简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Analysis: XAU/USD refreshes intraday high around $1,730 on Biden’s optimism

Abstract:Gold Price Analysis: XAU/USD refreshes intraday high around $1,730 on Biden’s optimism

Gold takes the bids after stepping back from 10-day top the previous day.

Biden lauds his administrations work on taming covid, stays cautious on job outlook.

Risks remain elevated amid vaccine optimism, hopes of further stimulus and economic recovery.

Light calendar in Asia probes bulls, US data eyed.

Gold refreshes intraday top to pierce $1,726, currently up 0.10% around $1,725, during early Friday. The yellow metal recently rose as US President Joe Biden gives his first prime-time appearance to commemorate the coronavirus (COVID-19)-led lockdowns anniversary and how the US managed to overcome.

During the initial words of the speech, US President Biden praised his administration during the initial two months of fighting the pandemic and promised vaccines for all American adults by May 01. The Democratic leader also praised the $1.9 trillion American Rescue Plan but hints at worries over the US jobs.

Even so, the markets arent too active. The recent lack of reaction to the key speech could be traced to the latest passage of the US $1.9 trillion stimulus and a lack of any hints for the recently chatters $2.5 infrastructure plan. Also, the pre-event update from the White House already conveying most highlights dimmed the importance of the event.

Even so, market sentiment remains positive as the US on the road to recovery from the pandemic times. Also favoring the mood could be the Novavax update suggesting strong results while trying to tame the UK covid variants.

Alternatively, AstraZeneca‘s fears to fall short of vaccine deliveries to the European Union (EU) and the US actions to disappoint Huawei suppliers join Australia’s dislike for Hong Kong conditions to challenge the risk-on mood.

Against this backdrop, US 10-year Treasury yields and S&P 500 Futures print mild gains whereas stocks in Asia-Pacific track Wall Streets uptrend by the press time.

Having witnessed the initial market reaction to US President Bidens prime-time speech, gold traders should keep eyes on the vaccine and unlock newsahead of the US Michigan Consumer Sentiment figures for March, expected 78.5 versus 76.8 prior.

Technical analysis

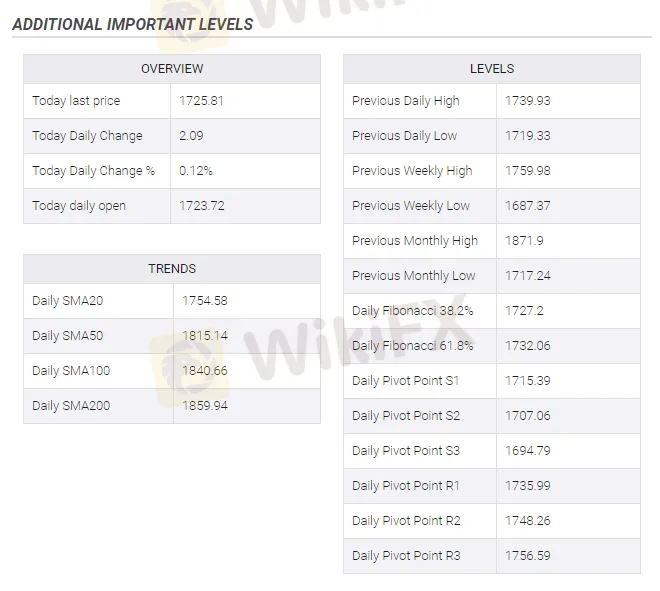

A clear break of 10-day SMA, currently around $1,713, not to forget sustained trading beyond the $1,700 threshold, keeps gold buyers directed towards the key $1,765 resistance confluence comprising a two-month-old falling trend line and November 2020 low.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Inflation hot at 13-year high, what will happen to gold?

Inflation hot at 13-year high, what will happen to gold?

Optimism Ahead Of Bank Of Canada Decision

Optimism Ahead Of Bank Of Canada Decision

FX Week Ahead - Top 5 Events: Chinese, Mexican, US Inflation Rates; BOC & ECB Rate Decisions

FX Week Ahead - Top 5 Events: Chinese, Mexican, US Inflation Rates; BOC & ECB Rate Decisions

Find Your Forex Entry Point: 3 Entry Strategies To Try

Find Your Forex Entry Point: 3 Entry Strategies To Try

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

New SEC Chair Paul Atkins Targets Crypto Regulation Reform

ED Exposed US Warned Crypto Scam ”Bit Connect”

Currency Calculator