简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Great Depression-Like Jobless Rate Seen for U.S.: Eco Week Ahead

Abstract:The devastation of the coronavirus pandemic on the U.S. labor market will be on display this week, with Fridays jobs report likely to show the unemployment rate soared to nearly 20% and employers cut millions more from their payrolls in May.

Asia

PMIs for May will be closely watched to assess the pace of the region‘s recovery. Australia’s central bank board will meet Tuesday, with no changes expected to its target for three-year bond yields or the cash rate -- both set at 0.25%. The following day, Australias first quarter GDP growth data will be released. Economists are currently expecting only a moderate contraction in the period as a pre-lockdown retail splurge offsets the impact of restrictions that came into effect at the end of the quarter.

For more, read Bloomberg Economics full Week Ahead for Asia

Europe, Middle East and Africa

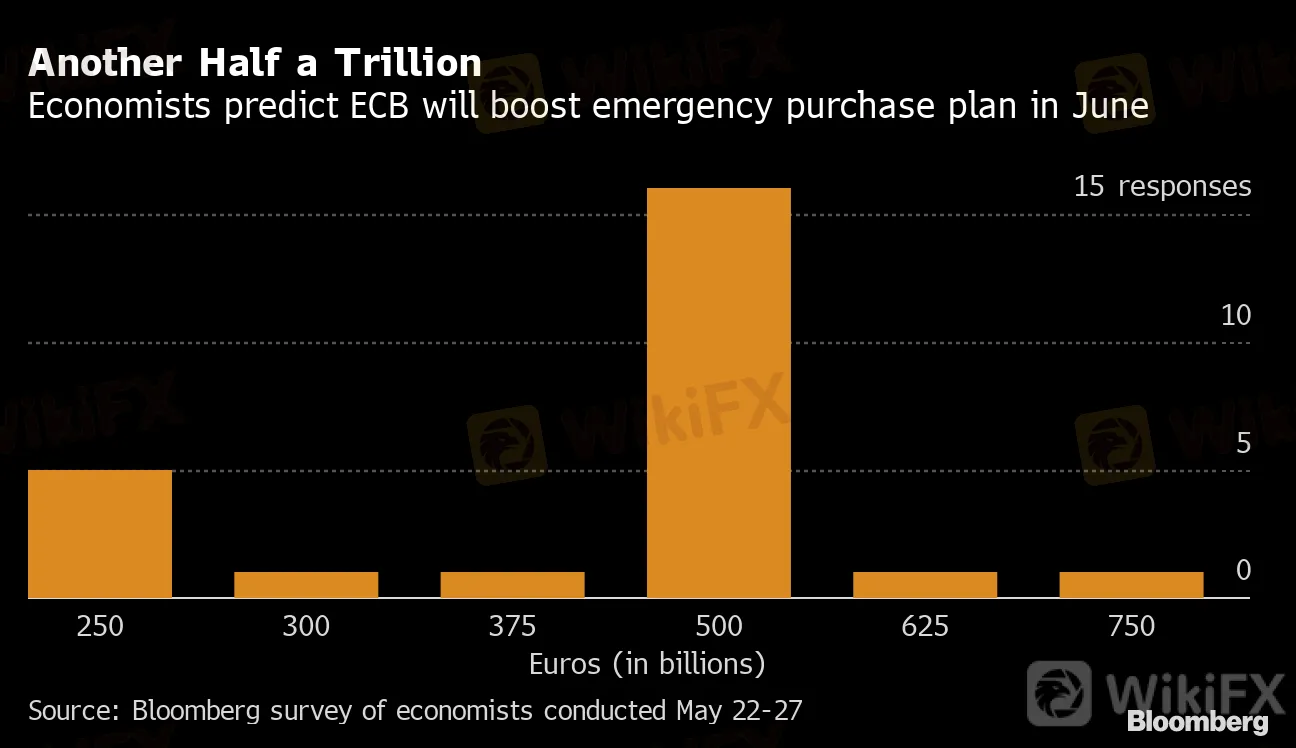

Anything less than an expansion of the ECBs emergency asset purchasing program will be a big shock to economists and investors, who widely anticipate a 500 billion-euro ($555 billion) top-up by the Governing Council. Policy makers will also release their latest economic projections, possibly confirming President Christine Lagardes remarks that the euro area is mired in a much-worse slump than initially hoped.

Another Half a Trillion

Economists predict ECB will boost emergency purchase plan in June

Source: Bloomberg survey of economists conducted May 22-27

On the data front, PMI survey readings could give investors a clue whether Italy and Spain, seen as the euro areas most vulnerable economies, are slowly starting to turn the page on the worst chapter of the crisis. In the U.K., house prices in May and mortgage approvals a month earlier could offer the first meaningful reading on the market after the lockdown brought viewings and sales to a halt.

Elsewhere in Europe, Romanias prime minister is expected to announce a new round of stimulus based on public investment and support for the private sector.

Data on Friday will show the South Africa Reserve Bank continued purchasing government bonds in May after more than doubling its holdings in April to reduce dysfunctionality in the market.

For more, read Bloomberg Economics full Week Ahead for EMEA

U.S. and Canada

The Federal Reserve is in blackout this week before its next regularly scheduled FOMC meeting later this month. Meanwhile, in the runup to Fridays jobs report, investors will digest more economic data showing the impact of the coronavirus. Reports include factory orders, trade numbers and the latest week of jobless claims.

Tiff Macklem takes over as Bank of Canada governor on Wednesday, starting a seven-year term that will be characterized by the lowest interest rates in the nations history and deepening links with the federal government.

For more, read Bloomberg Economics full Week Ahead for the U.S.

Latin America

On Monday morning, Chiles Imacec economic indicator, a proxy for output, may post a double-digit decline in April from a year earlier with the country shuttered by the outbreak and containment measures. That afternoon in Colombia, the minutes from Fridays central bank meeting should give a much better idea of where the current easing cycle is headed now that the key rate is at a record low.

On Wednesday, data in Brazil is likely to show that industrial output in April fell the most since at least 2003, when the national statistics agency introduced the current series. Reports on Friday from Chile and Colombia should show that inflation in both countries is slowing and well within their respective target ranges.

For more, read Bloomberg Economics full Week Ahead for Latin America

— With assistance by Alaa Shahine, Malcolm Scott, Robert Jameson, and Theophilos Argitis

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator