简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Thailands Struggle to Deploy Fiscal Spending Weighs on Outlook

Abstract:Fiscal policy is back in focus in Thailand as the central bank runs out of conventional monetary policy space to spur the economy.

Fiscal policy is back in focus in Thailand as the central bank runs out of conventional monetary policy space to spur the economy.

With interest rates near zero, the Bank of Thailand last week called for “more targeted and timely” government policies to support the recovery. Yet latest figures show the government has been slow to disburse its pandemic aid and the sudden resignation of the finance minister has thrown the policy outlook into turmoil.

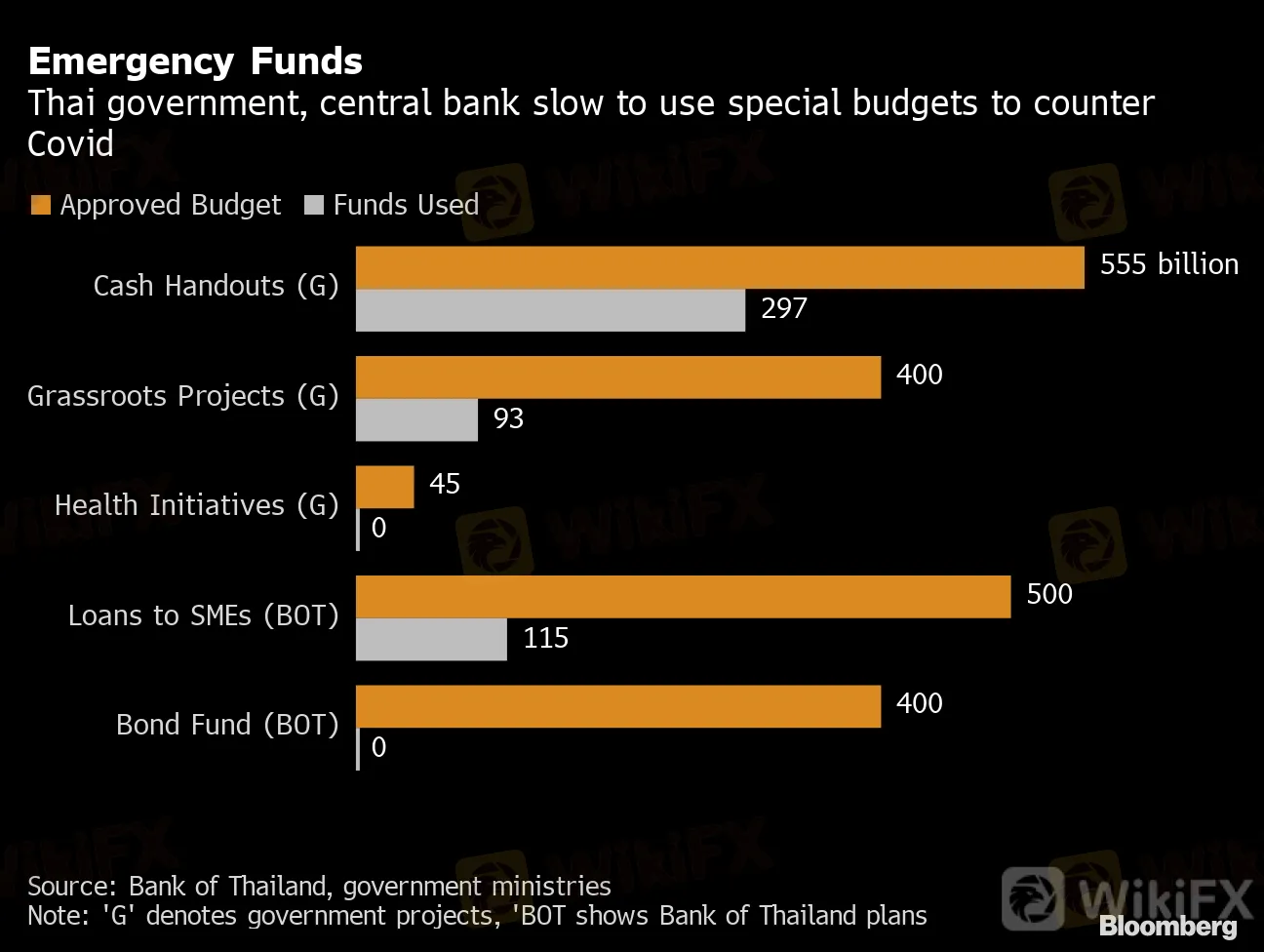

Less than a third of the 1.9 trillion baht ($60 billion) stimulus jointly unveiled by the government and the central bank has been spent, according to official figures as of Sept. 9. That could hold back the recovery in Southeast Asia‘s second-largest economy -- already on course for its worst-ever contraction this year. A rebound next year now depends on how fast the government can spend to make up for a slump in tourism and trade, the the nation’s key growth drivers.

Emergency Funds

Thai government, central bank slow to use special budgets to counter Covid

Source: Bank of Thailand, government ministries

Note: 'G' denotes government projects, 'BOT shows Bank of Thailand plans

While cash transfers to low-income groups have been satisfactory, for programs that could potentially generate bigger economic gains across the economy, “the disbursement has been slow and low -- not mutually exclusive,” said Maria Lapiz, head of research at Maybank Kim Eng Securities (Thailand).

{17}

“Perhaps relaxing some of the criteria will encourage more participation,” she said. “But this is easier said than done as it requires shifting of risk burden that is currently skewed to the private sector.”

{17}

Some of the reasons for the slow disbursement include:

Utilization of 400 billion baht under the grassroots projects has failed to take off due to difficulties in identifying the right projects. The government has tried to speed up its budget approval this month and expects as much as 100 billion baht to be injected into the economy in the fourth quarter

Cash transfers were initially delayed as authorities took a long time to overcome bureaucratic hurdles to design programs and target groups

Allocation for health initiatives are mostly reserved for vaccines and will be used up only when they become available

Much of the Bank of Thailand‘s 500 billion-baht funds for small and medium enterprises have remained unused because of lenders’ reluctance to give new loans on concerns of swelling bad loan portfolios

A 400 billion-baht corporate bond stabilization fund has been more of a liquidity backstop for highly rated companies

Dual Stimulus

{27}

Thai government, central bank allocate 1.9 trillion baht for virus response

{27}

Source: Bank of Thailand, government ministries

Note: 'G' is government budget in baht, 'BOT' show Bank of Thailand funding

Spending may gather speed in the fourth quarter with the cabinet approving several measures to boost domestic consumption and jobs. The proposals include boosting cash handouts to welfare cardholders and funds for members of a co-payment program geared to low-income earners and small retailers. That expands existing income support to 30 million people, or about 43% of the population, both in the formal and informal sectors to help them cope with the pandemic fallout.

{33}

The central bank has cut its growth forecast for next year to 3.6% from 5%, citing a significant drop in tourist arrivals while warning it may take two years for the economy to return to its pre-pandemic level.

{33}

Maybanks Lapiz said the “bazooka solution” in tackling the low state spending lies in handing provinces more money and authority in deploying it.

“Give each province a sizable amount to deploy and manage their own program of economic recovery,” she said. “Make each province set their deliverables and subsequent disbursements linked to performance milestones after audit.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

New SEC Chair Paul Atkins Targets Crypto Regulation Reform

ED Exposed US Warned Crypto Scam ”Bit Connect”

Currency Calculator