简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How will USD exchange rate change facing the oncoming US election 2020?

Abstract:2020 is a special year, the election year of the United Stated. After the financial markets of the United States have experienced the epidemic and riots, the general election of the United Stated is coming. For countries with a democratic or parliamentary government, the election year is often an uncertain period.

The 2020 US presidential election is the 59th quadrennial presidential election in American history. Looking back at history, since the major western currencies adopted floating exchange rate after the collapse of the Bretton Woods system in 1972, the United States has held 10 general elections, six of which have seen a sharp fall in the dollar before the election. Politics is an important factor affecting the trend of forex. In order to avoid the uncertainties before and after the election, investors usually sell the domestic currency, which causes the currency to depreciate rapidly in a short period. For the forex market, the result of the US presidential election will lead to a short-term rise in the US dollar. After all, this is a long-term uncertainty factor that has become a certainty; unless the result cannot be released for a long time. Extension of the uncertainty will lead to a short-term and rapid decline of the US dollar.

As for the trend of the dollar, as long as the result of the US presidential election and the short-term uncertainty are on schedule, the dollar will be supported by some covering positions. On this point, the election result does not make much difference. The political factors often emerge suddenly, come quickly and go violently, without warning in advance, so it is difficult to predict them and they do great damage to the forex market, which often causes the forex rate to rise and fall, or even deviate from the long-term equilibrium price. However, when the event occurs, the trend of forex will change in accordance with the direction of its long-term equilibrium price.

Generally speaking, short-term price changes can only correct the direction of long-term forex equilibrium price at most, but it is difficult to change or completely reverse its long-term fluctuation trend.

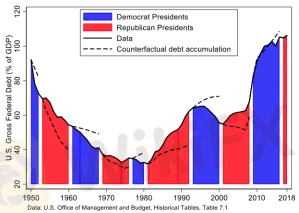

Monetary Policy: Republican Party.

Fiscal conservatism is the business card of the Republican Party. The proposed monetary policy focuses on reducing national debt and private sector job creation. Republican candidates are often seen as a harbinger of more business-friendly legislation, lower taxes and tighter government spending.

Looking back at the 2014 mid-term election, Republicans were expected to control the U.S. Senate and introduce legislation to challenge the Federal Reserve (Federal Reserve, FED) 's low interest rate policy and quantitative easing). In the days before the election, the dollar reached its highest level against the euro, Swiss franc and yen expected the election result and potential policy shifts. Although this was a rare situation, the 2014 mid-term election did illustrate the relationship between party politics and monetary policy facing the dollar. As the poll data became more specific in the days beforethe election, traders found a reason to buy the dollar, expecting interest rates to tighten and currencies to appreciate in the long run.

Monetary Policy: Democratic Party.

The Republican Party is opposed to the Democratic Party, whose monetary policy is centered on creating public sector jobs and increasing government spending. Support for legislation on issues such as universal health care, education welfare and large-scale public works projects can be attributed to the policies of the Democratic administration.

The 2012 presidential election provided an example of market conditions during the election period in which Democratic candidates stood out. This highly competitive election is often seen as a tie by political experts, and the money market shows the uncertainty of “experts”. EUR / USD, USD / SWF and USD / JPY have narrow annual volatility ranges, with little change in exchange rate valuations. The market conditions faced by these major dollar currency pairs are often attributed to the coming period of uncertainty and the “wait-and-see” trading strategy adopted by traders and investors.

WikiFX App is a third-party inquiry platform for company profiles.WikiFX has collected 17001 forex brokers and 30 regulators and recovered over 300,000,000.00 USD of the victims.

It, possessed by Wiki Co., LIMITED that was established in Hong Kong Special Administrative Region of China, mainly provides basic information inquiry, regulatory license inquiry, credit evaluation for the listed brokers, platform identification and other services. At the same time, Wiki has set up affiliated branches or offices in Hong Kong, Australia, Indonesia, Vietnam, Thailand and Cyprus and has promoted WikiFX to global users in more than 14 different languages, offering them an opportunity to fully appreciate and enjoy the convenience Chinese Internet technology brings. WikiFXs social media account as below:

Facebook:

USA Area:https://www.facebook.com/WikiFX.US/

UK Area:https://www.facebook.com/Wikifx.UK/

Nigeria Area:https://www.facebook.com/WikiFX.ng

Twitter:

Areas where English is an official language:https://twitter.com/WikiFX_Eng

More details about how to download WikiFX App:

Please download WikiFX APP from links below or scan QR code :

iosAppStore: https://apps.apple.com/us/app/fxeye/id1402501387?l=zh&ls=1

Googleplay: https://play.google.com/store/apps/details?id=com.foreigncurrency.internationalfxeye

If you have any questions, please feel free to contact us at wikifx@wikifx.com

Worried about missing out latest trends in the volatile market? WikiFX ‘News Flash’ is here to help!

With 24-hour real-time update of forex market data by minute, you can seize the opportunity of every bullish market! Bookmark the link below and follow the market trends immediately!

UK Area:https://live.wikifx.com/uk_en/7x24.html

USA Area:https://live.wikifx.com/us_en/7x24.html

Nigeria Area:https://live.wikifx.com/ng_en/7x24.html

Wiki Forum Forum Function:

In order to help more investors, WikiFX has launched the “WikiFX Forum” forum, which aims to provide urgently needed and professional services to Nigerian forex investors.

The exposure function of “WikiFX Forum” includes the following features:

1: Allow investors who have been defrauded by illegal broker to complain directly in the forum (as shown in the screenshots)

As long as there is sufficient evidence, a review panel and an executive team will contact the broker to discuss the complaint or expose it directly through the media. Here are the exposure channels:

2: Block low score brokers from entering the forum

3: Monitor suspicious communication in real time, and directly spot and deal with suspicious fraud;

4: Negotiate with highly reliable brokers selected by WikiFX in the secure environment of WikiFX Forum.

WikiFX APP exposure channel: https://activities.wikifx.com/gather/indexng.html

Information page to understand forex scam and exposure channel: https://activities.wikifx.com/gather/indexng.html

Website exposure channel: https://exposure.wikifx.com/ng_en/revelation.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator