简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Rebounds with Stability Expected at High

Abstract:From the start of the week, gold price is little changed compared with last week as it has quickly rallied from the fresh monthly low of $1,907.

WikiFX News (12 Sept) - From the start of the week, gold price is little changed compared with last week as it has quickly rallied from the fresh monthly low of $1,907; while current market trends may keep gold afloat as the crowding behavior in the US dollar persists in September.

Gold price may continue to consolidate as global stock markets are under pressure with the Nasdaq and S&P 500 sitting at a precarious position. However, the crowding behavior in the greenback may continue to coincide with the bullish behavior in gold as a bear-flag formation emerges in the DXY.

The FED seems to persist with the plan of “achieving an inflation that averages 2% over time”, which may not be changed before the US election. Gold price is expected to be lifted once the Chairman Powell raises the FEDs balance sheet back above $7 trillion.

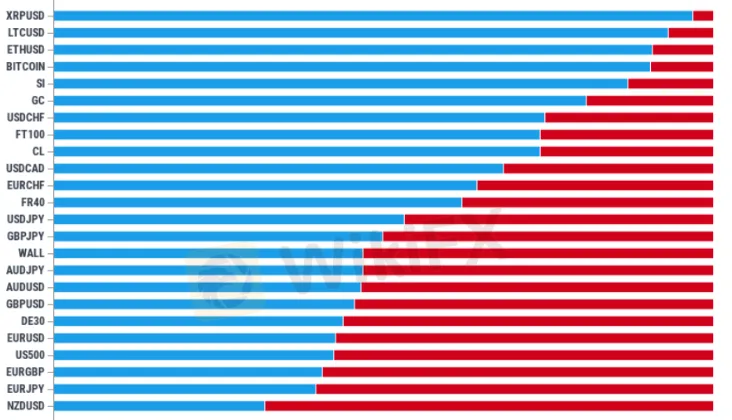

According to the IG Client Sentiment report, retail investors all hold net-long USD/CHF, USD/CAD and USD/JPY while remaining net-short AUD/USD, GBP/USD, EUR/USD and NZD/USD.

Gold price may continue to consolidate before a successful attempt of closing below $1,907-1,920. Only when a break/close above $2,016-2,025 appears can the record high price ($2075) finds its way. The next area of focus comes around $2,064 followed by $2,092.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App: bit.ly/WIKIFX

Chart: IG Client Sentiment Report

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Breakthrough again! Gold breaks through $2530 to set a new record high!

Spot gold continued its record-breaking rally as investors gained confidence that the Federal Reserve might cut interest rates in September and gold ETF purchases improved. The U.S. market hit a record high of $2,531.6 per ounce

Historic Moment: Gold Surges Above $2,500 Mark, Forging Glory!

Boosted by the weakening of the US dollar and the expectation of an imminent rate cut by the Federal Reserve, spot gold broke through $2,500/ounce, setting a new record high. It finally closed up 2.08% at $2,507.7/ounce. Spot silver finally closed up 2.31% at $29.02/ounce.

Weekly Analysis: XAU/USD Gold Insights

Gold prices have been highly volatile, trading near record highs due to various economic and geopolitical factors. Last week's weak US employment data, with only 114,000 jobs added and an unexpected rise in the unemployment rate to 4.3%, has increased the likelihood of the Federal Reserve implementing rate cuts, boosting gold's appeal. Tensions in the Middle East further support gold as a safe-haven asset. Technical analysis suggests that gold prices might break above $2,477, potentially reachin

【MACRO Insight】Monetary Policy and Geopolitics - Shaping the Future of Gold and Oil Markets!?

In the ever-evolving global economy, the intertwining influences of monetary policy and geopolitical factors are reshaping the future of the gold and crude oil markets. This spring, the gold market saw a significant uptrend unexpectedly, while Brent crude oil prices displayed surprising stability. These market dynamics not only reflect the complexity of the global economy but also reveal investors' reassessment of various asset classes.

WikiFX Broker

Latest News

Is $CORONA Memecoin a Legit Crypto Investment?

Is Pi Network the Next Big Crypto Opportunity?

Is Linkbex a Scam? SFC Warns of Virtual Asset Fraud in Hong Kong

Donald Trump’s Pro-Crypto Push Boosts PH Markets

5 Best Copy Trading Brokers: You Can Trust in 2025

3 EXCLUSIVE Ramadan Offers That Won’t Last Long! ACT NOW

The Next Crypto Giants: 5 Altcoins to Watch

Japan’s Shift in Crypto Policy and What It Means for Investors

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Currency Calculator