简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NZD/USD Selloff May Continue as Vaccine Rollout Issues, Geopolitical Risks Rise

Abstract:NZD/USD Selloff May Continue as Vaccine Rollout Issues, Geopolitical Risks Rise

NEW ZEALAND DOLLAR, NZD/USD, TREASURY AUCTION, NORTH KOREA - TALKING POINTS

US stocks add to recent losses, with the small-cap Russell 2000 leading the charge lower

Five-year Treasury note auction shows increased demand for bonds, sending yields lower

NZD/USD selloff may continue after slicing below a key psychological price level

US stocks peeled back across the major indexes on Wednesday as demand for US government bonds picked up. Small-cap stocks led the decline during the New York trading session, with the Russell 2000 closing 2.35% lower, its third consecutive loss. Technology stocks also saw heavy losses, reflected in the Nasdaq 100s 1.68% decline. Elsewhere, the S&P 500 dipped 0.55%, while the Dow Jones Industrial Average closed nearly unchanged after giving up gains into the close.

Yields on Treasuries across the curve continued to shift lower after Wednesday morning‘s note auction revealed robust demand for the 5-year. The Treasury Department auctioned $61 billion, with the bid-to-cover ratio – a measure for demand – ticking up to 2.36 from the prior month’s 2.24 level. The 5-year yield dropped 1.55%, while the closely watched 10-year yield moved 0.85% lower.

RUSSELL 2000, 10-YEAR TREASURY YIELD – 30 MINUTE CHART

Chart created with TradingView

THURSDAYS ASIA-PACIFIC OUTLOOK

Asia-Pacific stocks appear set for a lackluster open after Wednesdays session saw most major indexes move lower. Hong Kongs Hang Seng Index (HSI) dropped over 2% on news that the Chinese autonomous region would suspend Pfizer-BioNTech vaccinations due to packaging defects. The announcement represented another road bump to the major Asian financial center in its effort to vaccinate its population.

Japan‘s Nikkei 225 index was another big loser, recording its fourth consecutive loss after closing 2.04% lower. South Korea’s KOSPI fared better but still closed in the red with a 0.28% loss. The Australian ASX 200 index was a bright spot in APAC, gaining 0.50%. The upbeat performance came after the country saw better-than-expected PMI figures cross the wires. According to the DailyFX Economic Calendar, the services sector PMI reading for March came in at 56.2, up from 53.4 in the prior month.

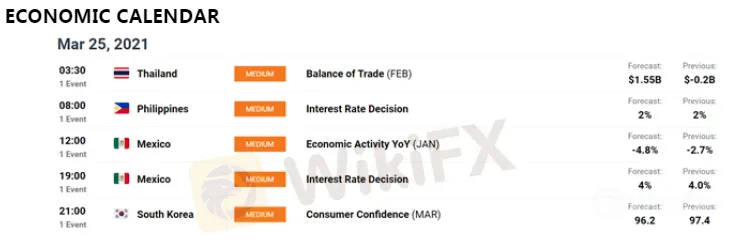

The Japanese Coast Guard reported early Thursday that North Korea may have fired a ballistic missile. Details remain sparse on the event, and markets appear to be unfazed for now. That may change, however, if these preliminary reports are confirmed, as it would likely increase military tensions in the region with global political implications. The economic calendar for today has an interest rate decision from the Philippines and Mexico. South Korea will also release consumer confidence data.

NZD/USD TECHNICAL OUTLOOK

The New Zealand Dollar is adding to overnight losses against the US Dollar following the formation of a bearish Simple Moving Average (SMA) crossover between the 20- and 50-day SMAs. NZD/USD sliced below its 0.7000 psychological level earlier this week, and more downside may be in store with an increasingly bearish MACD reading.

NZD/USD DAILY CHART

Chart created with TradingView

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

The Impact of Interest Rate Decisions on the Forex Market

STARTRADER Spreads Kindness Through Ramadan Campaign

Rising WhatsApp Scams Highlight Need for Stronger User Protections

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

How a Housewife Lost RM288,235 in a Facebook Investment Scam

The Daily Habits of a Profitable Trader

Currency Calculator