简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Czechs Hold Rates as Inflation Spike Curbs Case for More Easing

Abstract:LISTEN TO ARTICLE 2:07 SHARE THIS ARTICLE ShareTweetPostEmail A pedestrian wearing a protective fa

LISTEN TO ARTICLE

2:07

SHARE THIS ARTICLE

Share

Tweet

Post

A pedestrian wearing a protective face mask walks past the headquarters of the Czech central bank in Prague, Czech Republic, on March 18.

Photographer: Milan Jaros/Bloomberg

Photographer: Milan Jaros/Bloomberg

The Czech central bank held interest rates for a second meeting as an unprecedented government stimulus and resurgent inflation help the economy recover without the need to further ease monetary policy.

After cutting borrowing costs by a cumulative 2 percentage points from March to May, the fastest pace in the European Union, policy makers kept the benchmark at 0.25% on Thursday. Governor Jiri Rusnok is scheduled to comment on the decision and present fresh forecasts at 3:45 p.m. in Prague.

{15}

While the coronavirus continues to rattle economies worldwide and prompt central bankers to vow more action, the Czech Republic is facing a rare spike in price growth. Despite a 10.7% drop in second-quarter output from a year earlier, government support is keeping the lid on unemployment, which remains one of the lowest in Europe and is helping prop up consumer demand.

{15}

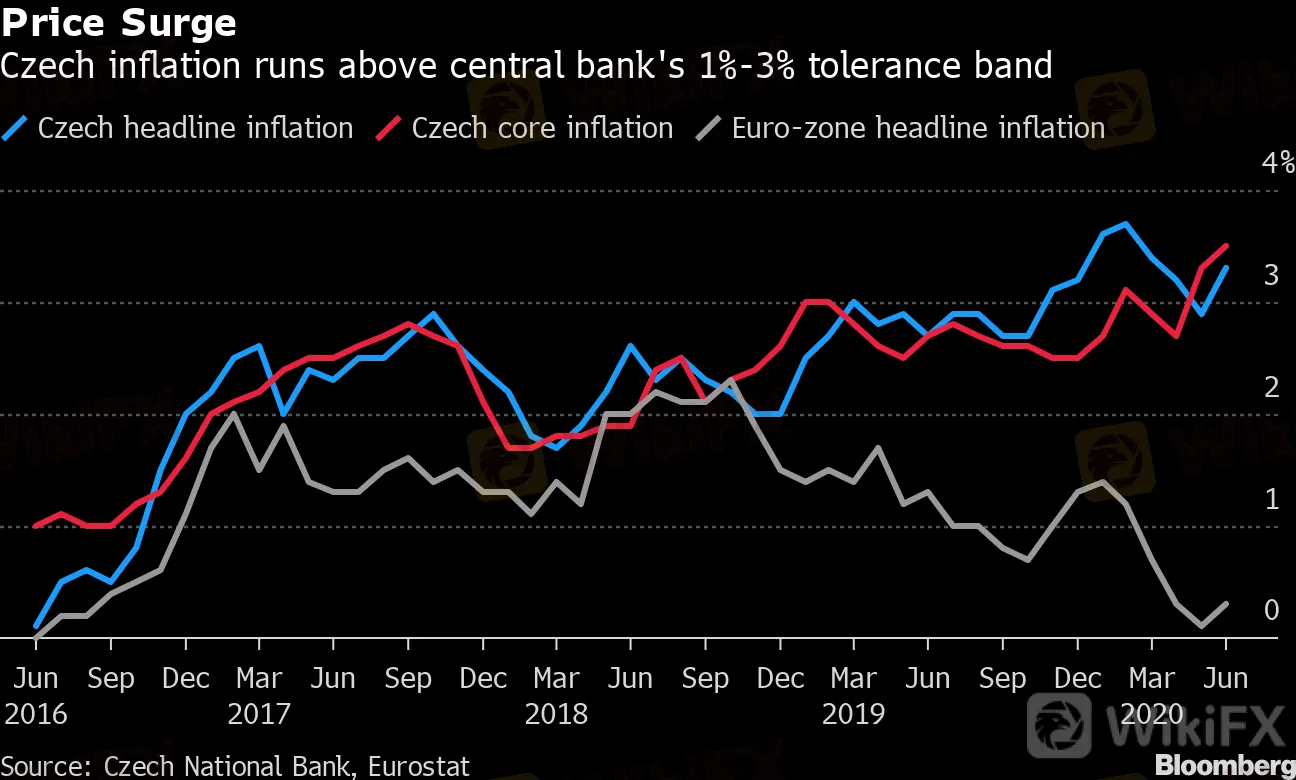

Price Surge

Czech inflation runs above central bank's 1%-3% tolerance band

Source: Czech National Bank, Eurostat

{777}

“Our baseline forecast scenario is for interest rates to remain stable at current levels until end-2021,” analyst Martin Gurtler at Komercni Banka AS said before the meeting. “Inflation is likely to slow significantly.”

{777}

Read more:

Record Economic Hit Is Better Than The Tragedy Czechs Braced For

Czech Rates to Stay Low as Stagflation Is Temporary, Holub Says

A $400 Billion Fund Bets Czech Rate Hikes Will Return Next Year

Virus Helps Czech Billionaire Leader Go on a Spending Spree

Worse-than-expected retail sales for June, the first month the economy almost fully emerged from a virus lockdown, show households remain uncertain. The country still has more job vacancies than unemployed, largely thanks to temporary government subsidies for workers salaries and state guarantees for cheap business loans.

After inflation unexpected jumped to 3.3% in June, central bank board member Tomas Holub said the “stagflationary trend” is temporary and no rate hikes will probably be needed for at least a year.

“Markets shouldnt look for rate hikes signals,” said economist Mai Doan at Bank of America Corp. in London. “We remove our rate-cut expectations for 2020 and see rates on hold at 0.25% through 2021.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Most Effective Technical Indicators for Forex Trading

What Can Expert Advisors Offer and Risk in Forex Trading?

Indian National Scams Rs. 600 Crore with Fake Crypto Website

Currency Calculator