简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

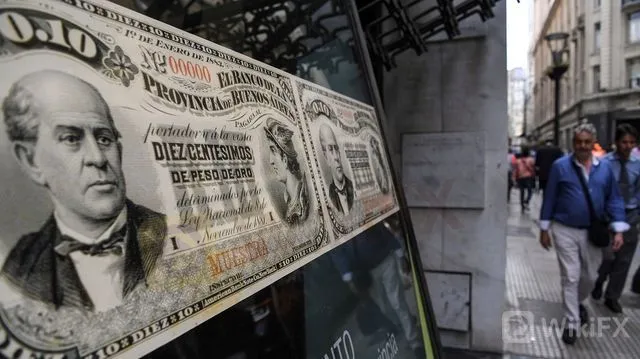

Argentina to Seek New IMF Plan Regardless of Debt Talks Outcome

Abstract:Argentina will seek a new program with the International Monetary Fund no matter the outcome of key talks with its bondholders, Economy minister Martin Guzman said.

Argentina will seek a new program with the International Monetary Fund no matter the outcome of key talks with its bondholders, Economy minister Martin Guzman said.

“After the debt restructuring process with the private creditors, we expect to request a new IMF program that replaces the previous one that didnt work,” Guzman told Bloomberg Television in an interview Tuesday. “This is going to happen regardless of what happens with private creditors, regardless what the outcome is.”

South Americas second-largest economy, which is at a crucial point in its bond restructuring process, also has on hold a $56 billion stand-by IMF agreement negotiated by the previous administration. Argentina is working on a tax reform and is fully committed toward fiscal consolidation, which will take longer than what both the country and the IMF have originally projected due to the coronavirus pandemic, Guzman said.

WATCH: Argentinas Economy Minister Martin Guzman says the country is fully committed to fiscal consolidation as a group of creditors seeks to extract better terms from the government in its $65 billion debt restructuring

Source: Bloomberg)

Argentina faces an Aug. 4 deadline with its proposal to restructure $65 billion of overseas debt after falling in default for the ninth time in the countrys history. While the government is open to improvements in the legal structure of the offer, the country has reached its maximum point in monetary terms, Guzman said during the interview.

“We significantly improved the offer, and we reached a point that is the maximum effort Argentina can make without compromising the social course we are trying to achieve,” Guzman said, echoing comments made recently by President Alberto Fernandez. “We have made a massive effort.”

Read More: Argentina Post-Virus Recovery Unclear Amid Unbalanced Policies

The country still doesn‘t have the support of the three main creditor groups, which say they represent holders of more than 50% of Argentina’s overseas debt after joining forces with other funds this week. The latest creditor proposal demands a net present value about 3 cents per dollar above current government offer of about 53 cents, according to a Goldman Sachs Group Inc. report.

Whatever the outcome, Argentina will spend a long time without issuing new foreign-denominated debt, Guzman said.

“We dont expect to tap the international markets for a while,” he said.

— With assistance by Guy Johnson, Alix Steel, and Patrick Gillespie

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

BSP Shuts Down Uno Forex Over Serious AML Violations

ACY Securities Expands Global Footprint with South Africa Acquisition

Tokyo Police Arrest 4 for Unregistered FX Trading Scheme

Rupee gains against Euro

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

US Regulators Tighten Oversight on Bank Anti-Money Laundering Efforts

Doo Group Expands Its Operations with CySEC License

Currency Calculator