Amega Information

Amega Global Ltd. operates in a regulated environment and offers trading services for various CFD assets, including Forex, Stocks, Indices, Commodities, Precious metals, and Energies, with leverage up to 1:1000. They use MetaTrader 5 (MT5) and provide Islamic account options, among others. Customer support is available through phone, email, and live chat, and they accept payments via many region-based providers, including SticPay, DusuPay, Skrill, Neteller, and many more.

Is Amega Legit?

Amega is unregulated by any authorities. Investors should be cautious when trading with this brokerage.

Pros and Cons

Account Types

Amega offers three live account options to suit different trading preferences:

- Standard Bonus Account: This account offers zero commissions and a bonus of up to 150%. It is ideal for those who are looking for an account with no additional charges on their transactions and a high bonus on deposits.

- Islamic Bonus Account: This account is designed for traders who follow Islamic finance rules, offering swap-free trading and a bonus of up to 150%. Swap-free accounts do not incur or earn swap or interest on any trades, in compliance with the prohibition of Riba (interest) in Islamic finance.

- Raw Bonus Account: With spreads from 0 pips, this account is ideal for those who prioritize low spreads. It also offers a bonus of up to 150% on deposits. This type of account is optimal for traders who are looking for cost-efficient trading where they can maximize their profits.

Spreads & Commissions

Amega spreads are subject to variation based on the chosen trading account and asset.

Forex Trading: In Forex trading, spreads are relatively low. For example, the AUD/CAD pair has a spread of 0.00147.

Stock Trading (as CFDs): Amega provides Stock CFDs with spreads that can vary depending on the trading account. AAPL, for instance, comes with a spread of 0.05.

Indices Trading: Trading indices involves spreads that may differ based on the trading account. The ASX200, for example, has a spread of 3.1.

Commodities Trading: Amega offers trading in agricultural commodities, with spreads varying by account. COCOA, for instance, features a spread of 4.

Precious Metals Trading: Precious metals spreads can also vary depending on the account type. For example, XAG/USD has a spread of 0.01.

Energy Trading: Energy commodity spreads fluctuate based on the trading account. NGAS has a spread of 0.013, for reference.

Deposit & Withdrawal

Deposit:

Sticpay: Deposits using Sticpay do not incur any fees. You can fund your trading account without any additional charges.

DusuPay: Deposits made via DusuPay also do not have any associated fees. You can transfer funds to your trading account at no extra cost.

Skrill: Deposits through Skrill are free of charge. You can add funds to your trading account without incurring any fees.

Neteller: Similar to Skrill, Neteller deposits do not involve any fees. You can deposit funds without additional costs.

Amega also offers many more region-based solutions that cater to both card-payments and bank transfers, as well as some QR code options.

Withdrawal:

Sticpay: Withdrawals using Sticpay will be subject to a 2% fee. When you request a withdrawal, 2% of the withdrawal amount will be deducted as a fee.

DusuPay: For withdrawals via DusuPay, there is a fee of 2.5% of the withdrawal amount plus an additional $3 processing fee. This means you'll be charged 2.5% of the amount you want to withdraw along with a fixed $3 fee.

Skrill: Skrill withdrawals incur a flat fee of $1. Regardless of the withdrawal amount, you'll be charged $1 for each Skrill withdrawal.

Neteller: Neteller withdrawals come with a fee of 1% of the withdrawal amount, with a maximum fee limit of $30. This means that you'll pay 1% of your withdrawal amount, but it won't exceed $30 as the maximum fee.

Promotions

Amega offers three key promotions to enhance the trading experience and provide opportunities for additional earnings:

- Deposit Bonus: This exciting promotion can boost your trading capital significantly. When you make a deposit, you receive a bonus worth up to 150% of the amount deposited. This allows for extended trading and potentially higher profits from increased capital.

- Loyalty Cashback: This promotion rewards frequent trading. For every lot you trade, you get a cashback of $1. The process is simple: continue trading, collect your rewards, and repeat. This can result in a consistent cashback income, based on the volume of your trades.

- STICPAY Cashback: In partnership with STICPAY, Amega offers a cashback promotion when you top up your account. After activating this offer by contacting the Amega support team and adding AMEGA on the STICPAY Cashback page, you can get up to $13 per lot for each position you open. This offer provides unlimited cashback, making it an advantageous tool to maximize your earning potential.

Customer Support

Customer Support at Amega is available through multiple channels for the convenience of its clients. You can contact them through phone at +357 97857441, offering a direct and immediate way to get assistance or have your queries addressed.

For written communication, you can reach out to their support team at support@amegafx.com. This is the primary channel for general support inquiries, where you can expect a timely response to your questions or concerns.

Live chat provides convenient access to the support team during working hours, as well as a comprehensive help center during after-hours.

If you are interested in affiliate-related matters or partnerships, you can contact the Affiliate department at partner@amegafx.com.

For broader inquiries related to business collaboration and career opportunities, you can get in touch via email at info@amegafx.com.

Conclusion

To provide a summary, Amega is an unregulated broker offering various market instruments and high leverage options.

Amega providethe user-friendly MT5 platform. Various account types and bonuses are available, as well as a Loyalty Program that offers volume-based cashback on every trade, regardless of the market direction.

FAQs

Is Amega Global Ltd a regulated broker?

Amega is regulated under the Mauritius Financial Services Commission

What trading instruments are available on Amega's platform?

Amega offers a variety of trading instruments, including Forex, Stocks (as CFDs), Indices, Commodities, Precious Metals, and Energy.

What is the maximum leverage offered by Amega?

Amega provides leverage of up to 1:1000, although the specific leverage can vary based on the chosen asset and account type.

What trading platform does Amega use?

Amega uses the MetaTrader 5 (MT5) trading platform, known for its user-friendly interface and advanced charting tools.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

Bin.n

Vietnam

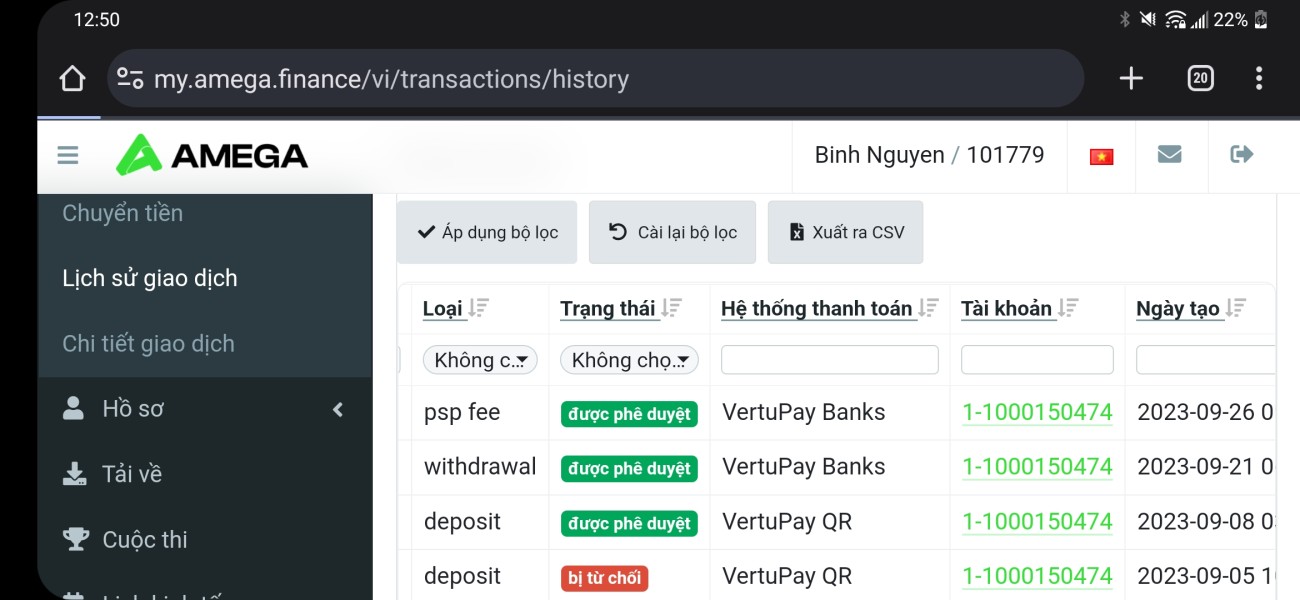

On September 21st, he succeeded, but did not succeed.

Exposure

2023-10-06

Happyday

United States

Amega offers a worthwhile trading experience so far. Their support team is always ready to troubleshoot issues, and I really appreciate their prompt withdrawal process. The flexibility in trading strategies definitely adds appeal. But they could make improvements in reducing commissions on raw accounts and refining the deposit and withdrawal processes. An increase in leverage on all account types would also be beneficial. Overall, a solid platform for trading. Contact Agent Tonia for further assistance, she's very helpful!

Neutral

2024-05-16

L33724

South Africa

After update the app, i can't accsess trading view again on terminal trading, why?

Neutral

2024-04-26

Aluke876

Singapore

Honestly, I came here largely because of its attractive deposit bonus, but I never expected that I would be lured by its competitive spreads and quick order execution. Amega is amazing! 👍👍👍 I would definitely recommend it to my friends.

Positive

2024-07-26

hold on to

Peru

Chris Weston is great, answers questions to his articles, has great insight into the markets. Better than your own Bloomberg terminal. Webinars are fantastic from Amega. They also treat you with respect and are generally helpful with most requests. Uptime with their cTrader platform has been like 99.999%. So far its been a good experience.

Positive

2024-05-29

Thanawat Pothiba

Nigeria

I stepped into the trading sea with Amega, paired with an easy account-opening process and a responsive customer service team to navigate my journey. Let's dive into their platform performance. Generally speaking, it has been reasonably good, serving real-time data and handling order execution well. However, there were a few instances where minor lags were noted. Fortunately, these hiccups didn't result in significant slippage, but it is something worth noting. Spreadwise, they do fall on the higher side compared to other brokers. While this is not a deal-breaker, I recommend keeping an eye on spreads, particularly if you perform high-frequency trading.

Positive

2023-11-30

Arina

Cyprus

good broker good withdrawal a lot of instruments

Positive

2023-10-18