简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

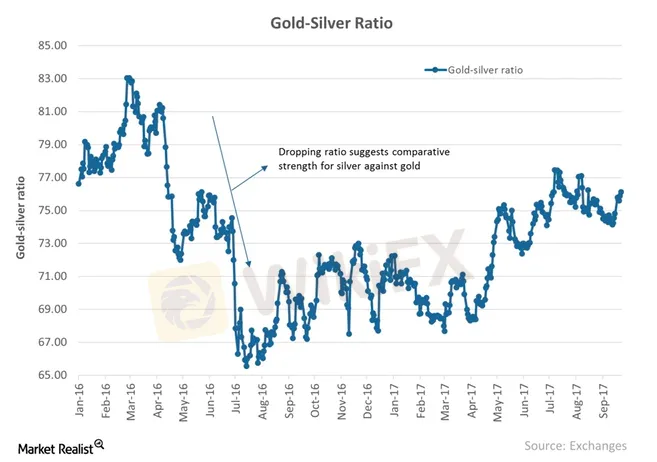

Serious Gold-Silver Ratio Divergence Makes Silver Worth-buying

Abstract:May 24th, from WikiFX news. Gold-Silver Ratio once hit a historical high of 112.82 in March 2nd this year. Now it’s slightly down, hovering around 100, but still at a relatively high level.

May 24th, from WikiFX news. Gold-Silver Ratio once hit a historical high of 112.82 in March 2nd this year. Now its slightly down, hovering around 100, but still at a relatively high level.

Spot silver dropped an overall 21.59% in the first quarter, with a performance much inferior to spot gold. But spot silver seemed to have its day coming in May, gaining 7.9% in compare to spot golds 3.06% rise. We see at least 3 reasons for silver to outperform gold.

First of all, historical data shows silver is relatively cheaper than gold.

Secondly, silver‘s positions are clearer (less packed than gold’s positions)

Finally, reopening of economy will likely see a rebound of industrial activities, and given that 50% of annual silver output is consumed by the industrial sector, silver consumption is expected to hike.

For speculative purpose, there‘s still plenty of room for silver. CFTC Commitment of Traders report shows that as of the week ending May 5th, investors cut their net long positions in silver by 403 tonnes, with net longs accounting for only 17% of open interests, significantly less than the historical peak of 57%. This suggests that once the market sentiment turns around, there’s plenty of room for additional speculative purchases.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

ATFX Enhances Trading Platform with BlackArrow Integration

IG 2025 Most Comprehensive Review

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

Should You Choose Rock-West or Avoid it?

Franklin Templeton Submitted S-1 Filing for Spot Solana ETF to the SEC on February 21

Scam Couple behind NECCORPO Arrested by Thai Authorities

Currency Calculator