简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Oil Falls Back Toward $40 as Supply Constraints Begin to Ease

Abstract:Oil slipped a second day as operations in the Gulf of Mexico began to resume following Hurricane Delta, Libya stepped up plans to restart production and oil workers in Norway called off a strike.

Oil slipped a second day as operations in the Gulf of Mexico began to resume following Hurricane Delta, Libya stepped up plans to restart production and oil workers in Norway called off a strike.

Futures in New York fell as much as 0.9%, after declining 1.4% on Friday. U.S. Gulf operators are beginning to restart production after the storm made landfall on Friday. Deltas approach had seen about 92% of oil production and 62% of gas output shuttered.

Libya took a major step toward reviving its battered oil industry by reopening its biggest field. The Sharara field will initially pump 40,000 barrels of crude a day, before reaching its capacity of almost 300,000 barrels in 10 days, a person with knowledge of the situation said.

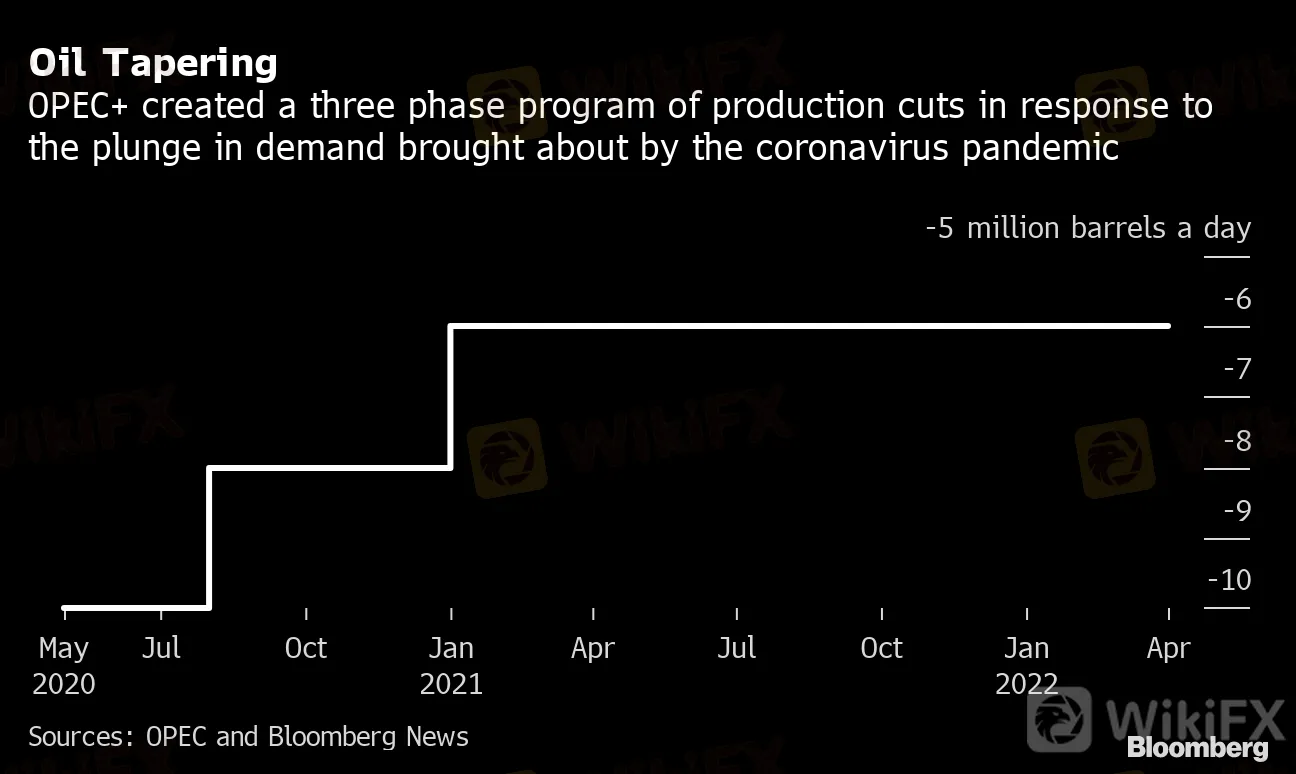

The resumption of supply from Libya is an added headache for OPEC and its allies as they mull whether to proceed with plans to further taper production curbs in January. With coronavirus cases accelerating in many countries, the cartel faces a difficult decision at its next policy meeting on Nov. 30-Dec. 1 to stay the course or delay the increase in production.

Oil Tapering

OPEC+ created a three phase program of production cuts in response to the plunge in demand brought about by the coronavirus pandemic

{13}

Sources: OPEC and Bloomberg News

{13}

| Prices |

|---|

|

Crude rallied last week as traders factored in the production hit from Hurricane Delta and as the U.S. inched closer to more fiscal stimulus. However, prices retreated on Friday after Norway’s oil workers agreed a settlement that will restore production at six fields shut down by the dispute and prevent an escalation to another six. It also averted a shutdown of Norways largest oil field, the 460,000 barrel-a-day Johan Sverdrup facility.

Iraq, OPEC‘s second-biggest oil producer, expects crude prices to remain at around $41 to $42 a barrel this year before rising to $45 in the first quarter of 2021, the state-run Al-Sabah newspaper reported, citing an interview with Oil Minister Ihsan Abdul Jabbar. The minister reiterated Iraq’s compliance with the OPEC+ pact to curb output.

Drilling rigs targeting crude oil in the U.S. rose by 4 to 193 last week, according to Baker Hughes, an increase of 14 in the last three weeks. Activity is starting to pick up despite a warning that demand might not recover to pre-pandemic levels until 2023. A Federal Reserve Bank of Kansas City survey of energy executives found a glum outlook not only for demand but for oilfield jobs, wages and access to credit.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Global Panic Builds as Forex Shifts into Risk-Off Mode

Shocking! Oil Prices Plunge Below $60

BI Alerts Filipinos: Telegram, Facebook Used for Trafficking Scams

AUD/USD Hits New Lows as Panic Selling Unfolds Amid Robust U.S. Jobs Report

SEC Fines Velox Clearing $500,000 for SAR Failures

How to protect your money during Black Monday

FCA Released New List of Unauthorized Brokers

Singapore Authorities Warned Against WeChat, UnionPay, Alipay Impersonation Scams

Deepfake Scams Nearly Drain $499K from Business

Currency Calculator