简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

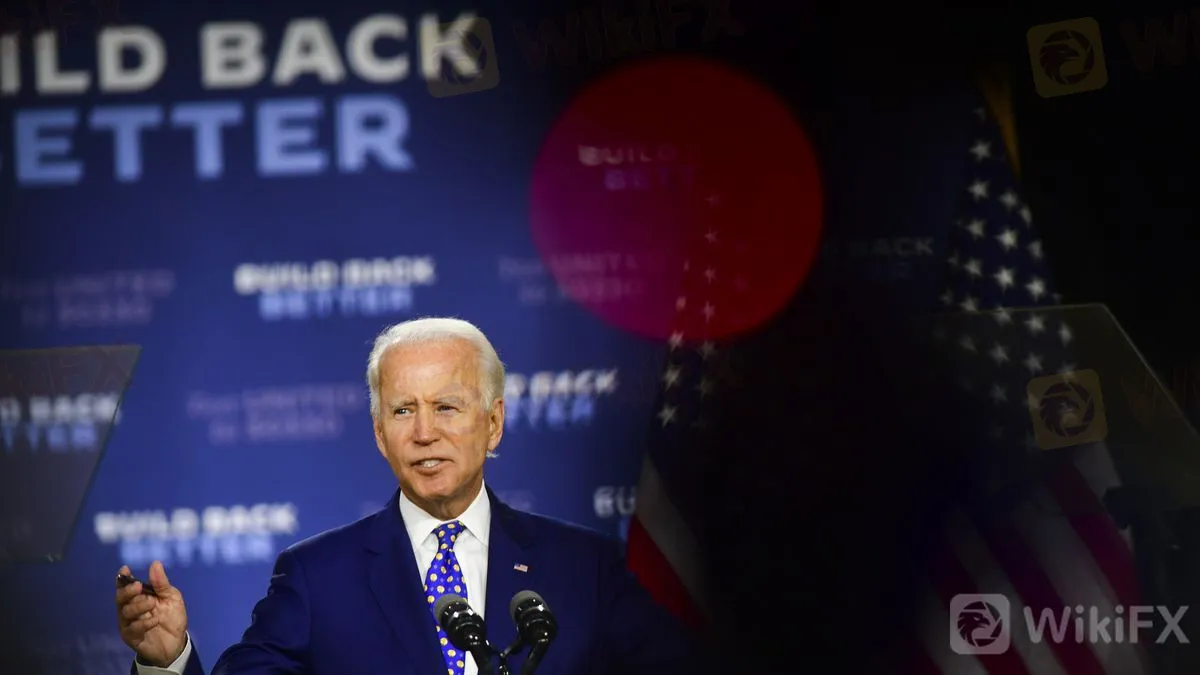

Implications Of Biden's Infrastructure Plan

Abstract:Implications Of Biden's Infrastructure Plan

Post first Blush Implications of Biden's Infrastructure plan China PMI and thoughts on selling the dollar

It's always a perilous task trying to be the fastest gun penning a market comment in Nonthaburi Bangkok (well probably the only gun), But after my first blush, I have a better read.

The fairly nonplussed reaction in equities, rates, and FX to US President Biden's infrastructure plan and it's less about it being fully priced, and more about markets struggling with its tax and spend mix implications, as well as the probability that it gets through Congress without material changes.

Trump‘s USD1 trn infrastructure plan was unfunded, whereas Biden’s USD2.25 trn proposal bakes in corporate tax hikes. Any increase in spending must be financed by future tax increases or government borrowing.

The unending fiscal debate is how economic envoys at the household level react. The Dems will argue that US consumer will not be discouraged in their spending today by corporate tax hikes tomorrow.

China PMI

Chinas March Caixin Manufacturing PMI was down to 50.6 vs 51.4 consensuses, from 50.9 in February. It's still indicating a marginal rate of improvement despite being the softest over the current 11-month period of expansion. Key findings: *Production increases again amid a further uptick in sales;*

Overseas demand became a bright spot with new export orders reaching positive territory for the first time YTD; *Prices of raw materials rose further, causing costs for manufacturing enterprises to soar, suggesting added inflationary pressures. Overall, China's manufacturing sector continued to recover in March, but the momentum slowed.

The market reaction has been pretty muted, suggesting with NFP's soon to get offered up on the dinner plate, the market has much bigger fish to fry.

Thinking about selling the dollar, choose your battlegrounds wisely

With EUR/USD approaching 1.17, the market narrative is gradually shifting that we have seen the highs for the year and that the risks are moving towards a more protracted downtrend. And scary how quickly people are into this.

News of a 4-week lockdown in France to combat rising Covid-19 cases starting this weekend appears fully priced. EURUSD is off the overnight Asia lows, and yields are drifting higher. A turnaround in EUR/USD is a necessary condition for investors to feel more confident in selling the USD.

Higher UST yields year to date have proved a major headwind for USD shorts, but looking for lower UST yields as a reason to justify USD shorts is perhaps missing a large piece of the puzzle. Instead, with a strong US-led recovery ahead, we can look to late 2016 as an environment in which USD selling was ultimately rewarded even as UST yields were rising on US infrastructure optimism.

Europe continues to badly lag the US in generating good news, which is undoubtedly the major angst point for EURO bulls. And while Economic indicators will doubtless continue to outperform in the US, but the question is about the hurdle for positive surprises, which undoubtedly at rock bottom.

Last summer's fiscal recovery plan was critical for politics. It moved the resting point for EURUSD to around 1.1700 from 1.1000. Though I'm dollar bullish, I'm not exceedingly bearish on the euro, and EURUSD could be reaching its lower limit. European vaccine rollout will improve, and Europe should start to catch up. I'm not willing to buy EURUSD, but I don't want to keep selling and prefer waiting for the market to take me out and signal a tipping point.

North Asia Trade & Mfg Rebound Continues

Providing more clarity into the global rebound, Japan's Tankan manufacturing indexbeat expectations, rising to +5 vs -1 consensus, from -10, the highest since Q3 2019.

Survey respondents expect USD/JPY to fall to 106.07 through FY 2021. However, this particular aspect of the survey lacks current informational content and tends to track the USD/JPY spot with a significant lag.

Beyond domestic economic drivers, the trajectory of UST yields remains the key driver of USDJPY.

Away from high-yielding or commodity-driven currencies, the recovery in recently-released trade data for North Asia reveals the strength of recovery that the rest of the world could see soon as the vaccine roll-out continues.

And today was no exception as Korean exports rose an on-consensus of 16.6% y/y in March vs 9.5% in February, while imports rose a below-consensus of 18.8% y/y vs 14.1% in February; the consensus was for 19.1%.

USD2 trillion over eight years and the bullish cocktail of fiscal stimulus and pent up consumer spending will propel economic growth powerfully.

President Biden began selling his infrastructure proposals today, and by all accounts, it went over exceedingly well. Investors first applauded then gobbled the array of equity market delectables on offer, spurred on by the once in generational spending splurge that continues to the tune of a massive $2 trillion ticket price. And bullishly, that would convert into 20,000 miles of rebuilt roads and a glossy catalogue of other ventures intended to create millions of jobs in the short run while strengthening Americas competitive domestic and foreign ambitions in the long run.

Whatever suggestion there was about “ everything being in the price” should be put to bed as by the looks of the price action; there is still a long catalyst runway on the reopening and vaccine narrative. Not to mention the arrival of those stimulus checks should feed directly into corporate profits, which is not necessarily reflected in earnings yet.

Markets remain incredibly resilient despite worries around rebalances. Rotation into Value continues to take hold – Europe outperforming, Banks exceeding Tech and momentum strategies seeing Value enter the composite provides an extremely powerful passive tailwind.

Vaccine rollouts remain the name of the game and drive the narrative even with the EU lagging, with investors' view that this is a function of time.

The bullish cocktail of fiscal stimulus and pent up (consumer) spending will propel economic growth powerfully. And the US consumer confidence data provided an excellent reminder of this.

I think pockets of froth exist in some reopening names, namely airlines, but it is difficult to fight this momentum en masse. Therefore relative trades remain the most prudent (long, strong balance sheets). The prospect of a meaningful summer travel recovery, as things stand in Europe, looks questionable.

Real yields rallying has boosted the cyclical and reflationary thematic aggressively this week – led by banks – but commodities have difficulty shrugging off the USD strength for now.

Markets will continue to pay close attention to the USD development while maintaining the view that the pace of the yield moves' trajectory is a potential headwind for equities rather than absolute levels. However, 2% seems to be the “consensus” headline level on the US 10yr yield that investors are looking to reassess allocations. So with that level becoming more factored into the price, investors are well on their way to calibrating their US real rate playbook for growth stocks.

Still, let's not forget the US rates debate remains at the forefront of all conversations and could eventually be the ultimate rally capper.

And with investors quickly pivoting from the Archegoes “ hair-on-fire” headlines, the fact that stocks remained at record highs even with the US yields holding higher ground suggests, at some level, the FED messaging is hearing an echo in the market with investors buying into their AIT mantra, which anchors short end rates but allows bond yields to rise, In other words, less gas but more brakes on the policy normalization front.

Finally, and not to put a wet blanket on things, passing a bipartisan bill is likely to be difficult as Republicans are saying higher taxes would be a non-starter, and the same goes for moderate Democrats Joe Manchin.

Oil Markets

We are in the midst of a very rough patch of oil as the short-lived bounce from the Suez Canal blockage has given way to another demand hit after France announced it was stepping back into the lockdown abyss. And the fragile demand recovery is begging more question than answers around the new variants that are raising alarm bells around the globe.

And while the market remains medium-term optimistic, it's hard not to stay short term defensive in the face of more lockdown, especially at this stage of the game where oil traders thought they would be mounting a solid offence not putting up a defensive front.

But the market is finding some legs on first blush to the glossy US infrastructure plans, so perhaps this could be the springboard or at least plank for prices to build a base, hopefully.

Still, traders need to position for OPEC what-ifs who in the past have been overly charitable at the cost of missing the opportunity to reintroduce some latent supply while it can before that becomes much more difficult in 2022 when shale producers could be in better financial positions.

But at the heart of it all, the rally was mainly on the back of OPEC+ production cuts—or rather, the fact that they agreed to hold production steady in April instead of ramping up production as the market had anticipated. So I suspect the oil market is experiencing a bit of reality check these days as the supercycle bulls might be giving way to the power of spare capacity as the thought of more barrels coming back continues to provide the medium-term supply headwind.

Gold Markets

With UST 10 year yields still above 1.70 and the dollar sailing on an even keel, gold seems to have been a significant beneficiary of month-end rebalancing.

It is worth highlighting going into quarter-end that gold has underperformed US 10-year bonds by 5% and US equities by around 15-20%, so if there was a need to rebalance portfolios, it is likely to be gold buying at current levels - and probably what is behind today's move.

Forex

Month-end distortions make it difficult to get an accurate read on the events of the past 24 hours, so here I'm merely commenting on the lay of the land after trading the GBPUSD higher month-end signal last night( Long GBP/USD 1.37277). I'm doubled down short GBP at 1.38062 ( s/l 1.3831) for the record.

Euro

The EUR struggles for direction this morning amid mixed signals relating to the economic outlook but weighted down buy France moving back into lockdown. The only thing is that short EUR/USD has come a long way, and as we approach a critical NFP so rather than chasing the current trend, US interday bulls might prefer to change tack and sell rallies into 1.1800, so a short term correction could be on the cards.

Malaysian Ringgit

With oil prices plummeting overnight due to France moving into lockdown, the Malaysian ringgit remains defensive. And with reopening sectors taking another hit after the government extended mobility restrictions in some areas, including KL after spot Covid outbreaks, the near term purview isn't great at the moment.

Implications Of Biden's Infrastructure Plan

----------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Stock Market Trading Volume Drops by 97.58 Billion Naira This Month

Why does your mood hinder you from getting the maximum return from an investment?

Currency Calculator