Score

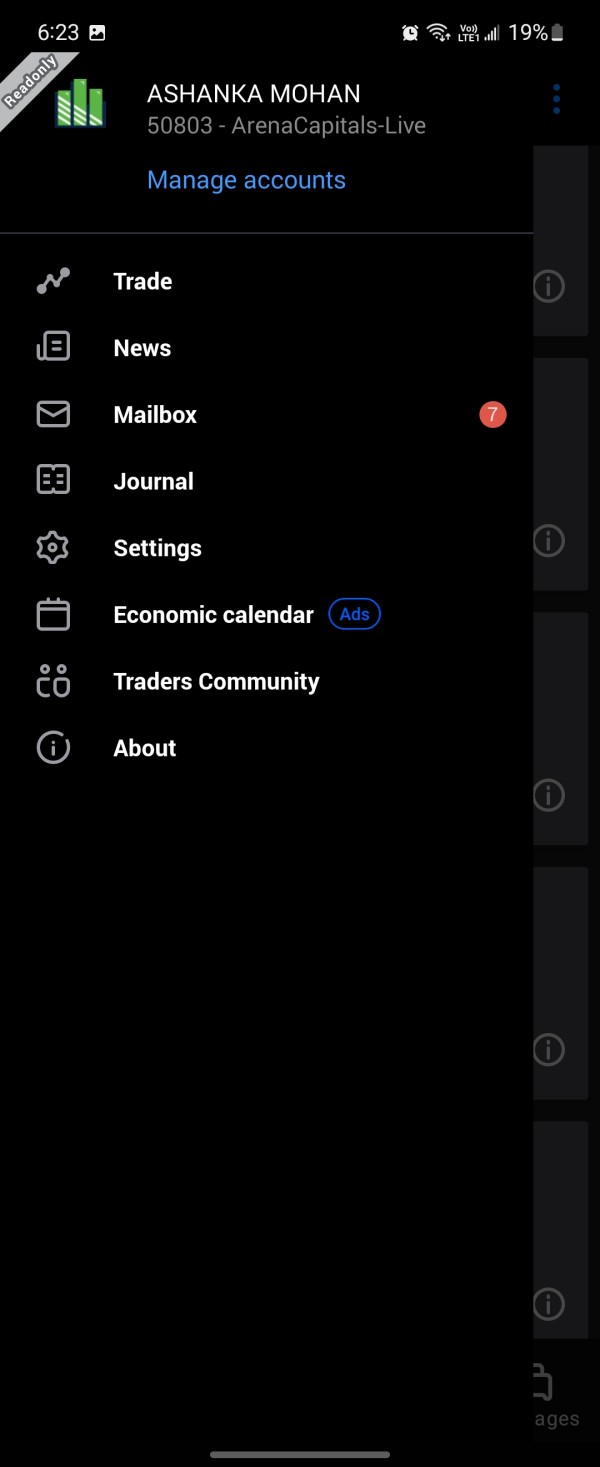

Arena Capitals

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://arenacapitals.com/index.php

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesUsers who viewed Arena Capitals also viewed..

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

arenacapitals.com

Server Location

United States

Website Domain Name

arenacapitals.com

Website

WHOIS.HKDNS.HK

Company

WEST263 INTERNATIONAL LIMITED

Domain Effective Date

2015-03-26

Server IP

107.180.46.234

Company Summary

| Aspect | Information |

| Company Name | Arena Capitals |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2021 |

| Regulation | Unregulated |

| Minimum Deposit | $5,000 |

| Services | Assest management,Investment advisory,Options&Futures trading |

| Commissions | 0 to 15% commissions,based on different exchanges |

| Trading Platforms | Meta Trader 4,Meta Trader 5 |

| Demo Account | Available |

| Customer Support | Phone:+44 20 39960970,Email:contact@arenacapitals.com |

| Deposit & Withdrawal | Bank transfer,credit/debit card,third-party payment |

Overview of Arena Capitals

Arena Capitals, established in 2021 and headquartered in Saint Vincent and the Grenadines, is an unregulated financial services company offering a range of services. The company specializes in asset management, investment advisory services, and options and futures trading. Arena Capitals requires a minimum deposit of $5,000 for clients to access their services. Commissions on trades can vary from 0% to 15%, depending on the specific exchanges involved. Clients have access to popular trading platforms like Meta Trader 4 and Meta Trader 5, and a demo account is available for practice. Customer support can be reached via phone at +44 20 39960970 or by emailing contact@arenacapitals.com.

Is Arena Capitals Legit or a Scam?

Arena Capitals operates as an unregulated entity in the financial services industry. This means that the company is not subject to oversight or regulation by any financial authorities or regulatory bodies.

The unregulated status is a significant factor for potential clients to consider when assessing the company's services and associated risks.

Pros and Cons

| Pros | Cons |

| Various Services | Unregulated Status |

| Availability of Popular Platforms | High Minimum Deposit |

| Demo Account | Commission Variability |

| Multiple Contact Channels | Limited Regulatory Safeguards |

| Commission Flexibility | New Establishment |

Pros:

Various Services: Arena Capitals offers a range of financial services, including asset management, investment advisory, and options and futures trading, allowing clients to access various investment opportunities.

Availability of Popular Platforms: Clients have access to widely used trading platforms like Meta Trader 4 and Meta Trader 5, which are known for their comprehensive features and user-friendly interfaces.

Demo Account: Arena Capitals provides a demo account, allowing traders to practice and refine their strategies without risking real capital.

Multiple Contact Channels: The company offers customer support through both phone and email, providing clients with multiple ways to seek assistance and have their queries addressed.

Commission Flexibility: The range of commissions from 0% to 15% offers flexibility to clients depending on their trading preferences and the specific exchanges involved.

Cons:

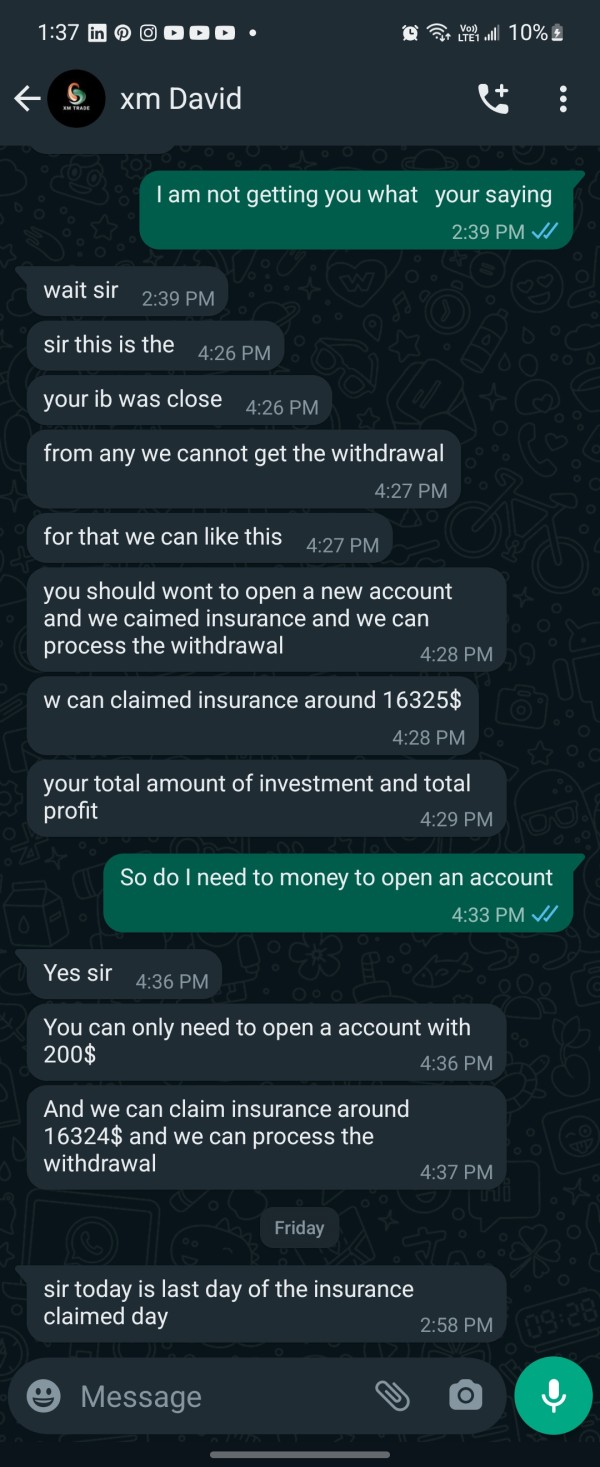

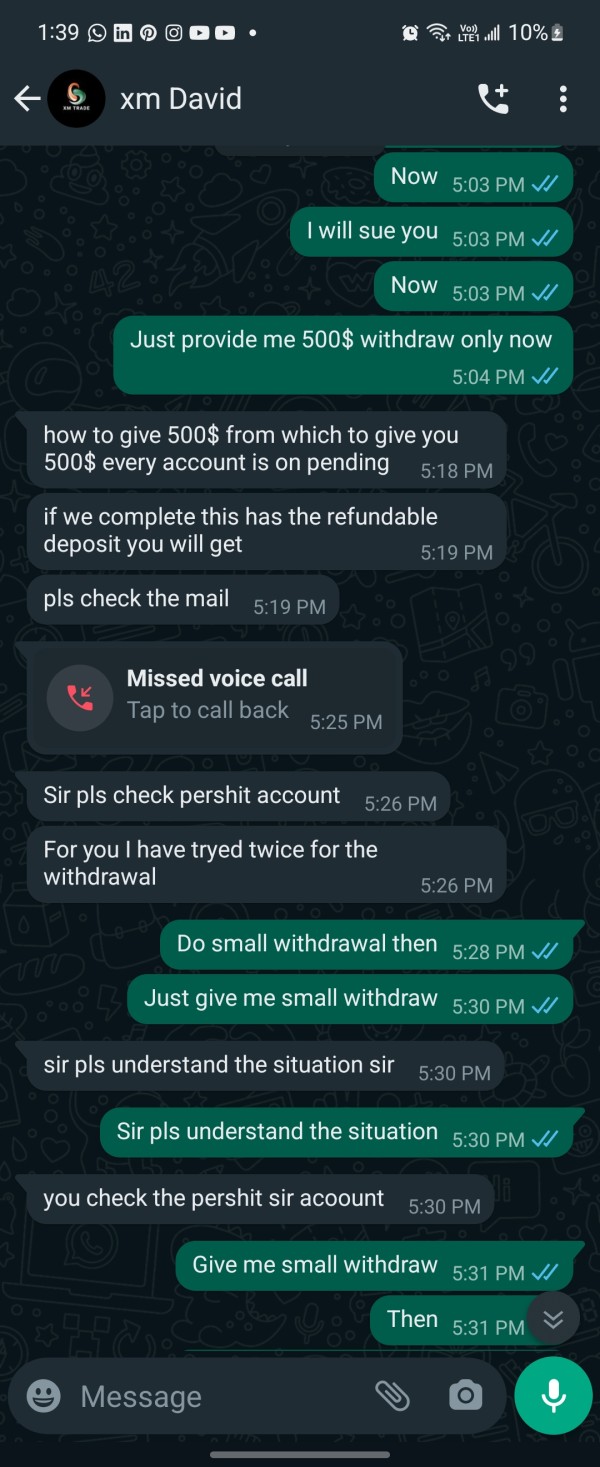

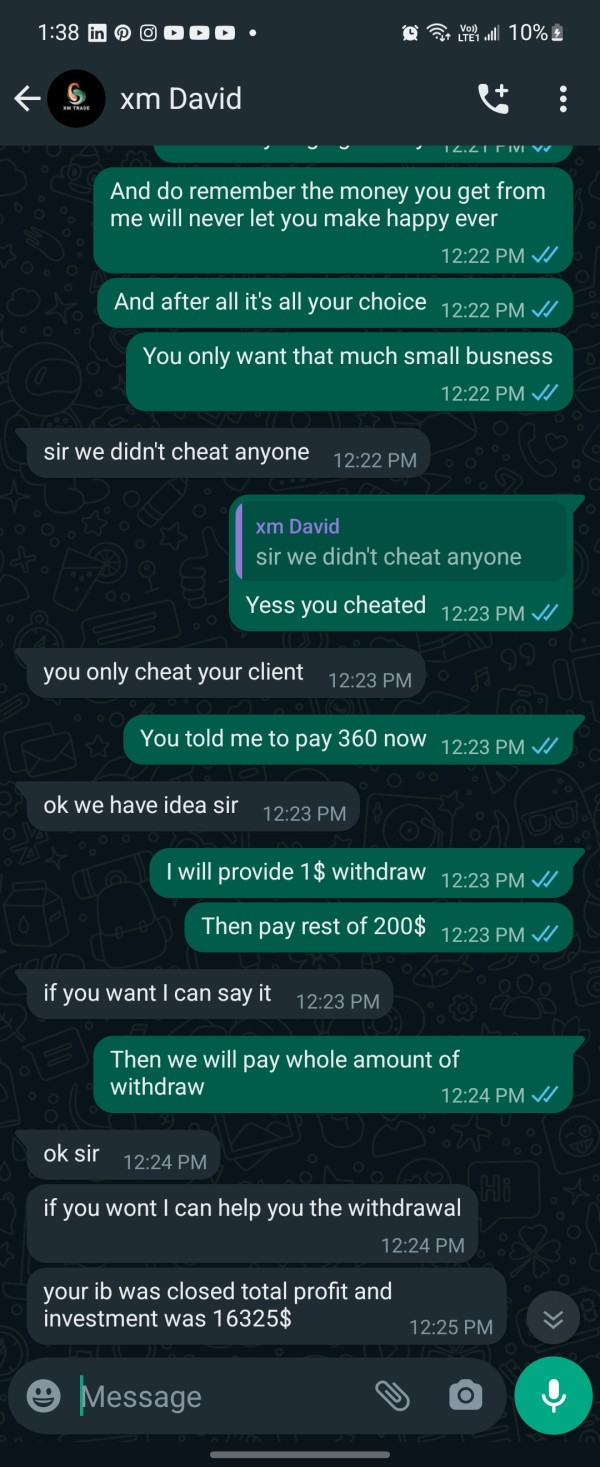

Unregulated Status: Arena Capitals operates without regulatory oversight, which can raise concerns about transparency, security, and investor protection.

High Minimum Deposit: The minimum deposit requirement of $5,000 may be a significant barrier for entry, making it less accessible for smaller or novice investors.

Commission Variability: The commission structure can be complex, with rates ranging from 0% to 15% based on different exchanges. Clients may find it challenging to navigate and understand these variations.

Limited Regulatory Safeguards: Due to the absence of regulatory oversight, clients may have limited recourse in case of disputes or issues with the company's services.

New Establishment: Arena Capitals was founded in 2021, making it a relatively new entrant in the financial services industry. Some investors may prefer established firms with a longer track record.

Products

Arena Capitals offers a range of financial services to its clients, including:

Asset Management: The company provides asset management services, allowing clients to entrust their investment portfolios to experienced professionals who make investment decisions on their behalf.

Investment Advisory: Arena Capitals offers investment advisory services, providing clients with expert advice and recommendations on investment strategies, asset allocation, and portfolio management.

Options and Futures Trading: The company facilitates options and futures trading, enabling clients to engage in derivative trading and speculate on the price movements of various financial instruments.

How to Open an Account?

Opening an account with Arena Capitals involves a straightforward process that can be summarized in three steps:

Visit the Official Website: Start by visiting the official website of Arena Capitals. Here, you can access information about their services and account opening procedures.

Complete the Registration Form: Fill out the registration form provided on the website. You will need to provide personal information, including your name, contact details, and financial information. Ensure that all information is accurate and up-to-date.

Fund Your Account: Once your registration is approved, you will need to fund your trading or investment account. Arena Capitals likely accepts deposits through various methods, such as bank transfers, credit/debit cards, and third-party payment systems. Ensure that you meet the minimum deposit requirement specified by the company.

Commissions

Arena Capitals' commission structure can vary based on different exchanges and trading activities. The company offers a range of commissions from 0% to 15%, depending on the specific exchanges and financial instruments involved.

The variability in commission rates provides flexibility to clients, allowing them to choose commissions that align with their trading preferences and strategies.

Trading Platform

Arena Capitals primarily offers the Meta Trader 4 (MT4) and Meta Trader 5 (MT5) trading platforms to its clients. Both MT4 and MT5 are well-established and widely used trading platforms in the financial industry.

These platforms are known for their user-friendly interfaces, advanced charting tools, technical indicators, and support for automated trading through Expert Advisors (EAs).

Traders of all experience levels often favor MT4 and MT5 for their reliability and versatility. The availability of both platforms provides clients with options to choose the one that best suits their trading preferences and needs.

Deposit & Withdrawal

Arena Capitals offers clients various methods for depositing and withdrawing funds from their accounts. Here are the common deposit and withdrawal methods available:

Payment Methods:

Bank Transfer: Clients can fund their accounts through bank transfers. This method is secure and suitable for larger deposits, although it may take some time for the funds to be processed.

Credit/Debit Card: Arena Capitals accepts deposits made using credit or debit cards. This option is often quicker, and funds are typically available in the trading or investment account almost immediately.

Third-Party Payment Systems: The company may support various third-party payment systems, which can provide convenience and speed in depositing funds.

Customer Support

Arena Capitals provides customer support through various channels. Clients can reach the company via phone at +44 20 39960970, offering a direct line for immediate assistance and inquiries.

Additionally, Arena Capitals can be contacted via email at contact@arenacapitals.com, providing clients with a written communication channel to address their queries or concerns.

The company's presence on Twitter, https://twitter.com/arenacapitals, may also serve as an additional platform for updates and communication.

Clients have multiple avenues to seek assistance and engage with Arena Capitals' customer support team, enhancing accessibility and responsiveness to their needs.

Conclusion

In summary, Arena Capitals, founded in 2021 and headquartered in London, United Kingdom, offers a range of financial services, including asset management, investment advisory, and options and futures trading.

However, the company operates without regulatory oversight, which may raise concerns about transparency and investor protection. The relatively high minimum deposit requirement of $5,000 could be a significant consideration for potential clients.

Arena Capitals provides popular trading platforms, Meta Trader 4 and Meta Trader 5, and offers flexibility in commission rates based on different exchanges.

FAQs

Q: What services does Arena Capitals provide?

A: Arena Capitals offers a range of services, including asset management, investment advisory, and options and futures trading, meeting various investment needs.

Q: Is Arena Capitals regulated by financial authorities?

A: No, Arena Capitals operates as an unregulated entity, which means it is not subject to oversight by financial regulatory authorities.

Q: What is the minimum deposit required to open an account with Arena Capitals?

A: Arena Capitals has a minimum deposit requirement of $5,000 for clients to access their services.

Q: Are there any commissions charged by Arena Capitals?

A: Arena Capitals offers commission rates ranging from 0% to 15%, depending on different exchanges and trading activities.

Q: What trading platforms are available at Arena Capitals?

A: Arena Capitals provides access to popular trading platforms, including Meta Trader 4 and Meta Trader 5, known for their advanced features and user-friendly interfaces.

Q: How can I contact customer support at Arena Capitals?

A: Customer support at Arena Capitals is accessible through phone at +44 20 39960970, email at contact@arenacapitals.com, and the company's Twitter account, https://twitter.com/arenacapitals. Clients have multiple communication channels to seek assistance and engage with the customer support team.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Comment 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now