简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Asian Stocks to Open Higher After U.S. Gains: Markets Wrap

Abstract:Asian stocks looked set to follow Wall Street higher after a better-than-expected U.S. jobs report overshadowed ongoing concerns that new coronavirus hotspots could derail the economic recovery.

Asian stocks looked set to follow Wall Street higher after a better-than-expected U.S. jobs report overshadowed ongoing concerns that new coronavirus hotspots could derail the economic recovery.

Investors cheered data showing payrolls rose by 4.8 million in June after an upwardly revised 2.7 million gain in the prior month. Still, Florida reported that infections and hospitalizations jumped the most ever, and Houston had a surge in intensive-care patients.

“There‘s still a general positive sentiment about how quickly we’re seeing the recovery,” said Chris Gaffney, president of world markets at TIAA Bank. “But we do think youre going to see the recovery level off, especially if we continue to see higher case numbers on the virus.”

The U.S. labor market made greater progress than expected last month digging out of a deep hole, yet optimism over the rebound was tempered by stubbornly high layoffs and a resurgent coronavirus outbreak across the country. President Donald Trump still said the report shows the economy is “roaring back.”

Elsewhere, oil closed at its highest level in almost four months before the U.S. holiday weekend. European stocks rallied.

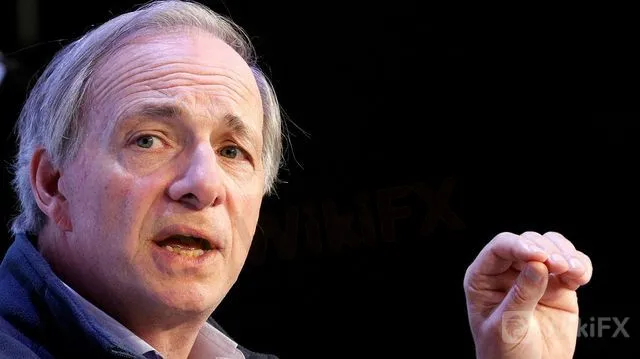

Ray Dalio, the billionaire founder of Bridgewater Associates, discusses his views on the global economy amid the coronavirus pandemic and why he‘s worried about the U.S.’s ability to compete with China.

Source: Bloomberg

These are some of the main moves in markets:

Stocks

The S&P 500 gained 0.5% on Thursday.

Futures on Japans Nikkei 225 advanced 0.6%.

Hang Seng futures earlier ended little changed.

Futures on Australias S&P/ASX 200 Index rose 0.6%.

Currencies

The yen was at 107.53 per dollar.

The offshore yuan traded at 7.0683 per dollar.

The Bloomberg Dollar Spot Index declined 0.1%.

The euro bought $1.1238.

Bonds

The yield on 10-year Treasuries declined one basis point to 0.67%.

Commodities

West Texas Intermediate crude advanced 1.2% to $40.29 a barrel.

Gold was at $1,775.35 an ounce.

— With assistance by Rita Nazareth, and Sophie Caronello

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Will Gold Prices Continue to Rise Due to Trump’s Tariffs?

Miami Firm Owner Pleads Guilty to $6M Ponzi Scheme Fraud

NBI Cebu Arrests Forex Trader for Illegal Investment Solicitation

PU Prime's "Feather Your Trades" Contest! Begin

eToro Files for IPO with $5 Billion Valuation on NASDAQ

Is FizmoFX a Scam? Fraud and Account Suspension of Traders

Why the Federal Reserve Is So Important

Boerse Stuttgart Digital Secures EU-Wide MiCAR Crypto License

BOJ to Announce Policy Decision This Week, Market Bets on a Rate Hike

Crypto.com’s Dual Front Battle: European Progress and U.S. Regulation

Currency Calculator