简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Exchange Tokens Hit New All-time Highs as Stock Traders Rush to Crypto

Abstract:GameStop caught the stock-buying public's imagination. That excitement has spilled over to crypto.

GameStop caught the stock-buying public's imagination. That excitement has spilled over to crypto.

Some retail equities traders, frustrated with recent restrictions on stock buying on trading platforms including Robinhood, are turning their attention to centralized and decentralized cryptocurrency exchanges (CEX and DEX, respectively), according to new data. That‘s helping to drive several of these exchanges’ tokens to new highs.

Last week GameStop (GME) and and other stocks involved in a battle between a short-selling hedge fund and a Reddit group captured the imagination of the general public, a battle that drove these stocks prices higher and squeezed the short seller.

Now, some of that buying excitement has spilled over to crypto where CEX and DEX trading volumes have risen over the past week, according to several crypto trading data sites.

CEX volumes rise, taking tokens with themTrading volumes for bitcoin futures on Binance and FTX surged over the weekend, according to data site Skew.

Source: Skew

Binance's BNB token hit a new all-time high at $50.27 during early U.S. trading hours on Monday, while FTXs FTT token logged a record price of $12.95 on Friday, according to data from Messari.

“ATH [all-time highs] on a few different matrices” [for BNB], Changpeng Zhao, chief executive of Binance, tweeted earlier Monday.

Through a spokesperson, Zhao told that Binance's utility token's price rally is driven by its multiple use cases.

“[BNBs] use cases have expanded to hundreds of applications on numerous platforms and projects within the crypto ecosystem [and] these are reflected in its growing price,” said the spokesperson, quoting Zhao. “…To become a true mass-adopted application, BNB must be able to facilitate billions of transactions per day. In its current form, we still have a long way to go.”

The traffic spike last weekend pushing BNB and FTT to the record highs likely resulted from increased trading traffic by retail traders coming from the traditional stock market, according John Todaro, director of institutional research at TradeBlock.

“The recent retail trading saga has shown that trading platforms, brokerages and even exchanges can shut down aspects of the trade process without much notice,” Todaro said. “This pushed some retail traders into cryptocurrency markets, as we saw with dogecoin, xrp, and stellar lumens catching a bid on the week.”

In an effort to capitalize on the retail trading frenzy caused by the GameStop stock drama, FTX last week listed a WallStreetBets (WSB) index quarterly futures contract, named for the Reddit group involved with the GameStop drama. The basket of stocks in the contract include GameStop plus Nokia (NOK), BlackBerry (BB), AMC Entertainment (AMC) plus the iShares Silver Trust (SLV) because of recent interest in silver.

“FTX lists tokenized equities, so investors could also be anticipating that Robinhood users and others may switch over to FTX to continue investing in stocks without the limits that various traditional brokerages have applied on their retail users,” Todaro added.

UniSwap and SushiSwap lead way for DEXsActivity in decentralized finance (DeFi) is on the upswing. Total January trading volume on DEXs soared to an all-time high above $50 billion. On a seven-day basis, UniSwap and SushiSwap, the two leading DEXs, took 48.8% and 23.3%, respectively, of all DEX trading volumes, according to Dune AnalyticsDEX metrics tracker.

Monthly trading volumes on Uniswap and Sushiswap since September 2020.

Source: Dune Analytics

“Overall, the [crypto] market has had a lot of volume increased, both on CEX and DeFi,” Peter Chan, lead quant trader at Hong Kong-based OneBit Quant, said. He credits growing trade volume on SushiSwap for its SUSHI tokens price surge.

At the same time, Uniswap (UNI) and SushiSwap tokens exceeded their previous high prices, on Jan 31. and Feb. 1, respectively, according to data from Messaris decentralized finance tracker.

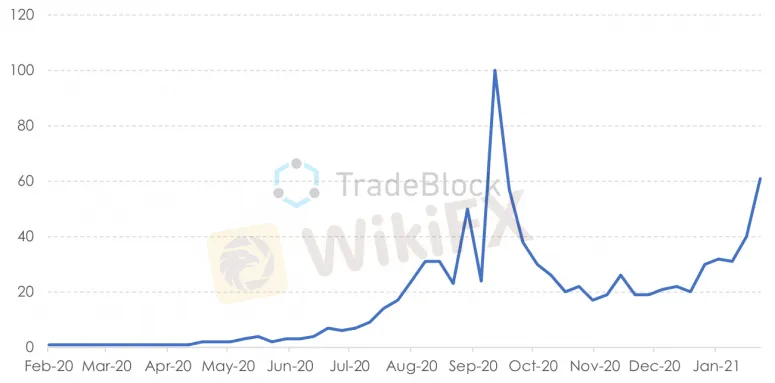

Retail traders appear to be driving at least part of the price movement. The number of Google searches for “Uniswap,” the biggest decentralized exchange by market cap, is almost as high as during last year‘s “DeFi summer” boom. That is an indicator of retail demand for DEXs, according to TradeBlock’s weekly newsletter of Feb. 1. It also reflects some retail traders growing concerns regarding centralized trading platforms, with more people wanting to learn about decentralized exchanges such as Uniswap.

Uniswap Google search interest over time.

Source: TradeBlock

“Within DeFi, arguably the most ostensible applications in the sector are the DEXs [such as] Uniswap and SushiSwap,” Todaro said. “As the sector heats up, UNI and SUSHI have been the primary benefactors as they are the most visible.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

The Impact of Interest Rate Decisions on the Forex Market

STARTRADER Spreads Kindness Through Ramadan Campaign

Rising WhatsApp Scams Highlight Need for Stronger User Protections

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

How a Housewife Lost RM288,235 in a Facebook Investment Scam

The Daily Habits of a Profitable Trader

Currency Calculator