简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

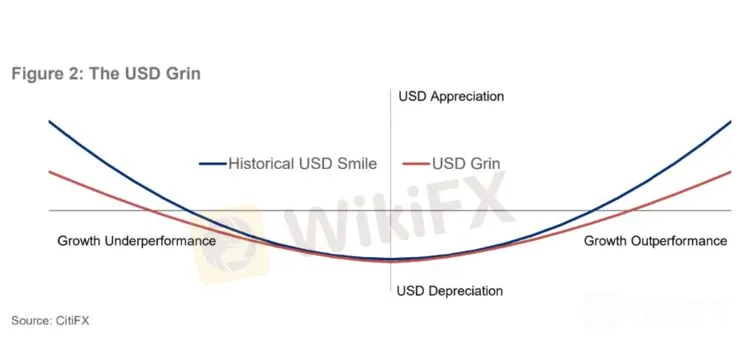

Crash in USD: the Dollar Smile Turned into a Painful “Grin”

Abstract:DXY has slid as more as 10% since this March and the losses have deepened in recent weeks amid the second wave of the pandemic. The theoretical dollar smile has flattened, sending a painful “grin” to investors instead.

WikiFX News (8 Aug)- DXY has slid as more as 10% since this March and the losses have deepened in recent weeks amid the second wave of the pandemic. The theoretical dollar smile has flattened, sending a painful “grin” to investors instead.

Capital Ltd., the U.S. currency tends to increase in value against other currencies when the U.S. economy is weak. It goes up at either end of the spectrum, just like the smile on your face. Actually, after hitting the high in March, the greenback continuously slumped to a two-year low in July. In this regard, it should have poised for a rally in theory.

But the assumption he made turned out to be wrong. The dollar has languished as rising infections and mortality from the pandemic sapped appetite for the currency as a haven. The dollar smile has flattened and turned into a painful “grin”.

According to Boris Schlossberg, managing director of FX strategy at BK Asset Management, the dollar has suffered from a very serious decline during the whole month of July. Interest rates are going down, and that makes the dollar much less attractive, but the market is starting to become aware of the political risk of the dollar. He thus made a bold prediction that the dollar was heading for a crash and the world gold standard system would rise again.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/WIKIFX

You can also find us here-

Vietnam: www.facebook.com/wikifx.vn

Thailand: www.facebook.com/wikifx.th

Indonesia: www.facebook.com/wikifx.id

South Asia: www.facebook.com/wikifxglobal

Italy: www.facebook.com/wikifx.it

Japan: www.facebook.com/wikifx.jp

India: www.facebook.com/wikifx.in

Pakistan: www.facebook.com/wikifx.pk

Arabian countries: www.facebook.com/wikifx.arab

Russian countries: www.facebook.com/wikifx.russian

French countries: www.facebook.com/wikifx.French

Western Pacific area: www.facebook.com/wikifx.westernpacific

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Economic and Political Shifts Impact Global Markets Part 2

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

Economic and Political Shifts Impact Global Markets Part 1

Recent developments include President Biden's potential re-election reconsideration, Asia-Pacific market highs, PwC's auditing issues in China, potential acquisitions in the energy and retail sectors, geopolitical tensions, and regulatory actions impacting markets. Key impacts include fluctuations in USD, CNY, CAD, TWD, EUR, GBP, and AUD, with significant effects on stock markets across the US, Asia, and Europe.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

GEMFOREX - weekly analysis

The week ahead: 5 things to watch

WikiFX Broker

Latest News

Crypto.com Delists USDT and 9 Tokens to Comply with MiCA Regulations

AI Fraud Awareness Campaign: "We're Not All F**ked"

How to Use Financial News for Forex Trading?

Fake ‘cyber fraud online complaint’ website Exposed!

Day Trading Guide: Key Considerations

GMO-Z com Securities Thailand to Cease Operations in 2025

Oil Prices at $90 to $100 Could Push Philippines Inflation Beyond Target

Do More Liquid Currencies Yield Higher Profits?

Trump Media Expands into Crypto with $250M Truth.Fi Investment

NAGA Launches CryptoX: Zero Fees, 24/7 Crypto Trading

Currency Calculator