简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Next Turkey Rate Move May Be Up But Its Set to Hold for Now

Abstract:Turkeys first interest-rate hike since 2018 may be in play later this year but economists are unanimously predicting the central bank will extend its current pause on Thursday.

Turkeys first interest-rate hike since 2018 may be in play later this year but economists are unanimously predicting the central bank will extend its current pause on Thursday.

As the inflation outlook deteriorates and with risks remaining around Turkeys currency, a Bloomberg survey found not a single dissenter for the first time since Governor Murat Uysal took over a year ago. Every polled economist predicts the key rate will stay at 8.25% for a second month.

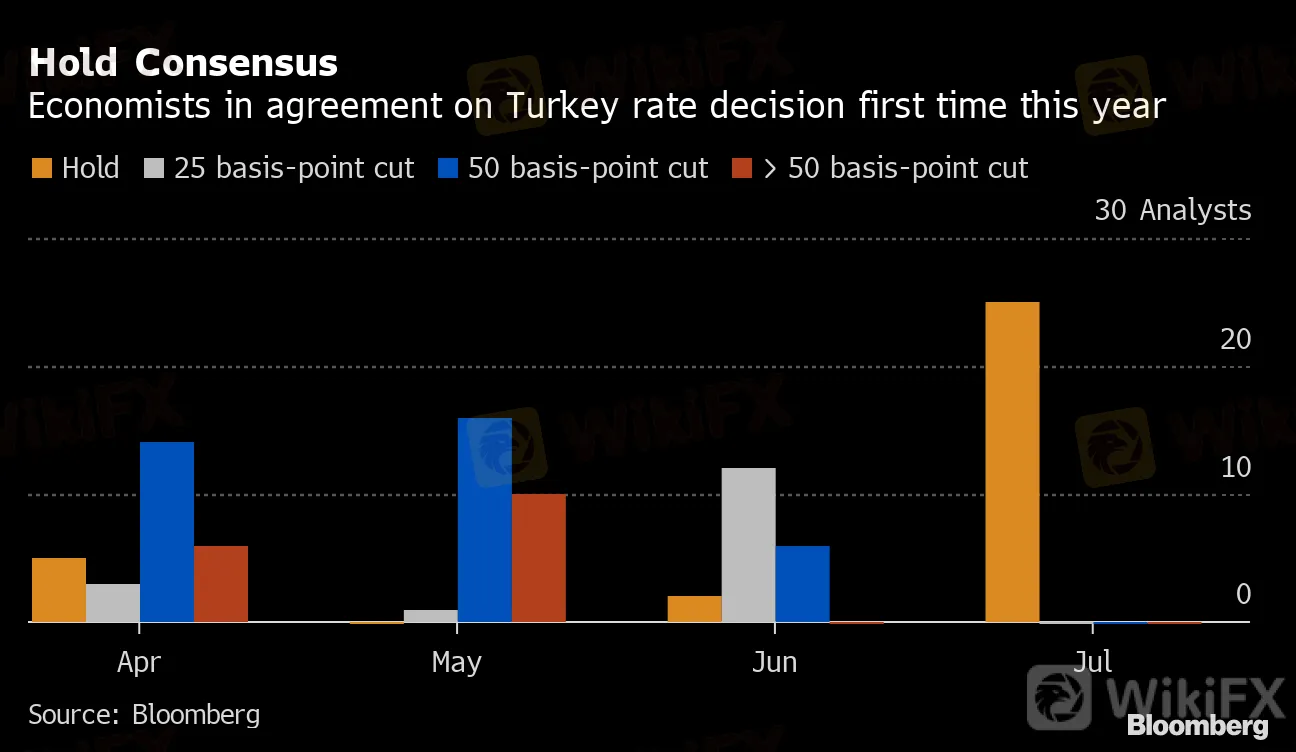

Hold Consensus

Economists in agreement on Turkey rate decision first time this year

Source: Bloomberg

The focus instead is turning to the possibility that borrowing costs will have to rise after the central bank delivered 1,575 basis points of easing in nine consecutive steps before stopping in June. More caution is warranted now that Turkeys inflation-adjusted rates are among the lowest in the world while state lenders unleash credit and policy makers inject liquidity by scooping up government bonds.

Read more: No Room Left for Turkish Rate Cuts to Former Central Banker

“With recovering domestic demand and increasing price pressures, the next move will be a hike,” said JPMorgan Chase & Co. analysts including Yarkin Cebeci. “We have the first hike in the first half of 2021, but a sharper-than expected demand recovery could lead to heightened risks to price and financial stability, encouraging the central bank to act earlier.”

While most analysts surveyed by Bloomberg in June saw lower borrowing costs at the end of the year, inflation has picked up for a second month and is now more than 5 percentage points above the central bank‘s year-end forecast of 7.4%. Meanwhile the lira is one of this year’s worst performers in emerging markets with a loss of about 13% against the dollar.

| What Our Economists Say... |

|---|

| “Real rates are deeply negative after colossal rate reductions in the last 12 months and the recent uptick in inflation. The latest surge in price growth means the central bank will likely keep rates on hold again this week.”-- Ziad DaoudClick here to view the piece. |

A downswing in the general inflation trend is needed for another rate cut, according to Enver Erkan, an economist at Tera Securities in Istanbul. “We think that the central bank has come to an end in the interest-rate cut cycle,” he said.

Read more: Inflation Going the Wrong Way for Turkey After Rate Cuts Paused

Policy makers say they still provide a “reasonable” real rate of return based on projected price growth. An updated set of forecasts the central bank will unveil next Wednesday may shed more light on its next move than this weeks rate decision.

A combination of faster price increases and an external funding gap means Turkey will likely need to tighten monetary policy before the end of this year, according to Goldman Sachs Group Inc.

“Rates will ultimately have to rise to attract foreign funding and slow down domestic demand to keep imports in check,” Goldman economists including Kevin Daly said in a report before the decision. “Otherwise, reserves and the lira are likely to remain under pressure.”

— With assistance by Harumi Ichikura

(Updates with lira performance in fifth paragraph)

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Fake ‘cyber fraud online complaint’ website Exposed!

Day Trading Guide: Key Considerations

NAGA Launches CryptoX: Zero Fees, 24/7 Crypto Trading

Scam Alert: 7 Brokers You Need to Avoid

AvaTrade Launches Advanced Automated Trading Tools AvaSocial and DupliTrade

What Determines Currency Prices?

Why More Traders Are Turning to Proprietary Firms for Success

MC Markets Review 2025

How to Use an Economic Calendar in Forex Trading

T4Trade Enhances Forex Trading with Advanced Tools for 2025

Currency Calculator