简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

New M&A Wave Seen for Gulf Banks Trying to Outrun Virus Slowdown

Abstract:The coronavirus-induced economic slowdown is prompting a new wave of consolidation talk among banks in the Persian Gulf.

The coronavirus-induced economic slowdown is prompting a new wave of consolidation talk among banks in the Persian Gulf.

In less than a week, two potential tie-ups have been announced, adding momentum to an already unprecedented merger and acquisition spree. Saudi Arabia‘s biggest lender National Commercial Bank kicked off the most recent wave with an offer to buy rival Samba Financial Group in what could be the world’s biggest banking takeover this year. Days later, two Qatari lenders said theyd started initial talks to combine.

“Banks are struggling to deliver top-line growth in an environment where low oil prices are crimping public spending and denting private-sector confidence, and where low interest rates are keeping margins in check,” said Rahul Shah, the Dubai-based head of financials equity research at Tellimer Ltd. The Saudi deal is also being driven the desire to create a regional champion and other lenders “may be forced to respond.”

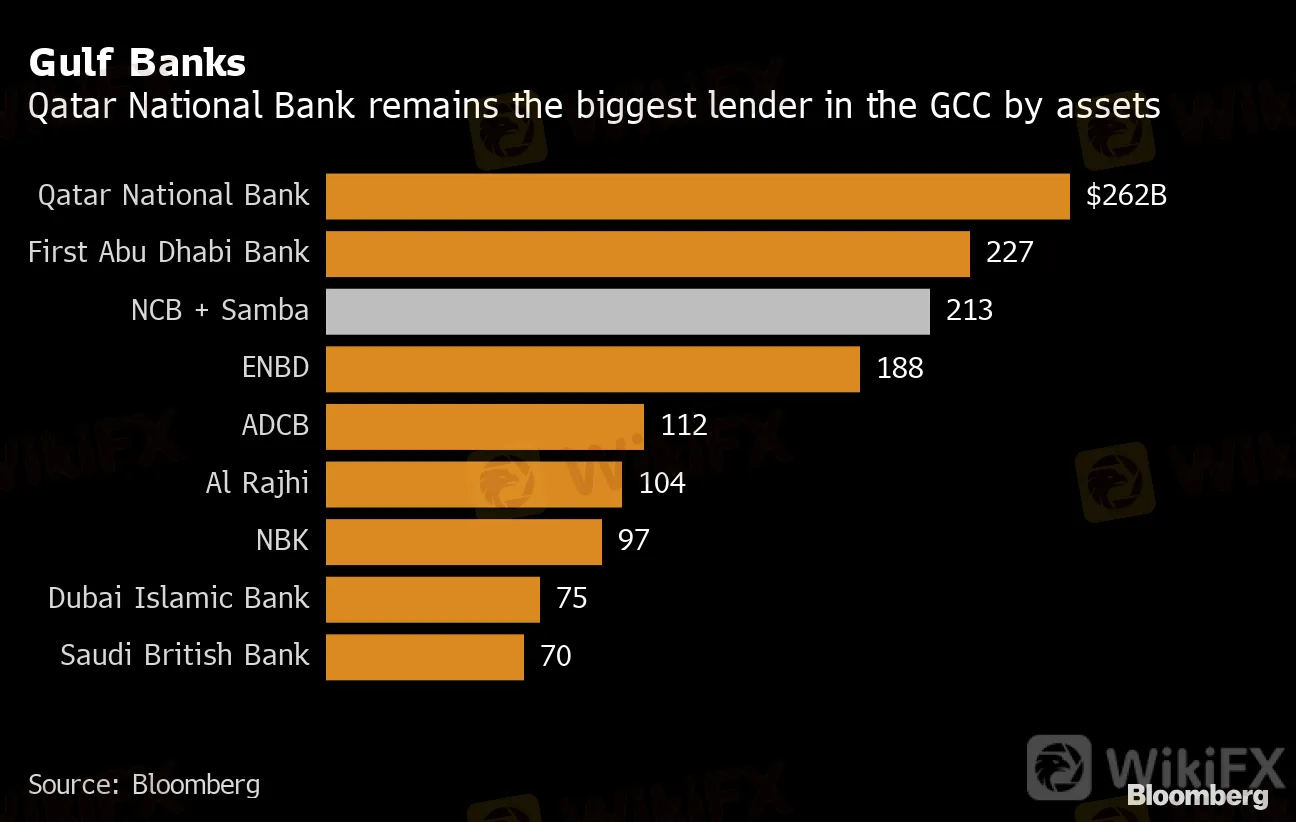

Gulf Banks

Qatar National Bank remains the biggest lender in the GCC by assets

Source: Bloomberg

The region is also heavily over-banked and lenders are being compelled to do deals to remain competitive. There are more than 70 listed banks in the six-nation Gulf Cooperation Council, according to data compiled by Bloomberg, catering to a population of about 50 million people.

“The economic trauma from lower oil revenues and the Covid-19 lockdowns are the catalysts for another round of consolidation in the banks,” said Hasnain Malik, the head of equity strategy at Tellimers Dubai unit. “This reduction of excess capacity has been long overdue.”

Qatar, for instance, has 2.5 million people being served by about 20 local and international banks, and its second-biggest lender has less than a fifth of the assets of its the biggest bank. This leaves smaller lenders at a disadvantage unless they can find a niche or competitive edge.

Qatari Banking Landscape

The combined entity will be neck-to- neck with QIB for the second spot

Source: Bloomberg

Higher compliance costs with the implementation of new accounting standards, rapid technological innovations, the impact of the introduction of value added tax and the need for stronger corporate governance is also adding to the costs for banks, compounding pressure on small- and medium-sized lenders to consolidate. Regional institutions are heavily reliant on government deposits, which have been dwindling in tandem with lower crude prices.

More than 20 financial institutions with total assets exceeding $1 trillion were in deal talks in the region last year. But the mergers are complex, and given the large holdings held by governments, succees is highly dependent on political backing. While many discussions have started, only a handful have completed.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

ATFX Enhances Trading Platform with BlackArrow Integration

IG 2025 Most Comprehensive Review

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

Should You Choose Rock-West or Avoid it?

Franklin Templeton Submitted S-1 Filing for Spot Solana ETF to the SEC on February 21

Scam Couple behind NECCORPO Arrested by Thai Authorities

Currency Calculator