简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Final Jobs Report Before U.S. Election in Store: Eco Week Ahead

Abstract:The last U.S. jobs report before the November election will probably show the labor markets rebound continued in September, though losing some steam.

The last U.S. jobs report before the November election will probably show the labor markets rebound continued in September, though losing some steam.

The monthly jobs report on Friday will follow the first presidential debate between President Donald Trump and Democratic challenger Joe Biden on Tuesday. The report will also wrap up a busy week on the U.S. economic calendar, which includes figures on income and spending, manufacturing and consumer confidence.

Personal spending on goods and services, which accounts for about two-thirds of gross domestic product, is projected to rise 0.8% in August, bringing the value of outlays closer to its pre-pandemic level. Still, the pace of monthly spending growth is moderating as activity with service industries such as travel, leisure and food services remains constrained by the coronavirus.

What‘s more, the government’s report is also forecast to show a sharp decline in personal income after a federal program that delivered $600 in supplemental unemployment benefits expired at the end of the July, leaving many Americans to dig into savings to support spending.

What Bloombergs Economists Say..

“We estimate that another modest payroll gain in September will leave the level of employment well below the pre-crisis peak. Further declines in the unemployment rate may slow in the coming months due to increased participation from Americans trying to find work following the expiration of augmented unemployment benefits.”

--Yelena Shulyatyeva, Andrew Husby and Eliza Winger. Read the full PREVIEW.

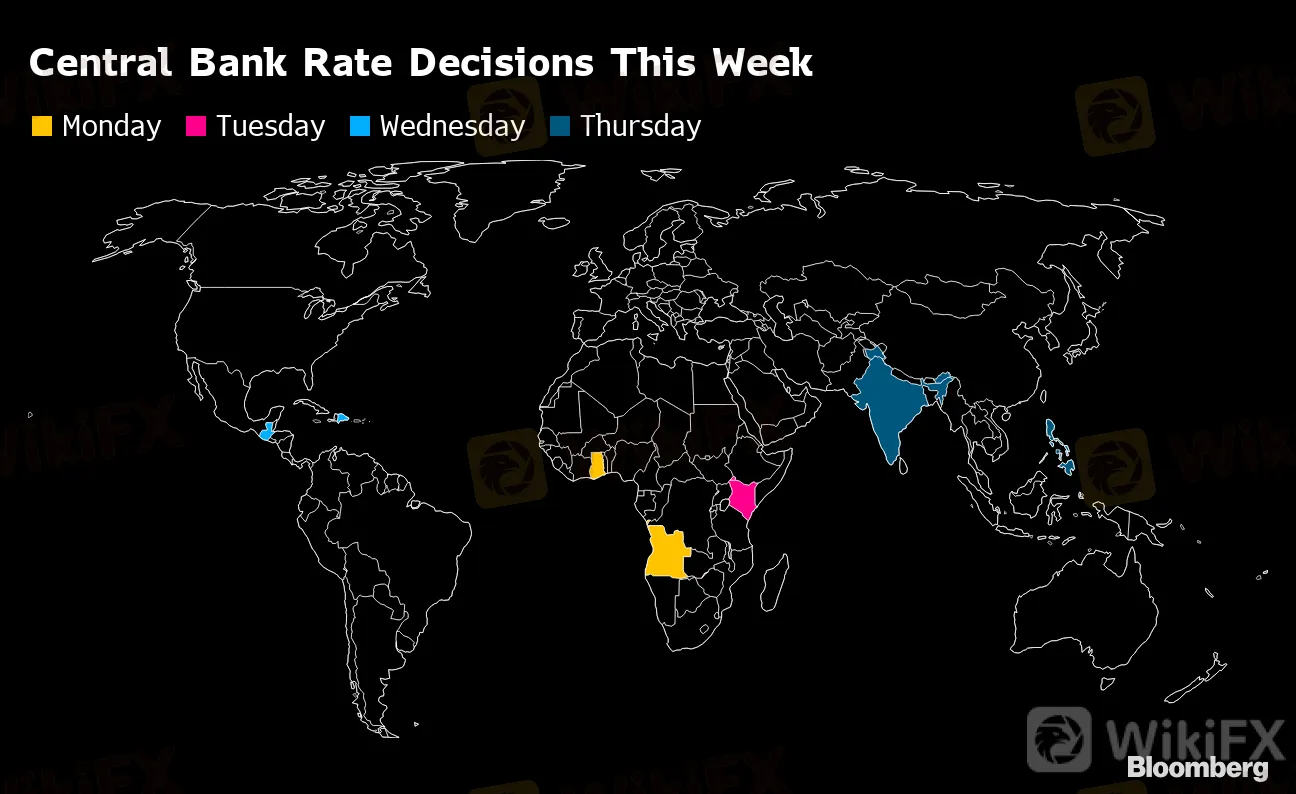

Elsewhere, central banks in India, Kenya and the Philippines set rates and a slew of monetary policy officials are set to speak.

{14}

Click here for what happened last week and below is our wrap of what else is coming up in the global economy.

{14}

U.S. and Canada

In the run-up to Fridays jobs report, a throng of Federal Reserve officials including Loretta Mester, John Williams, Richard Clarida, Randal Quarles, Neel Kashkari and Michelle Bowman are scheduled to speak.

{18}

Canada published GDP data for July and August on Wednesday.

{18}

For more, read Bloomberg Economics full Week Ahead for the U.S.

Asia

{21}

Indias central bank meets on Thursday and with inflation uncomfortably above its desired ceiling, economists say itll need to rely on tools beyond its benchmark interest rate lever if it is to add additional stimulus. Philippines monetary officials also meet the same day. Finance ministers and central bankers from across Asean convene virtually on Thursday and Friday.

{21}

{777}

Central Bank Rate Decisions This Week

{777}

In China, official PMI reports will gauge how the nations economic pickup fared in September amid signs consumers are beginning to spend again.

In Japan, Tokyo inflation data is expected to show prices continuing to fall, while industrial production, retail sales and jobless figures are likely to further illustrate the slow pace of recovery. The Bank of Japan will release its summary of opinions from its most recent meeting. The BOJs Tankan survey is forecast to show businesses are far less gloomy, though the easing of the mood will be less apparent in smaller firms.

South Korean export data are expected to show the first increase in seven months, a positive sign for global trade even if the figure has been largely propped up by a holiday distortion.

For more, read Bloomberg Economics full Week Ahead for Asia

Europe, Middle East, Africa

The rise in coronavirus infections are adding urgency to the debate about whether the economy needs more stimulus. European Central Bank policy makers will have a chance to weigh in at a key conference on Wednesday. Speakers include Christine Lagarde, Philip Lane and Jens Weidmann.

Data from the euro area may add pressure on them to act, with unemployment projected to continue rising gradually and the inflation rate staying below zero.

{34}

Eastern European central bank chiefs meet in Rovinj, Croatia, to discuss monetary policy and financial stability during the pandemic. In addition to the host nation, the debate will feature governors from Slovenia, Serbia, Montenegro, Bosnia-Herzegovina, North Macedonia and Lithuania.

{34}

Ghana will probably hold its key rate on Monday after the economy contracted less than forecast in the second quarter. In Angola, the benchmark will likely also stay unchanged after the governor said earlier this month that hiking will cause more damage to the economy. Kenya may have room for easing on Tuesday, with inflation well inside the central banks target band.

Data on Tuesday will probably show South Africas unemployment rate surged to a new record in the second quarter as lockdown restrictions forced many businesses to cut jobs to save costs, or close permanently.

For more, read Bloomberg Economics full Week Ahead for EMEA

Latin America

The week kicks off with the minutes of Colombia‘s Sept. 25 central bank meeting, likely providing guidance on what’s next with the key rate at a record-low 1.75%. Next up, Argentinas July output report may signal improvement over June. Nonetheless, the larger picture remains that the country is only just emerging from its ninth default and was heading for a third year of recession before the pandemic arrived.

Fast Comeback

Brazil's wholesale prices expected to jump in September

Sources: Fundacao Getulio Vargas, Instituto Brasileiro de Geografia e Estatistica

Note: Sept. figure is survey estimate; IGP-M = 60% wholesale, 30% consumer, 10% construction

Brazil indicators this week underscore some challenges there: the IGP-M price index out Tuesday will show another jump in wholesale prices that‘s not yet pressuring headline numbers; the central bank’s budget report Wednesday will point out some dire debt dynamics; and, Friday‘s industrial production report should dovetail with what’s seen as a significant output gap.

In Chile, the Imacec economic activity indicator may begin to illustrate why the central bank has upwardly revised economic forecasts.

{50}

For more, read Bloomberg Economics full Week Ahead for Latin America

{50}

— With assistance by Theophilos Argitis, Benjamin Harvey, Robert Jameson, Malcolm Scott, and Alaa Shahine

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator