investment preferences.

Deposit & Withdraw

Deposit:

BX offers multiple deposit methods for users, including bank transfer, credit cards, and debit cards. It's important to note that there is a 1% fee applied to all deposits. Typically, deposits are processed within 1 business day, ensuring that users can start trading promptly.

Withdrawal:

BX provides various options for users to withdraw their funds, including bank transfer, credit cards, and debit cards. Similar to deposits, there is a 1% fee charged for all withdrawals. Withdrawals are usually processed within 3 business days, allowing users to access their funds in a timely manner.

Pros and Cons

Trading Platforms

BX offers a variety of trading platforms to cater to the diverse needs of traders. These platforms provide different features and functionalities to enhance the trading experience.

MetaTrader 4 (MT4): BX supports the popular MetaTrader 4 platform, which is widely recognized in the industry. It offers a user-friendly interface and a comprehensive suite of trading tools. Traders can access real-time market quotes, advanced charting capabilities, and a wide range of technical indicators. MT4 also supports automated trading through Expert Advisors (EAs), allowing traders to implement algorithmic strategies. Examples of instruments available on MT4 include forex pairs, commodities, and indices.

WebTrader: BX provides a web-based trading platform that allows traders to access their accounts and trade directly from their web browsers. WebTrader eliminates the need for downloading and installing software. It offers a user-friendly interface, real-time market data, and essential trading features. Traders can execute trades, monitor their positions, and access trading tools on the go, without the limitations of a software installation.

Mobile Trading Apps: BX offers mobile trading apps for iOS and Android devices, providing traders with the flexibility to trade anytime, anywhere. These mobile apps offer a user-friendly interface, real-time market quotes, and essential trading functionalities. Traders can place trades, monitor their positions, and access charts and technical indicators on their smartphones or tablets. The mobile trading apps ensure that traders can stay connected to the markets and manage their trades while on the move.

Pros and Cons

Educational Tools

Market Analysis: BX offers market analysis tools to help traders stay informed about market trends and developments. These tools may include daily market analysis reports, technical analysis charts, and fundamental analysis insights. Traders can access information on various financial instruments, such as forex, stocks, and commodities, to make more informed trading decisions.

Educational Webinars: BX conducts educational webinars to educate traders on various aspects of trading. These webinars cover topics ranging from basic trading concepts to advanced trading strategies. Traders can learn from experienced professionals who provide valuable insights and practical tips to improve their trading skills.

Video Tutorials: BX provides video tutorials that cover a wide range of trading topics. These tutorials offer step-by-step guidance on using the trading platform, understanding chart patterns, conducting technical analysis, and implementing trading strategies. Traders can access these videos and learn at their own pace.

Economic Calendar: BX offers an economic calendar that provides traders with information on important economic events and indicators. This calendar helps traders stay updated on key announcements that may impact the financial markets. Traders can plan their trading activities around these events and make informed decisions based on economic data releases.

Customer Support

BX provides customer support through various channels. Traders can reach out to the Chinese (Simplified) support line at 400-842-8865 for assistance. Additionally, customers can contact BX's customer support team via email at cs@bxfxcs.com. These contact methods allow traders to seek help and address any inquiries they may have.

Reviews

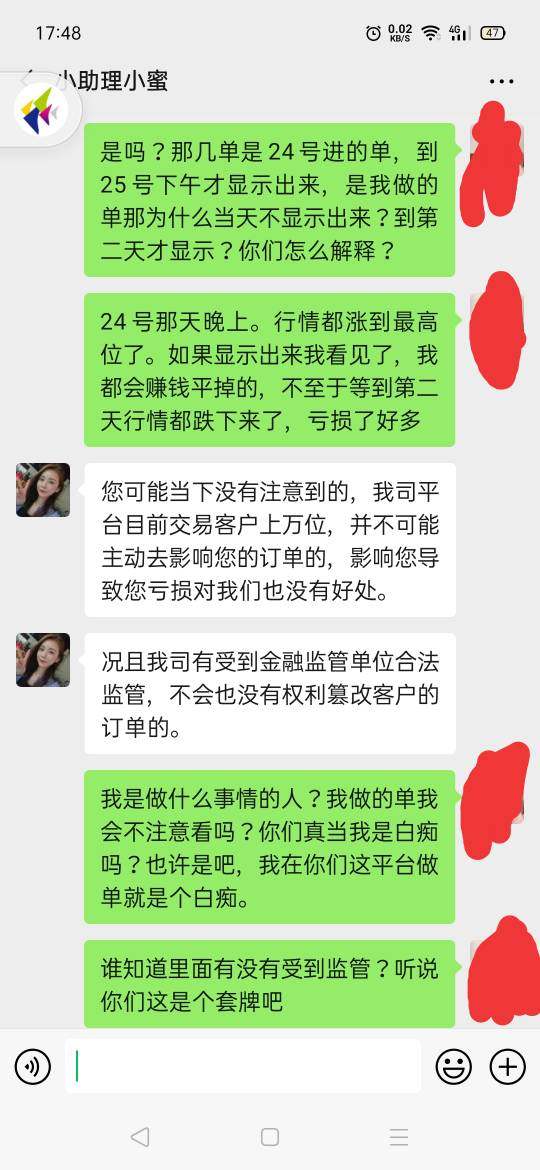

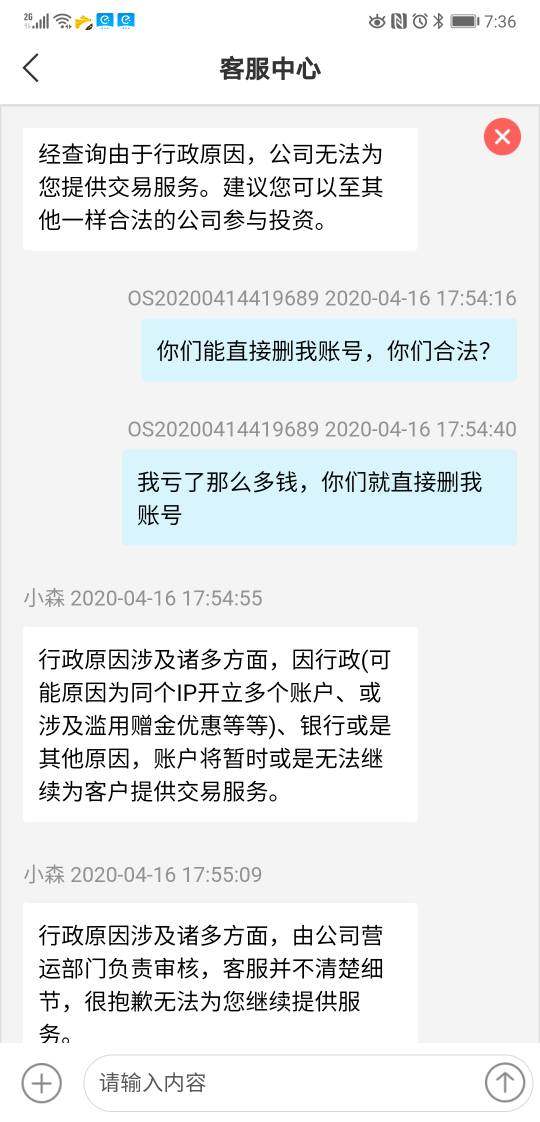

The reviews of BX on WikiFX highlight numerous concerns and allegations of fraudulent activities. Traders have reported difficulties in accessing the website, contacting customer service, and withdrawing funds. There are complaints about significant losses, forced liquidations, manipulated orders, frozen accounts, and slippage issues. Traders have accused BX of inducing deposits, deleting accounts, and engaging in scam practices. The reviews reflect a lack of trust and dissatisfaction among users, with some individuals reporting losses of significant amounts. It is important for traders to exercise caution and consider these experiences when evaluating BX as a trading platform.

Conclusion

BX, operated by 8 Bitnex Limited, is a trading platform based in China. While BX offers a wide range of market instruments, including forex, precious metals, commodities, and stock indices, it is important to note that the company is not currently regulated by any recognized regulatory agency. This lack of regulation raises concerns about the legitimacy and potential risks associated with trading on this platform. Traders should exercise caution and be aware of the warnings regarding potential scams. BX offers different account types with varying leverage options and spreads, but specific details about currency, depositing methods, withdrawal methods, and commissions are not provided. The platform supports popular trading platforms like MetaTrader 4, a web-based platform, and mobile trading apps for iOS and Android devices. BX provides some educational tools, including market analysis, educational webinars, video tutorials, and an economic calendar. However, it is important to consider the numerous concerns and allegations of fraudulent activities reported by users. These include difficulties in accessing the website, poor customer service, withdrawal issues, and allegations of scam practices. Traders should take into account the lack of trust and negative experiences expressed in user reviews when considering BX as a trading platform.

FAQs

Q: Is BX a regulated broker?

A: No, BX is not regulated according to the provided information.

Q: What trading instruments are available on BX?

A: BX offers Forex, Precious Metals, Commodities, and Stock Indices for trading.

Q: What are the account types offered by BX?

A: BX offers Standard, Professional, and Premium account types.

Q: What is the maximum leverage provided by BX?

A: BX offers a maximum leverage of up to 500:1.

Q: What is the minimum deposit requirement for BX?

A: The minimum deposit varies based on the account type, starting from 100 USD.

Q: What trading platforms are available on BX?

A: BX provides MetaTrader 4 (MT4), WebTrader, and mobile trading apps for iOS and Android.

Q: What educational tools are offered by BX?

A: BX provides market analysis, educational webinars, video tutorials, and an economic calendar.

Q: How can I contact BX's customer support?

A: You can contact BX's customer support through the Chinese (Simplified) support line or via email.

Q: Are there any concerns or complaints about BX?

A: Yes, there are concerns and allegations of fraudulent activities associated with BX based on reviews and user experiences.

乱

Hong Kong

BX Global has lost contact, the website cannot be logged in, and the customer service cannot be contacted. I have been trading on this platform for several years. It is not using MT4, but a platform developed by himself. Lost more than 40,000 before and after, often slipped, and now has lost contact.

Exposure

2022-06-25

ZH立冬

Hong Kong

Who had made profit from here? I had been lost all the time for many years. I stopped trading for a while and the customer service called many times to induce deposit. Now, I got some loss and cannot withdraw.

Exposure

2021-12-30

曹蓉

Hong Kong

BX manipulated on my orders which should be profitable to cause liquidation and deleted the evidence. This fraud has ripped many victims off.

Exposure

2020-07-06

玉面飞龙老龚

Hong Kong

The platform induced me to deposit fund and then closed position compulsorily. As long as I argued with them, they would deleted my account directly.

Exposure

2020-04-17

Z9

Hong Kong

The scam platform froze my account, stopping losses maliciously and giving no access to withdrawal.

Exposure

2020-03-22

韩掌柜

Hong Kong

There was a serious slippage with BX . Now it even canceled my account. Neither complaining nor reporting is feasible.

Exposure

2020-03-20

VTgame

Hong Kong

After trading for long, I wanted to make a withdrawal. But the related surface is blank. The company manipulated on it, leading to unavailable withdrawal.

Exposure

2020-03-03

K43150

Hong Kong

The highest pip was 59.265, while the platform closed my position inexplicably at 59.29.

Exposure

2020-01-13

致远76353

Hong Kong

BX scammed me over 400000 RMB. I have called the police.

Exposure

2019-12-26

行者55831

Hong Kong

8BX.COM scammed me over 600000 RMB and terminated my account.

Exposure

2019-12-08

南辰

Hong Kong

Don’t deposit in BX , which is a scam.

Exposure

2019-12-06

致远76353

Hong Kong

I registered in BX on September 3rd,2018 and the expiry date is September 3rd,2019.Now it is due! Teachers in BX profit by making investors lose fund.Please contact me to negotiate as soon as possible!

Exposure

2019-10-28

致远76353

Hong Kong

After defrauding me of more than 400000 RMB, BX even canceled my account without my permission.Fraud platform.I have called the police to file a case!

Exposure

2019-10-25

OrionZigg 80923

United Kingdom

Honestly, spreads are not as tight as they advertised, per my real trading experience. I have been trading with this broker for only two weeks, but I chose to go. You know why? Sure, you can guess.

Neutral

2024-08-07

FX5192548022

Hong Kong

Previously, I have traded on other platforms and encountered quite a few unscrupulous platforms. This platform offers a lot of bonus funds and the deposit and withdrawal speed is also relatively fast.

Positive

2024-08-12

Julia926

Taiwan

Baoxing Global platform is very good and I recommend it to everyone. Customer service is good and welcoming. Fast deposit and withdrawal! Thumbs up

Positive

2023-07-20