简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

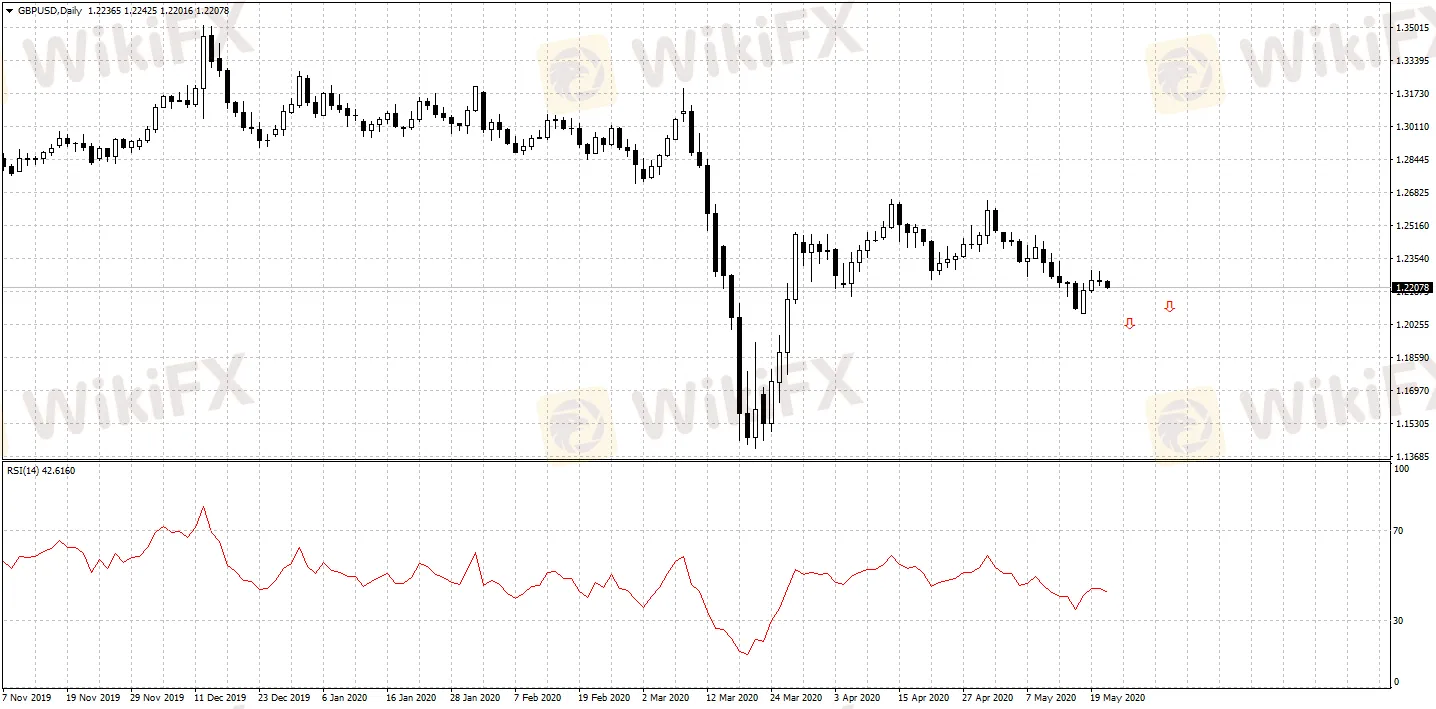

GBP Faces Pressure with Inflation Rate at 4-year’s Low

Abstract:Britain’s inflation rate dropped to the lowest since August, 2016, raising speculations that the Bank of England will have to take further measures to boost demand.

May 21st from WikiFX News. Britains inflation rate dropped to the lowest since August, 2016, raising speculations that the Bank of England will have to take further measures to boost demand.

In addition, Britan‘s CPI grew 0.8% year-on-year, lower than economists’ expectations. The figure may kindle an even more heated debate over whether the central bank should introduce negative interest rate for the first time.

HSBC downgraded its forecast of GBP/USD before the end of the year from the previous 1.35 to 1.2, while pointing out the risks including Britains fiscal well-being(as the worst of G10 members) and Brexit: euro is expected to rise from 0.81 to 0.87 against pound before the end of the year, the British government again dismissed the possibility of extending the Brexit transitional period, while it seems unlikely for the two sides to completely settle a free trade deal before the end of 2020.

With Britain sinking into a severe recession and the economy in sluggish recovery, structural factors may further weigh on the pound.

GBP/USD daily pivot points: 1.2243-1.2253

S1 1.2210 R1 1.2276

S2 1.2182 R2 1.2314

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

How UK house prices can help lift the GBP next week

How UK house prices can help lift the GBP next week

GBP Set to Decline in 2021

GBP/USD is set to decline amid the challenges to the UK's economy in 2021, albeit recent boost of the Brexit deal.

GBP Turns Around Drops on Extended Trade Talks

Britain and the European Union said after the Sunday meeting that talks would continue on a trade agreement.

GBP Falls Suddenly amid UK-EU Division

A no-deal Brexit seems possible as UK-EU trade talks reached the crisis point on Thursday, dragging GBP/USD down to 1.3250.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

ATFX Enhances Trading Platform with BlackArrow Integration

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

IG 2025 Most Comprehensive Review

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Should You Choose Rock-West or Avoid it?

Franklin Templeton Submitted S-1 Filing for Spot Solana ETF to the SEC on February 21

Top Profitable Forex Trading Strategies for New Traders

Currency Calculator