简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

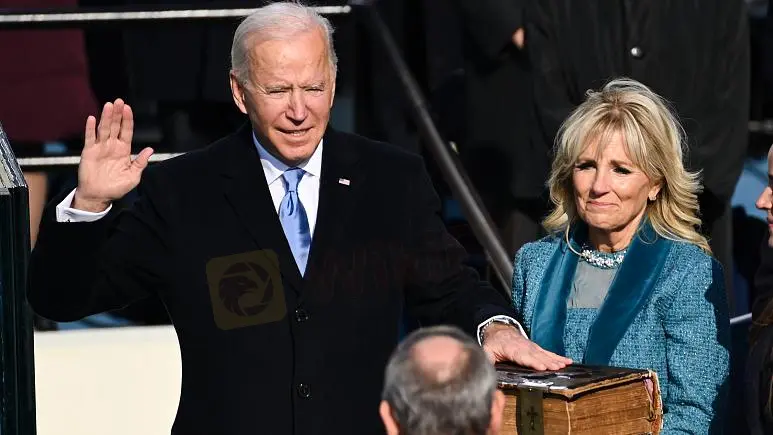

Gold Surges $30 as Biden Sworn In as US President

Abstract:The gold market saw a V-shaped rally on Wednesday as Joe Biden was being sworn in as 46th president of the United States. Spot gold rebounded to $1,850/ounce from $1,832.30, after touching a high of $1,860.

WikiFX News (21 Jan.) - The gold market saw a V-shaped rally on Wednesday as Joe Biden was being sworn in as 46th president of the United States. Spot gold rebounded to $1,850/ounce from $1,832.30, after touching a high of $1,860.

“Much of today's rally is just investors believing that you are going to see the Biden administration work nicely with the Treasury in providing a significant amount of stimulus in the first 100 days,” said Edward Moya, senior market analyst at OANDA .

“The $1,900 level is likely to be short-term resistance this week, and if the rally continues to see strong support, I wouldn't be surprised to see gold at $1,950 by the middle of next month,” Moya added.

Meanwhile, there is still a lot of uncertainty when it comes to the vaccine rollout, growing case numbers, and new virus variants.

“One of the concerns is that the South African virus strain would potentially become a big problem. The worry is that the mutation is resistant to anti-body neutralization, which means that vaccines might not be able to protect from re-infection,” Moya noted. “This raises expectations that we are going to see lockdowns a lot longer, and it will force more fiscal efforts, which will be the backbone for gold prices.”

Use WikiFX to discern market trends, capture trading opportunities and make more profits.

Chart: Trends of Gold

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

These Are How Millionaire Forex Traders Think and Act

It's no secret that in the world of trading, the most difficult thing is realization. Everyone can expect to be a successful trader, a trader who wins a lot of money, to a millionaire trader. But all this could be a dream if they didn't try to chase it.

How to Register Forex Trading, 5 Easy Steps to Follow

Foreign exchange has been developed and turned into something big in all of society. Not just office employees, but also students, kids in school, housewives, and even the unemployed.

Pip In Forex Trading, The Relation to Profitability

Pip or price interest point or percentage in point is a measurement tool associated with the smallest price movement any exchange rate makes. Usually, there is four decimal places used to quote currencies.

Euro Drops to 2-Decade Low on Recession Fears

Worries about how the European Central Bank will react also undermined sentiment after Germany's Bundesbank chairman Joachim Nagel lashed out at the ECB's plans to try and protect heavily indebted countries from sharp increases in lending rates.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

New SEC Chair Paul Atkins Targets Crypto Regulation Reform

ED Exposed US Warned Crypto Scam ”Bit Connect”

WikiFX Elites Club —— Fun Spring Camping in Malaysia Successfully Concluded!

Currency Calculator