简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Indian Rupee Faces Challenge as Credit Spread Widens

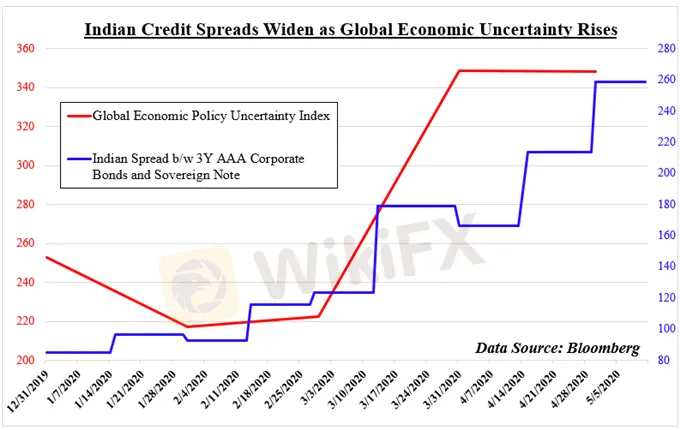

Abstract:India's credit spread has widened year to date, hovering around 260 basis points which can put Indian rupee in a difficult situation in the coming weeks.

May 17th, from WikiFX. India's credit spread has widened year to date, hovering around 260 basis points which can put Indian rupee in a difficult situation in the coming weeks.

Markit India Manufacturing PMI and Services PMI both hit a record low in April, at 27.4 and 5.4 respectively. A reading below 50 usually indicates shrinking business activities.

According to a survey by the Indian Economic Supervision Center (CMIE), the unemployment rate in India will reach a record high of 27.1%. In order to help the Indian economy severely affected by the epidemic, the Indian authorities have taken action in fiscal and monetary policies. To date, stimulus measures of about 1.7 trillion Indian rupees have been implemented, accounting for about 0.8% of GDP.

India's credit spread has widened year to date, hovering around 260 basis points. This credit spread is basically the difference in yield between Indian AAA corporate bonds and the sovereign government bonds of the same level.

With rising global economic uncertainties and the possibility for India to lift social distancing measures, the Indian rupee may face difficulties in the coming weeks.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator