Score

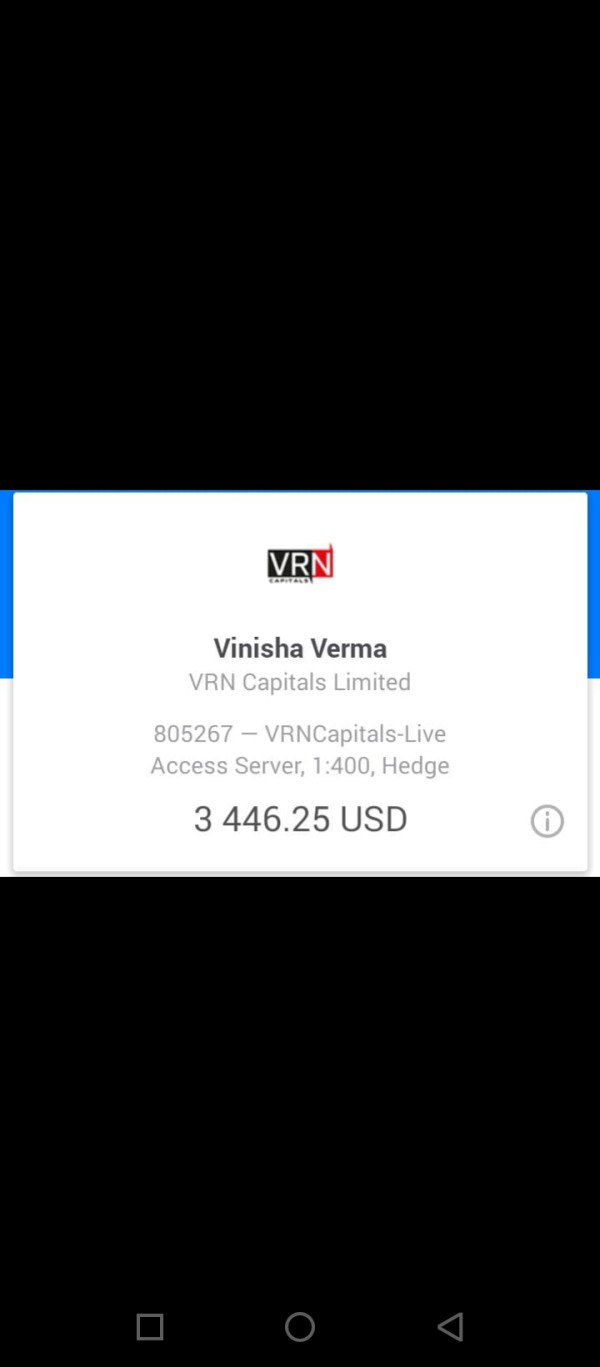

VRN Capitals

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://vrncapitals.com/index.php

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomAccount Information

Users who viewed VRN Capitals also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

vrncapitals.com

Website Domain Name

vrncapitals.com

Server IP

104.21.77.144

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| country/registered area | United Kingdom |

| Foundation year | 1-2 years |

| Company Name | VRN Capitals |

| Regulation | no regulation |

| minimum deposit | Varies by account type |

| Maximum Leverage | Up to 1:1000 |

| Untables | From 0 pips |

| trading platforms | MetaTrader 4, MetaTrader 5, virtual reality application |

| tradable assets | Forex, metals, oil, indices |

| Account Types | Classic, Ultimate, ECN, Prime, VIP, PAMM |

| demo account | Available |

| islamic account | Unmentioned |

| Customer Support | Telephone, Email, Whatsapp |

| Payment methods | Local transfer, electronic wallets, cryptocurrencies |

| educational tools | Free business guide, training sessions. |

General information

UK Registered, VRN Capitals is a forex broker that offers a number of trading instruments for both retail and professional traders, including forex, metals, oil and indices through the advanced mt4 trading platform. with the VRN Capitals platform, investors have the flexibility to choose from five trading accounts, with leverage up to 1:1000, spreads as low as 0.1 pips.

Pros and cons

VRN Capitalsoffers several potential advantages and disadvantages. On the positive side, it provides potential profit opportunities through price movements and diversification of investment portfolios. Traders gain access to global markets and various trading opportunities, with the option to use leverage to enhance trading possibilities. VRN Capitals offers a range of account options, including leverage options and low minimum deposits for certain accounts. In addition, it provides a variety of types of spreads and swaps on most accounts. however, it is important to consider the potential risks involved. market volatility can lead to financial losses and there are no guarantees or protections for investments. there is a risk of scams or fraudulent activity, and VRN Capitals it operates without regulatory oversight, which can limit control and transparency. In addition, limited information is available on trading conditions and certain accounts may incur commission charges. traders must carefully weigh these pros and cons to make informed decisions when considering VRN Capitals as a trading platform.

| advantages | Contras |

| Profit potential from price movements | Risk of financial loss due to market volatility |

| Portfolio diversification opportunities | Lack of guarantees or protections for investments |

| Access to global markets and various business opportunities | Possibility of scams or fraudulent activities |

| Availability of leverage for better trading opportunities | Limited control over external factors that affect market prices |

| Diverse range of account options | Lack of regulatory oversight |

| Take advantage of options for different needs | Increased potential risk due to unregulated status |

| Low minimum deposit for some accounts | Possible lack of transparency |

| Variety of propagation types | Commission charges on certain accounts |

| SWAPS availability on most accounts | Limited information on trading conditions |

is VRN Capitals legal?

VRN Capitalsis a financial entity that operates in the brokerage industry. however, it is important to note that VRN Capitals it is not a regulated entity. this means that it is not subject to the surveillance or supervision of any recognized financial regulatory authority.

the lack of regulation raises concerns regarding the credibility and safety of VRN Capitals as a brokerage firm. Regulatory bodies play a crucial role in ensuring that financial institutions adhere to certain standards, follow proper procedures, and protect the interests of their clients. Without regulatory oversight, there is an increased risk of potential fraudulent activity, mismanagement of funds, or other unethical practices.

Market Instruments

with the VRN Capitals platform, you can trade four classes of trading instruments including currencies, metals, oil and indices.

he VRN Capitals The platform offers traders the opportunity to participate in the trading of various market instruments. These instruments are classified into four classes, namely currencies, metals, oil and indices. Let's take a closer look at each of these classes:

1. FOREIGN EXCHANGE: The foreign exchange (Forex) market allows traders to buy and sell different currencies. Forex trading offers the opportunity to profit from fluctuations in exchange rates between currency pairs. It is a highly liquid market with high trading volumes, giving traders ample opportunities to enter and exit positions.

2. RAILS: The metals market involves trading in precious metals such as gold, silver, platinum, and palladium. Precious metals are widely regarded as a store of value and are sought after for both industrial and investment purposes. Trading metals allows investors to diversify their portfolios and potentially profit from the price movements of these commodities.

3. OIL: The oil market allows traders to speculate on the price movements of crude oil, one of the most traded commodities globally. Oil trading is influenced by factors such as supply and demand dynamics, geopolitical events, and economic indicators. Traders can take advantage of price volatility and potentially profit from rising and falling oil prices.

4. INDEXES: The indices market involves the trading of financial instruments that represent a specific segment of the stock market. Indices are built to track the performance of a group of stocks, providing an overall snapshot of the market or a specific sector. Trading indices allows investors to gain exposure to a diversified portfolio of stocks without having to trade individual securities.

| advantages | Contras |

| Profit potential from price movements | Risk of financial loss due to market volatility |

| Portfolio diversification opportunities | Lack of guarantees or protections for investments |

| Access to global markets and various business opportunities | Possibility of scams or fraudulent activities |

| Availability of leverage for better trading opportunities | Limited control over external factors that affect market prices |

| Reliance on accurate market analysis and decision making. |

Account Types

VRN Capitalsoffers several types of trading accounts to meet the diverse needs of its clients. These accounts are designed to provide different features and benefits depending on the trading preferences and investment capabilities of the traders.

CLASSIC ACCOUNT:

The Classic account is suitable for traders looking for a lower minimum deposit requirement, starting from $10. Offers leverage of 1:1000, allowing traders to extend their trading positions. The account operates with floating spreads, starting at 1 pipe, and does not charge any commission. Swaps are applicable on this account.

LAST ACCOUNT:

The Ultimate account is designed for traders who are willing to deposit a minimum of $100 Provides leverage of 1:500, allowing traders to access higher trading volumes. Similar to the Classic account, it operates with floating spreads, from 1 pipe, and does not charge any commission. Swaps are also applicable on this account.

ECN ACCOUNT:

The ECN account is suitable for traders who prefer a higher minimum deposit of $500. Offers leverage of 1:1000 and trades with floating spreads, from 1 pipe Unlike the previous two accounts, the ECN account charges a commission for each trade executed. Swaps are also applicable on this account.

MAIN ACCOUNT:

The Prime account requires a higher minimum deposit of $1000 and offers leverage of 1:200. Trade with floating spreads, starting at 0 pipes The Prime account charges a commission for each trade and does not impose swaps.

VIP ACCOUNT:

The VIP account is designed for high net worth individuals or experienced traders who are willing to deposit a minimum of $2500. Offers leverage of 1:100 and trades Raw floating spreads, which means potentially lower spreads. Similar to the Prime account, it charges a commission for each operation and does not impose swaps.

PAMM ACCOUNT:

The PAMM account is specifically designed for professional money managers or traders who want to manage multiple accounts. Requires a higher minimum deposit of $10,000 and offers leverage of 1:200. Trade with floating spreads, starting at 0.2 pipes, and charges a commission for each operation. Swaps are applicable on this account.

| advantages | Contras |

| Diverse range of account options | Lack of regulatory oversight |

| Take advantage of options for different needs | Increased potential risk due to unregulated status |

| Low minimum deposit for some accounts | Possible lack of transparency |

| Variety of propagation types | Commission charges on certain accounts |

| SWAPS availability on most accounts | Limited information on trading conditions |

In addition to live trading accounts, demo accounts are also available for newcomers to get familiar with this platform and practice their trading skills without risking their real capital.

how to open an account with VRN Capitals ?

open an account with VRN Capitals It is an easy and simple process:

1. Click on the CREATE ACCOUNT link and fill in some required details on the popup page.

2. Upload your personal details for this company to verify their details.

3. Fund your account and start trading with this forex broker.

Leverage

when it comes to leverage, VRN Capitals allows traders to use leverage of up to 1:1000, incredibly higher than levels considered appropriate by many regulators, with maximum leverage for major currencies up to 1:30 in Europe and Australia, and 1:50 in Canada and us uu.

Since leverage can also cause serious loss of funds, it is important for inexperienced traders to choose the appropriate amount that they are most comfortable with.

Spreads and Commissions

VRN Capitalsoffers different spreads and commissions depending on the type of trading account you have on their platform. the classic account, the definitive account and the ecn account offer spreads from 1 pipe On the other hand, the Prime account offers spreads starting from 0 anyone.

in addition to the spreads, the vip account in VRN Capitals offers raw spreads. this means that the spreads offered on this account are not marked up or modified by the broker. However, it is important to note that the VIP account also incurs a commission of $5 per 10,000 dollars traded This commission is charged separately from spreads and is based on trading volume.

deposit and withdrawal

deposit and withdrawal options provided by VRN Capitals include local transfer, electronic wallet, Skrill, bank transfer, CoinPayments, Bitcoin, Ethereum and PerfectMoney. To make a deposit or withdrawal, clients can use the VR Capital payment system.

To initiate a deposit or withdrawal, clients must complete the payment and send a screenshot of the transaction, along with their Client ID, to the VR Capitals office via WhatsApp, email, or the client portal. Upon verification, the deposit will be credited instantly within 24 hours.

In addition to the above options, VRN Capitals also supports QR Code UPI Payments. Customers can download the UPI payment QR code and proceed with the transaction. Also, bank details for wire transfers are provided for those who prefer this method.

| advantages | Contras |

| Instant credit in 24 hours | Lack of regulatory oversight |

| Multiple options for deposit and withdrawal | Potential risk of fraudulent activities |

| Support for popular e-wallets and cryptocurrencies | Limited transparency and accountability |

| Payment option with UPI QR code | Reliance on sending screenshots for verification |

| Bank transfer option available | Potential delays in processing withdrawals |

business platform

VRN Capitalsoffers multiple trading platforms to cater to different types of traders.

PLATFORM METATRADER 5

One of its outstanding options is the Meta Trader 5 platform, which is considered one of the best forex trading platforms available. It is especially recommended for traders who prefer to use MetaTrader 5. This platform offers several advantages, including low spreads on major currency pairs, a wide range of CFDs, fast ECN trading speeds with low latency, and the availability of educational support. commercial.

VR APP

in addition to metatrader 5, VRN Capitals also offers the option to download your virtual reality app. This app is designed to enhance the trading experience by offering a virtual reality environment where traders can immerse themselves in the market and make more informed decisions.

PLATFORM METATRADER 4

besides, VRN Capitals offers the popular MetaTrader 4 Platform. MT4 is known for its user-friendly interface, extensive charting capabilities, and a wide range of technical analysis tools. It gives traders the ability to execute trades efficiently and access real-time market data.

| advantages | Contras |

| Low spreads on major currency pairs | Limited regulatory oversight |

| Free Funding and Withdrawal Methods | Lack of information on commercial conditions. |

| Support for business education. | Limited platform options |

| High ECN trading speeds with low latency | |

| low commissions |

Business tools and educational resources

VRN Capitalsoffers a range of trading tools and educational resources to help traders in their investment process. These resources are intended to provide valuable information, strategies, and techniques for trading successfully. The following paragraphs describe the different types of tools and resources available:

1. free market education: VRN Capitals offers a free online trading guide that provides comprehensive information on various trading strategies and techniques. Traders can learn and improve their knowledge through this guide, allowing them to identify daily opportunities in the market. besides, VRN Capitals offers free training sessions and demo accounts, along with one-on-one tutorials for personalized learning.

2. open forex account and support: VRN Capitals allows traders to open forex trading accounts quickly and easily. merchants can apply in person or online with zero account opening and maintenance fees. VRN Capitals provides multiple account types to meet the various needs of traders.

3. Market advisor and consultancy: VRN Capitals offers advisory and market consulting services. this includes assistance in buying and selling foreign currency, providing top-notch customer service to international travelers. Traders can benefit from expert insight and guidance to make informed trading decisions.

4. portfolio management: VRN Capitals provides portfolio management services where traders can outsource the management of their portfolios to expert portfolio and fund managers. this allows traders to enjoy profits without the need for in-depth market knowledge and continuous monitoring.

5. financial business events: VRN Capitals organize seminars and business events to educate people on specific topics or teach particular skills. these events feature expert speakers and provide valuable insight into the financial industry.

6. Business tools and software: VRN Capitals offers trading software equipped with tools that help investors analyze markets and execute trades. The software includes advanced technical analysis capabilities and pattern recognition features to improve trading decision making.

| advantages | Contras |

| Free trading guide and educational resources provide valuable insights and strategies. | Lack of information on the depth and quality of educational content. |

| Quick and easy forex account opening process | Limited details on types and features of trading software and tools |

| Market advisory and consultancy services offer expert guidance | Lack of transparency about advisors' experience and qualifications |

| Portfolio management services enable passive investing | Limited information on the track record and performance of fund managers |

| Business events provide opportunities to network and learn | Insufficient information on the frequency and availability of events |

| Trading software offers advanced technical analysis capabilities | Limited information about the specific features and functionality of the software |

Customer Support

customer service in VRN Capitals is available to assist customers with any queries or problems they may encounter. users can communicate with the support team through various communication channels, ensuring accessibility and convenience.

the following methods can be used to contact VRN Capitals ' Customer Support:

1. Phone: customers can contact VRN Capitals dialing +447520640867. this allows direct and immediate communication with a representative who can address your concerns.

2. Email: Users can send questions or concerns to support@vrncapitals.com. This method provides a written record of the communication and allows for detailed explanations or attachments if necessary.

3. whatsapp: VRN Capitals also offers support via whatsapp, although the specific contact details of this platform are not provided in the information provided.

besides, VRN Capitals maintains a physical presence with a registered business address located at 2nd floor college house, 17 king edwards road, ruislip, london - ha4 7ae, united kingdom. this allows customers to visit or correspond with the company if necessary.

besides, VRN Capitals He maintains an online presence on various social media platforms including Facebook, YouTube, Instagram, and Linkedin. Clients can follow these platforms to stay up to date on broker activities, educational content and announcements.

Conclusion

in conclusion, VRN Capitals operates as a financial institution in the brokerage industry, offering traders the opportunity to participate in trading various market instruments. however, it is important to note that VRN Capitals it is not a regulated entity, which raises concerns regarding its credibility and security. while VRN Capitals offers diverse account options, significant leverage and multiple trading platforms, the lack of regulatory oversight and limited information on trading conditions pose potential risks. In addition, the absence of guarantees or protections for investments and the possibility of scams or fraudulent activities add to the disadvantages of choosing VRN Capitals as a brokerage firm. merchants should carefully consider these factors before committing to VRN Capitals .

frequent questions

what is it VRN Capitals a regulated entity?

a: no, VRN Capitals it is not regulated by any recognized financial regulatory authority.

Q: What market instruments can I trade? VRN Capitals ?

to: VRN Capitals offers trading opportunities in currencies (forex), metals, oil and indices.

q: what types of business accounts do you have VRN Capitals offer?

to: VRN Capitals It offers classic, ultimate, ecn, prime, vip and pamm accounts, each with different features and benefits.

q: how can i open an account with VRN Capitals ?

a: to open an account with VRN Capitals , visit their website, locate the account opening section, choose between a real or demo account, fill in the required details, submit the necessary documents for verification, fund your account and start trading.

q: what leverage options VRN Capitals offer?

to: VRN Capitals offers leverage of up to 1:1000, which is higher than what is normally allowed by regulated financial authorities.

Q: What are the spreads and commissions you offer? VRN Capitals ?

A: Spreads and commissions vary depending on the type of trading account. Spreads start from 1 pip for Classic, Ultimate and ECN accounts, and from 0 pips for Prime and VIP accounts. The VIP account incurs a commission of $5 for every 10,000 USD traded.

q: what deposit and withdrawal options are available with VRN Capitals ?

to: VRN Capitals offers options such as local transfer, e-wallets, skrill, bank transfer, coin payments, bitcoin, ethereum and perfectmoney for deposits and withdrawals.

q: what do trading platforms do VRN Capitals offer?

to: VRN Capitals offers metatrader 5 platform, vr app and metatrader 4 platform.

q: what business tools and educational resources does VRN Capitals provide?

to: VRN Capitals offers free market education, market advice and consultancy, portfolio management services, financial trading events, trading tools and software, and a variety of educational resources.

Q: How can I contact you? VRN Capitals ' Customer Support?

A: you can contact VRN Capitals customer support by phone, email and possibly whatsapp. they also have a physical business address and maintain an online presence on social media platforms.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 4

Content you want to comment

Please enter...

Comment 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Anis shaikh

India

change leverage any time by company 500 to 400 and many time 400 to 100 apply by broker

Exposure

2022-02-23

不忘初心21686

Morocco

The platform is easy to navigate, the execution is generally fast, and I have not encountered any major issues with their customer service. However, as a trader who has invested a relatively small amount, I have been mindful of minimizing my costs and maximizing my returns. Therefore, I am now considering switching to their ECN account, which offers tighter spreads and potentially lower trading costs.

Positive

2023-03-29

FX1320939513

United Kingdom

One of the most decent trading platforms and brokers I have encountered throughout my trading career I guess. I trade a whole bunch of assets including forex, precious metals and indices at low cost.

Positive

2023-03-06

naitikkk

India

this is one of the Best broker

Positive

In a week