General Information

Santander UK is a large retail and commercial bank based in the UK and a wholly-owned subsidiary of the major global bank Banco Santander. It is registered in England and Wales, authorised by the Prudential Regulation Authority, and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. It manages its affairs autonomously, with its own local management team, responsible solely for its performance. It has its origins in three constituent companies—Abbey National, Alliance & Leicester and Bradford & Bingley—all former mutual building societies. It is one of the leading personal financial services companies in the United Kingdom, and one of the largest providers of mortgages and savings in the United Kingdom.

Regulation

Santander UK Plc is a regulated institution under the jurisdiction of the United Kingdom's Financial Conduct Authority (FCA) with License No. 106054. It holds a Market Making (MM) license type and has been regulated since December 1, 2001. The institution operates with the license type of “No Sharing.” You can contact them via email at customerservices@santander.co.uk and find more information on their website: https://www.santander.co.uk/. The regulatory status does not specify an expiry date, and Santander UK Plc is located at 2 Triton Square, Regent's Place, London NW1 3AN, UNITED KINGDOM, with a phone number of 448003897000. Certified documents related to their regulatory status are not provided in the information provided.

Pros and Cons

Santander offers a wide range of financial products and services to cater to diverse customer needs. However, it's essential to consider both the advantages and disadvantages when evaluating their offerings.

Pros:

Comprehensive Product Range: Santander provides a diverse selection of banking, investment, insurance, and borrowing options, allowing customers to find suitable solutions for their financial goals.

Accessible Customer Support: Customers can easily reach Santander's support through telephone, live chat, or the ATM/Branch Locator. The extended hours of operation and accessibility options accommodate various needs.

Regulated Institution: Santander is regulated by the UK's Financial Conduct Authority (FCA), providing customers with confidence in their financial stability and adherence to industry standards.

Cons:

Monthly Fees: Some of Santander's current accounts come with monthly fees, which may not be ideal for individuals seeking fee-free options.

Complexity: With numerous products and services, navigating Santander's offerings can be overwhelming for some customers who may prefer simpler banking solutions.

Eligibility Criteria: Eligibility criteria apply to certain products, such as personal loans, which may limit access to individuals who do not meet specific income or credit requirements.

Here is a table summarizing the pros and cons of Santander:

Market Instruments

The Santander UKs segments include Retail Banking, Corporate & Commercial Banking and Corporate & Investment Banking. The Retail Banking segment offers a range of products and financial services to individuals and small businesses, through a network of branches and automated teller machines (ATMs), as well as through telephony, digital, mobile and intermediary channels. The Corporate & Commercial Banking segment offers a range of products and financial services include loans, bank accounts, deposits, treasury services, trade and asset finance for small medium enterprises (SME) and corporate customers. The Corporate & Investment Banking segment serves corporate clients and financial institutions.

Here's a summary of their products:

Current Accounts:

Santander Edge Up Current Account:

Earn cashback on selected household bills, supermarket, and travel costs.

Earn interest on credit balances up to £25,000.

Requires funding the account with £1,500 each month and setting up 2 active Direct Debits.

No charges for using the debit card outside the UK.

£5 monthly fee.

Santander Edge Current Account:

Earn cashback on selected household bills at supermarkets and travel spend.

Access to an optional savings account with exclusive rates.

Requires funding the account with £500 each month and setting up 2 active Direct Debits.

No charges for using the debit card outside the UK.

£3 monthly fee.

Everyday Current Account:

1|2|3 Student Current Account:

Free 16-25 railcard for four years.

Interest-free overdraft of £1,500 for the first 3 years of studies.

Requires regular deposits of at least £500 every 4 months.

1|2|3 Mini Current Account:

Designed to help children and young people learn money management.

Offers interest on balances at certain thresholds.

Choice of contactless debit card or cash card.

Basic Current Account:

Mortgages:

Services for first-time buyers, home movers, and those looking to remortgage.

Options for changing lenders, borrowing more money, and managing existing mortgages.

Later life mortgages for individuals aged 55 or over.

Partnership with ufurnish.com for home furnishing experiences.

Credit Cards:

Savings and ISAs:

Investments:

Investment options with cashback incentives.

Investment Hub for online advice and fund selection.

Investment advice and resources available.

Insurance:

Home insurance, including contents insurance for renters.

Life insurance, including critical illness cover.

Health insurance.

Mortgage life insurance.

Family and lifestyle insurance.

Over 50s Life Insurance.

Car insurance, including electric vehicle insurance.

Travel insurance.

Business insurance and landlord insurance.

Personal Loan:

Personal loans with fixed interest rates.

Loan amounts from £1,000 to £25,000.

Flexible repayment terms.

Loan eligibility criteria apply.

Santander provides a comprehensive range of financial products and services to cater to their customers' banking, investment, insurance, and borrowing needs.

Accounts

Six digit account sort codes are used in the range between 09-00-xx to 09-19-xx. Sort codes for accounts formerly held by Alliance & Leicester use the range 09-01-31 to 09-01-36.

Credit Rating

In October 2011, Moody's downgraded the credit rating of twelve financial firms in the United Kingdom, including Santander UK, blaming financial weakness. In June 2012, Moody rated Santander UK as being in a more financially healthy position than its parent company, Banco Santander.

Deposit & Withdrawal

In November 2009, Santander launched the first current account in the United Kingdom without fees (including unauthorised overdrafts) for its current and future mortgage customers. In January 2010, the bank began waiving fees for customers using Santander's automated teller machines in Spain, which traditionally would incur fees for transactions in a foreign currency.

Accepted Countries

Santander's Corporate and Commercial Banking division operates from a number of regional business banking centres across the United Kingdom. Less than 1% of Santander UK's business is held abroad.

Customer Service

Santander has frequently been rated the worst bank for customer service in the United Kingdom, although by July 2011 had sought to improve, notably by returning call centre operations to the United Kingdom from India. Its '123' product range was ranked third best in the United Kingdom in 2013, and in a moneysavingexpert.com poll in February 2014, customers ranked their satisfaction higher than with any of other main high street banks.

Santander's customer support offers several ways to contact them and obtain assistance:

Telephone Support:

Customers can reach a Customer Service Center Advisor at 1-877-768-2265.

Hours of operation are from 8 a.m. to 8 p.m. EST, Monday to Saturday.

For customers with hearing/speech impairments, there is a dedicated relay service at 7-1-1.

International Calls:

Live Chat:

ATM/Branch Locator:

Santander's customer support is accessible through various channels, including phone, chat, and online resources, ensuring that customers have multiple options to address their banking needs and inquiries. The telephone support hours are accommodating, and they provide accessibility options for customers with hearing or speech impairments.

Summary

Santander UK Plc is a regulated financial institution under the United Kingdom's Financial Conduct Authority (FCA) with License No. 106054. They offer a diverse range of financial products and services, including current accounts, mortgages, credit cards, savings and ISAs, investments, insurance, and personal loans. Santander provides accessible customer support through telephone, live chat, and an ATM/Branch Locator, ensuring customers have various ways to seek assistance with their financial needs. Their customer service hours are from 8 a.m. to 8 p.m. EST, Monday to Saturday. Santander's comprehensive product offerings aim to meet a wide array of customer banking and financial requirements.

FAQs

Q: What types of current accounts does Santander offer?

A: Santander offers various current account options, including the Santander Edge Up, Santander Edge, Everyday Current Account, and specialized accounts for students and children.

Q: How can I contact Santander's customer support?

A: You can reach Santander's customer support by calling 1-877-768-2265 for general inquiries. For international calls, dial 1-401-824-3400. Alternatively, you can use the live chat feature on their website.

Q: Are there fees associated with Santander's current accounts?

A: Some current accounts may have monthly fees, such as £5 for the Santander Edge Up Current Account and £3 for the Santander Edge Current Account. The Everyday Current Account, however, has no monthly fee.

Q: What types of insurance does Santander offer?

A: Santander provides a range of insurance options, including home insurance, life insurance, health insurance, car insurance, and travel insurance, catering to various coverage needs.

Q: Can I apply for a personal loan from Santander?

A: Yes, Santander offers personal loans with fixed interest rates. You can apply for loan amounts ranging from £1,000 to £25,000, with flexible repayment terms. Eligibility criteria apply, and you can typically get a decision within 5 minutes.

VX-DCEP8888

Hong Kong

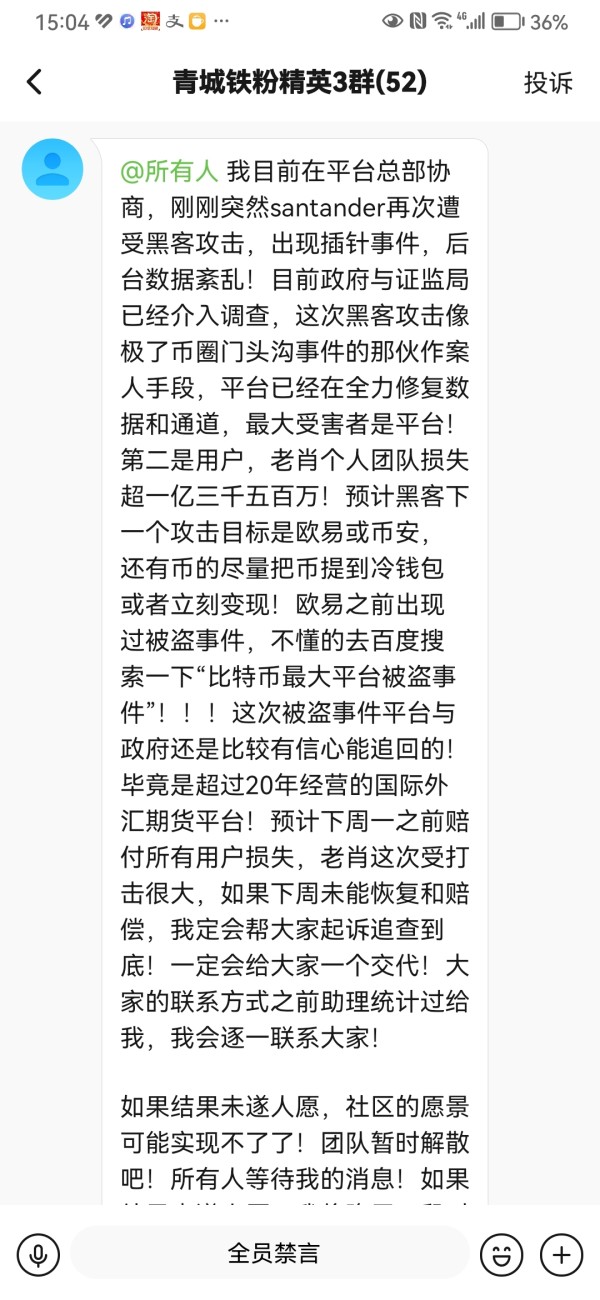

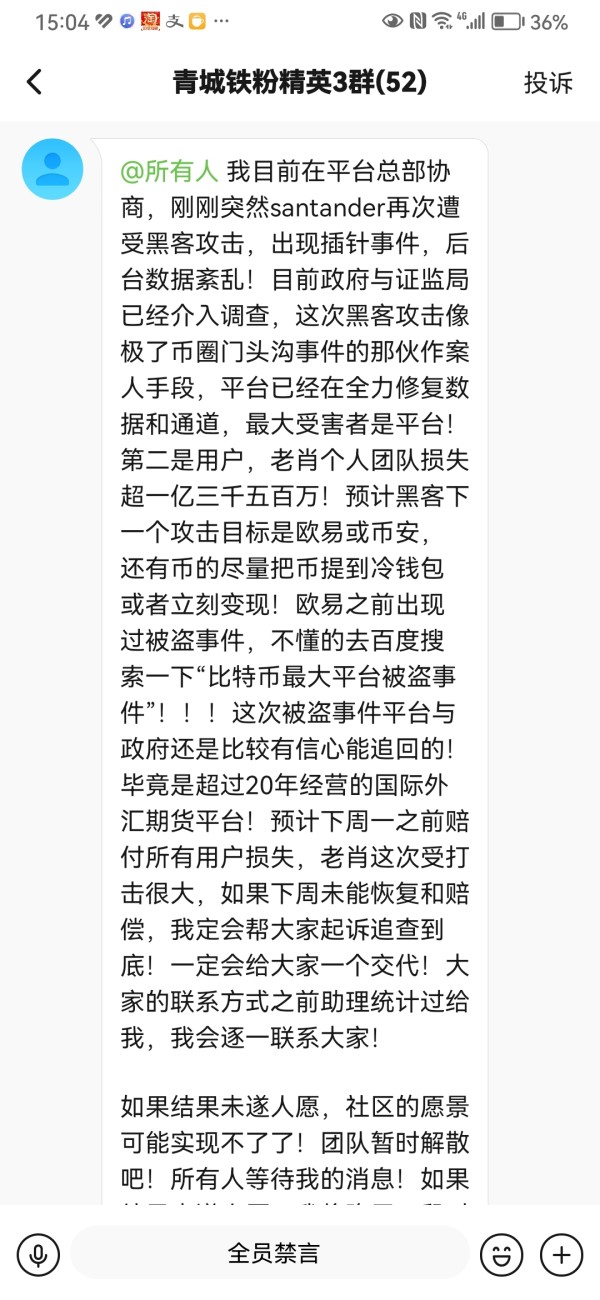

Xiao Peng began to gain the trust of members through lectures, and step by step induced everyone to register for the fake Santander website: https://www.santanderfx.com. Starting from depositing money, he induced everyone to buy gold and crude oil, and finally directly controlled the platform to liquidate their positions! They lied about a hacker attack and no one can withdraw money. The website is currently unavailable! This is pure fraud. Please be sure to unite and contact me on WeChat to wipe out the Xiao Peng gang together to prevent more people from being deceived!

Exposure

2024-02-11

幸福3324

Hong Kong

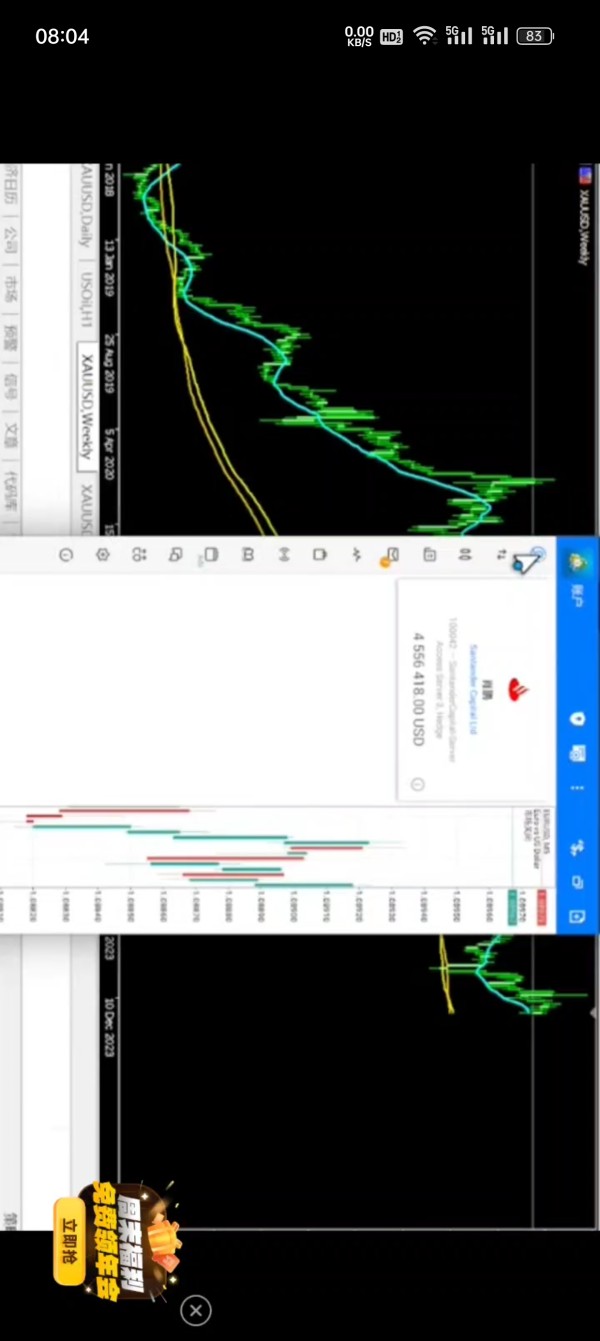

Xiao Peng's fraud team uses lectures to deceive our trust and induces us to download the mt5 platform. He persuades us to choose the Santander trader and conduct copy trading! The malicious marking caused us to liquidate our positions. The trading platform was hacked last Thursday and we were unable to withdraw cash. Furthermore, the chat group was suddenly disbanded and blacklisted! Withdrawal is currently unavailable! I have called the police. The police has accepted the case and has been sorting out relevant information.

Exposure

2024-02-11

幸福3324

Hong Kong

I was defrauded by Xiao Peng's team. The telecom network used the fake meta5 platform. It is the trader Santander. My position is currently liquidated and I am unable to withdraw money. I have reported the case! The police are sorting it out!

Exposure

2024-02-11

布鲁斯李7022

Hong Kong

I was also deceived by Xiao Peng, fake Santander, now has a burst position, has been unable to withdraw funds, Santander has been unable to log in.

Exposure

2024-02-10

谁来救我

Hong Kong

Can only find the genuine to send exposure information, this site is fake, can not withdraw. Has burst the position to obtain the user's assets, now can not withdraw, everyone should keep our own rights, join the following group, more people power big rights, do not let go of the Xiao Peng, this gang.

Exposure

2024-02-09

布鲁斯李7022

Hong Kong

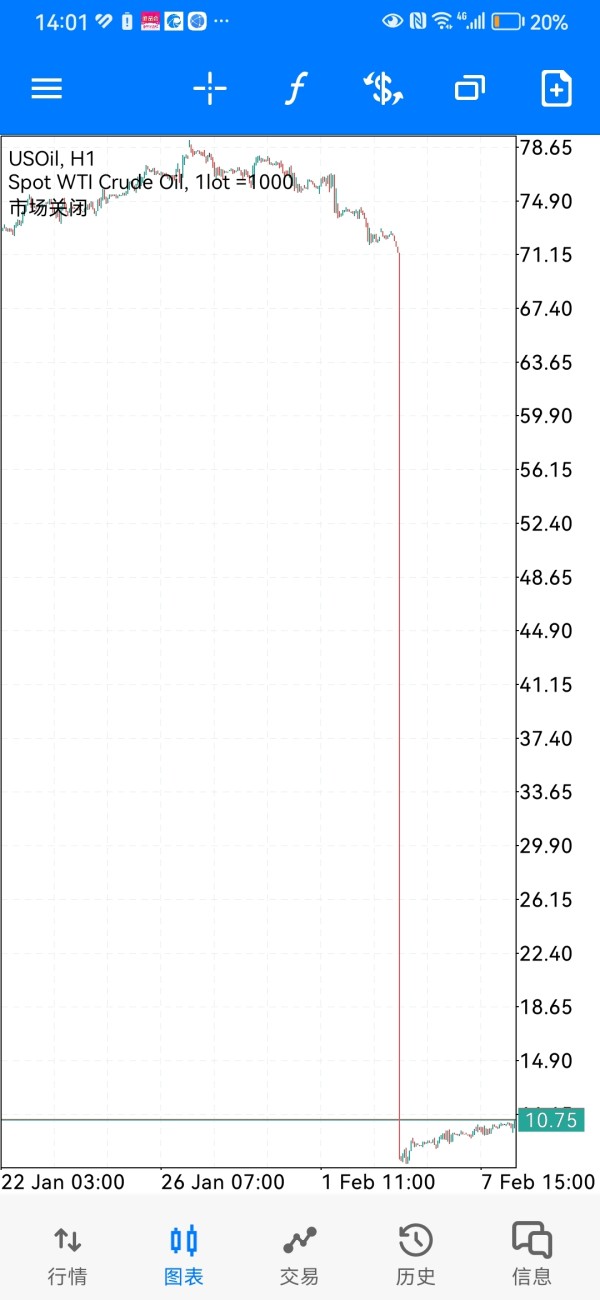

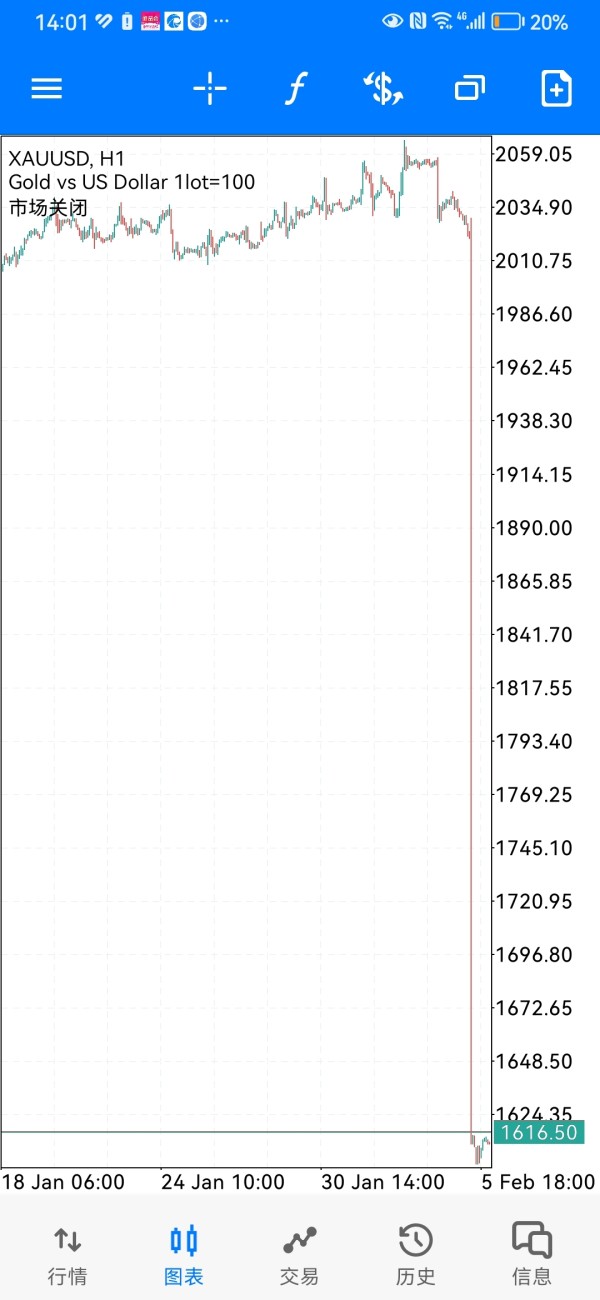

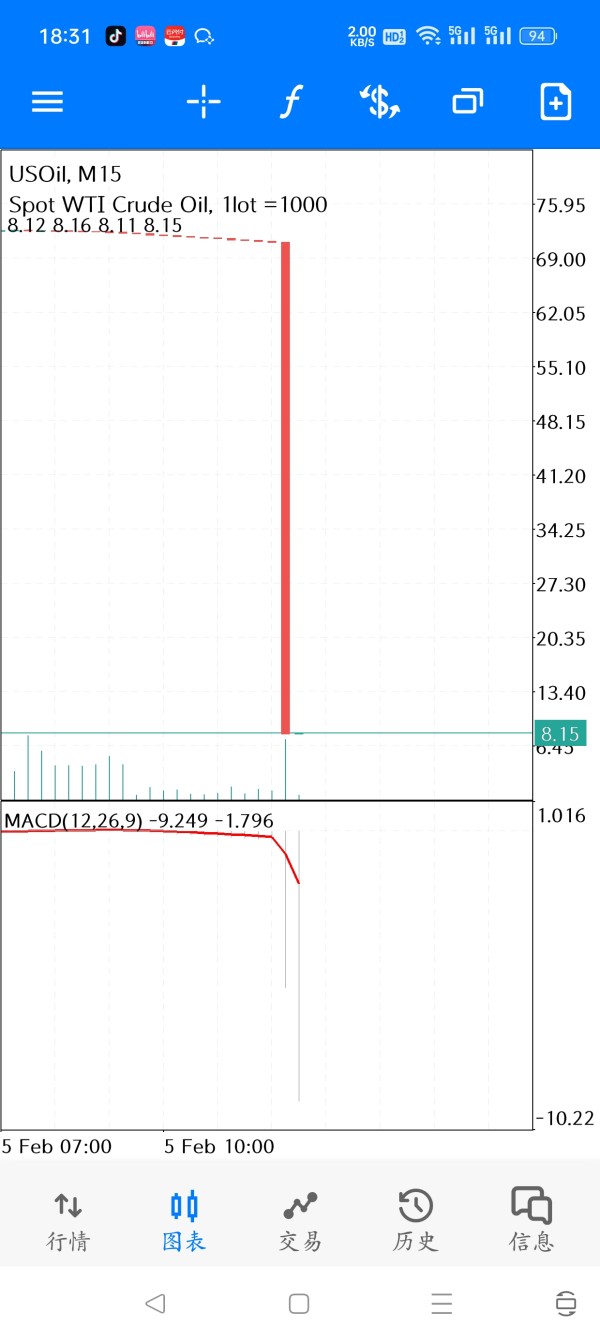

I first deposited money into this broker and made some money at the beginning. I tried to withdraw 200u, I was still able to withdraw money smoothly. Later, they operated the K-line, I lost money directly, leaving only a little bit of principal. Then they induced me to deposit money again until I ran out of money, and directly controlled the K-line. Crude oil fell directly from 72 to single digits, and gold was cut in half. I hope no one will be scammed again.

Exposure

2024-02-09

FX4184815529

Hong Kong

I can only post the exposure information under the official ones. The ones marked below are official. The platform I deposited is fake. The address of the fraudulent and fake platform: is https://www.santanderfx.com It has been liquidated to obtain the user's assets. I am now unable to withdraw funds.

Exposure

2024-02-06

8618

Japan

I registered this account using the code given to me by the recommender. Now I don't know if it's the platform policy or what. Originally, the reason why I couldn't withdraw money was because I hadn't paid taxes on my profits. I need to pay 20% of the profit to withdraw money. But I still can't withdraw money after paying the taxes. The platform also said that the money associated with the account was not paid. What kind of policy is this? My own taxes and my account have been paid, but I cannot withdraw funds yet. I can't understand. The person who recommended me now is always saying that he has no money to pay and has been out of contact. I couldn't withdraw my principal, and I paid another 20563 usd in taxes!

Exposure

2023-08-16

FX4981129072

Chile

I deposited $146 on this platform and transferred $4030 from suouesta. But my account was blocked.

Exposure

2021-10-15

FX1208880192

Brazil

Too good

Positive

03-07