Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

just 4644

Hong Kong

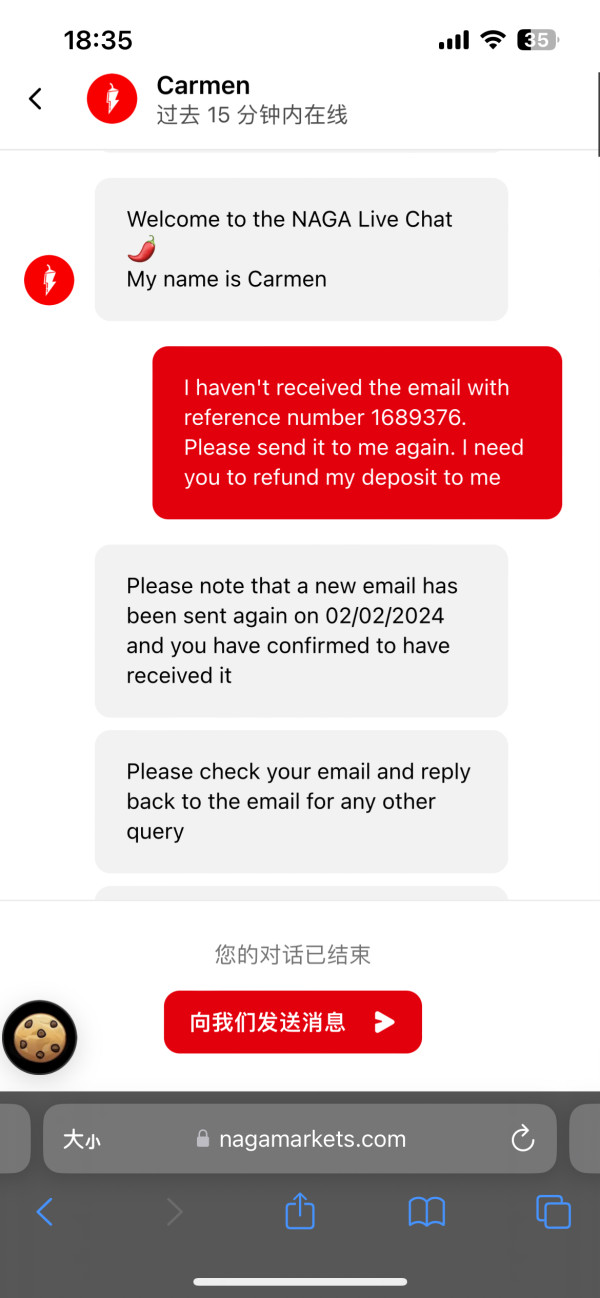

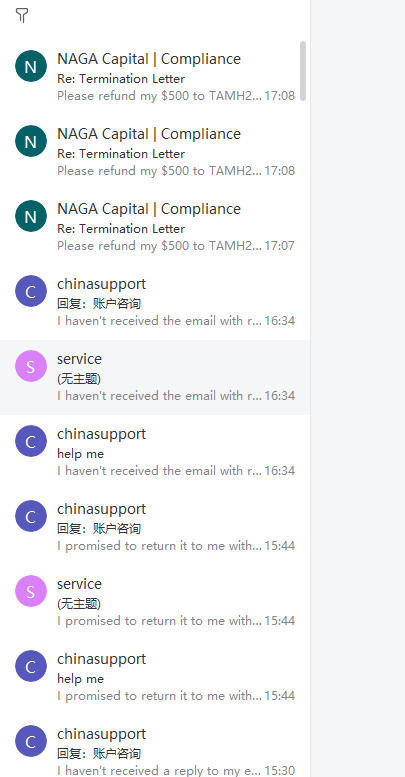

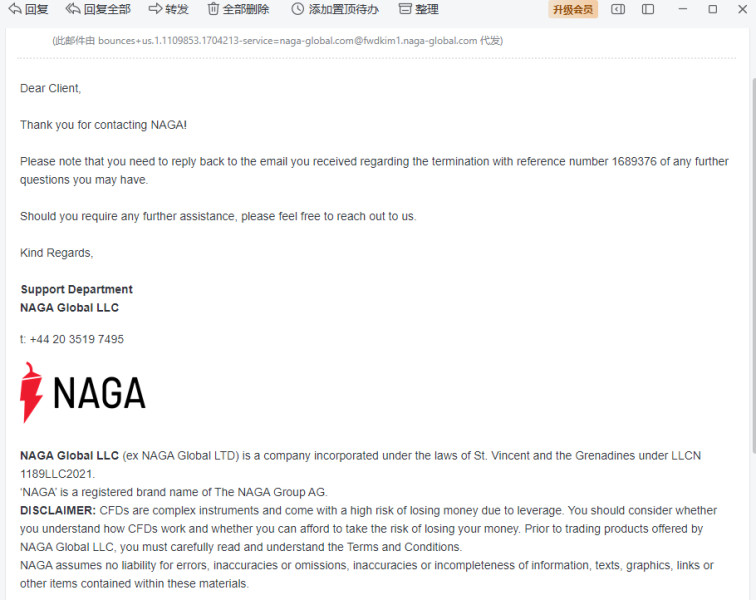

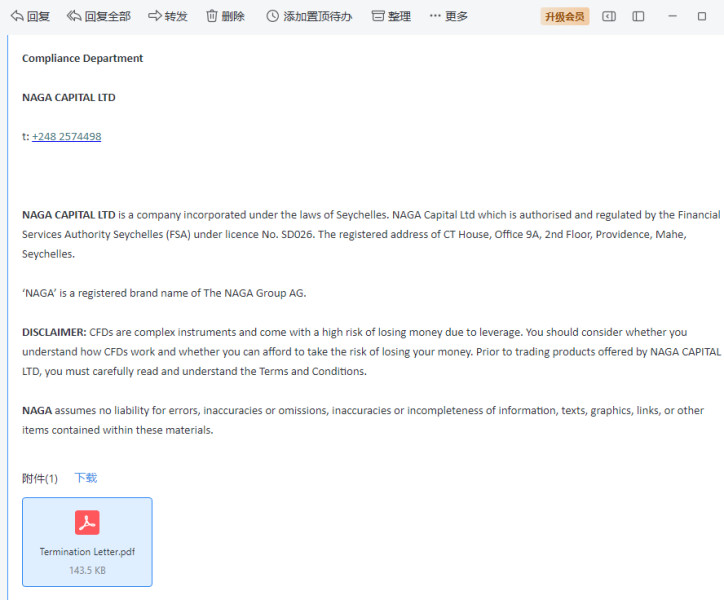

I deposited money on January 26, and my trading account is 7005736. After the profit was submitted for withdrawal, the platform deleted my account. Now I can't log in to the platform. The customer service staff kept delaying and said they had sent me an email to terminate the transaction. But after I replied to the email, there was no further response. A month later, it’s still the same. I send emails almost every day asking, but no one answers me. The website customer service closed the dialog box every time after I asked a question.

Exposure

2024-02-08

ING

India

Trading with NAGA has been an enriching experience. Their wide asset selection, autocopy feature, and thorough onboarding process really stand out.

Neutral

2024-04-19

FX1482523789

Australia

I've been trading on NAGA and honestly, it's quite reliable. Being regulated and part of a listed company gives it credibility. The social trading feature is a standout; you can mimic other traders' moves, which is cool but risky—choose wisely who you copy!

Positive

2024-06-04

FX1518667510

New Zealand

Platform performed really well, without any technical issues or lags. I appreciated that they offered a demo account. It allowed me to practice and get comfortable with my trading strategies before putting real money on the line. In terms of spreads, they were stable and predictable. In my experience, there were no unexpected jumps or falls. The spreads' stability played a significant part in me making some profit through my trades. 👍

Positive

2023-10-11