简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Stock Market Is Taken over by Speculation

Abstract:Currently, a speculative atmosphere has been pervading US stocks. After the junk stocks such as bankruptcy concept stocks has been speculated, speculators begin to hype "black concept stocks".

WikiFX News (21 June)- Currently, a speculative atmosphere has been pervading US stocks. After the junk stocks such as bankruptcy concept stocks has been speculated, speculators begin to hype “black concept stocks”.

Whether because of living in an epidemic quarantine zone or having received a government subsidy that is higher than usual salary, retail investors in US stocks have been betting on stocks of listed companies that have filed for or are close to bankruptcy, playing against each other in a highly leveraged environment.

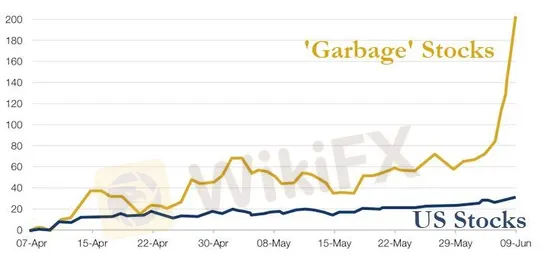

According to the “junk stock index” constructed by analysts, since April 7th, junk stocks have significantly outperformed the Morgan Stanley Capital International MSCI US Index (MSCI US Index), and stock prices seem to have completely deviated from the fundamentals.

In addition, the “BLM (Black Lives Matter.)” movement also seems to have affected US stocks. Traders try to show their virtues by greedily hyping “black concept stocks” and betting heavily on black-owned corporation. For example, the black-operated Carver Bancorp's bank has recently risen by nearly 800%.

The above information is provided by WikiFX, a world-renowned forex query provider that offers comprehensive information about forex brokers. For more information, please download the WikiFX App. bit.ly/WIKIFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Super Micro Computer Eyes $40B Revenue by Fiscal 2026 Amid Challenges

Super Micro Computer targets $40B revenue by fiscal 2026 despite slashed 2025 guidance and Nasdaq delisting risks. Shares surge 10%.

Webull Review 2025: Pros and Cons Revealed

Webull was founded in 2017, quite newer to the brokerage industry than traditional players like Charles Schwab, Fidelity, Interactive Brokers and Robinhood. However, it stands tall when it comes to products offerings: Stocks, Options, cryptos, Index Options, Futures, ETFs, OTC, Margin, Fractional Shares. Webull applies no commission on stock, options and ETFs trading listed on U.S. Exchanges.

In Bursa Malaysia: Local Institutions Sustain Buying Streak & New Subsector Classification

Bursa Malaysia maintains market momentum with sustained institutional buying while introducing a renewable energy subsector to attract sustainability-focused investors and support Malaysia's green transition.

Oriental Kopi’s IPO: Worth the Buzz or Not?

Kopi Holdings Bhd, a café chain operator under the brand Oriental Kopi, is gearing up for its listing on the ACE Market of Bursa Malaysia. The company has garnered a positive valuation from Mercury Securities Sdn Bhd, which has assigned a fair value of 68 sen per share, citing strong earnings growth potential driven by outlet expansions and increasing contributions from fast-moving consumer goods (FMCG) sales.

WikiFX Broker

Latest News

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

The Impact of Interest Rate Decisions on the Forex Market

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

STARTRADER Spreads Kindness Through Ramadan Campaign

Rising WhatsApp Scams Highlight Need for Stronger User Protections

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

How a Housewife Lost RM288,235 in a Facebook Investment Scam

The Daily Habits of a Profitable Trader

Currency Calculator