简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Quasimodo Pattern (Over and Under)

Abstract:Quasimodo Pattern (Over and Under)

TABLE OF CONTENTS:

Easy guide to trading the Quasimodo Pattern

What is the Quasimodo (Over and Under) Pattern?

Conclusion

Easy guide to trading the Quasimodo Pattern

The Quasimodo Pattern or Over and Under pattern is a relatively new entrant to the field of technical analysis in the financial markets. Although new, the Quasimodo pattern is a commonly occurring theme that is more frequent when price carves a top or a bottom or when price begins a major correction to the trend.

The Quasimodo Pattern, although complex as it might seem is actually very simple. This trading pattern is especially powerful because when it occurs, in most cases, traders will notice a confluence with other methods of analysis.

For example, when a trader spots a Quasimodo pattern near a support or resistance level, it increases the confidence of the trader or the trading probability. Likewise, when trading divergences, when you spot a Quasimodo pattern, that confluence can be used to trade the divergence set up with more confidence.

As we can see from the above, the Quasimodo pattern is not a trading strategy by itself but is more of a confluence pattern that can be used to confirm a trader‘s bias. Of course, the Quasimodo pattern doesn’t appear all the time, but when it does, traders can be sure that the market offers a high probability trade set up.

What is the Quasimodo (Over and Under) Pattern?

A Quasimodo Pattern is simply a series of Highs/Lows and Higher or Lower highs or lows.

Quasimodo Short Signal Pattern

There should be a prior uptrend in the markets

Price makes a new high, declines and makes a new local low

Price then rallies above the previous high to mark a new higher high

Price then falls to form a new lower low

Price then rises towards the initial high (but does not make a new higher high).

There should be a prior downtrend in the markets

Price makes new low then makes a small rally and forms a local high

Price then declines to form a new lower low taking out the previous low

Price then rallies to make a new higher high and then declines

The final decline is equal to the first low

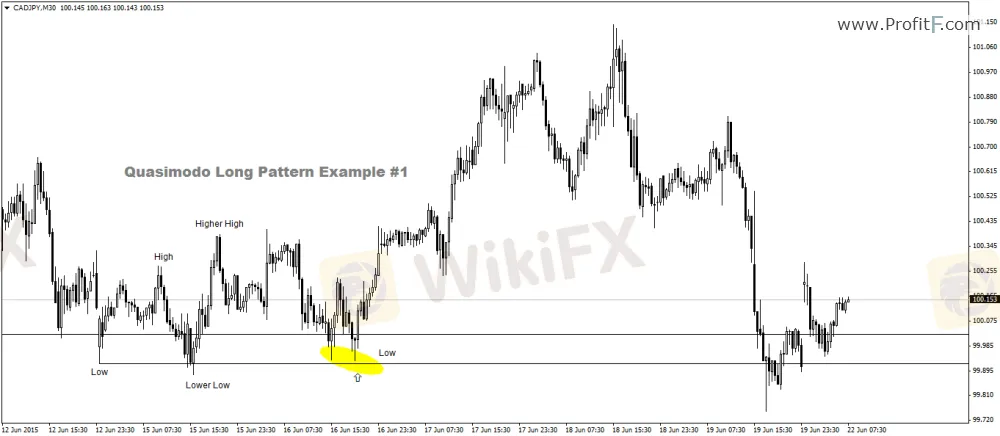

Price is in a downtrend

Price then makes a new low at 99.923 and then makes a new local high at 100.274

Price then declines and makes a new lower low at 99.983

Price then rallies to make a new higher high at 100.38 and then declines

The final leg in the decline is just a few pips above the previous low. This triggers a long signal

Price is in an uptrend

Price then makes a new high at 1.5251 and then declines to make a low at 1.5187

Price then rallies to make a higher high at 1.5321 and then declines

A new lower low is posted at 1.5165

Price then makes a modest rally and this high stalls a few pips close to/above the previous high

A short entry is then taken with stops near the highest high

There is also an additional confirmation yet again with the RSI divergence as well

The fifth level in the set up is the trigger, where a short position is taken. Stops are set above the higher high and the take profit level is up to the trader.

Quasimodo Long Signal Pattern

The fifth leg in this pattern is the trigger for long positions with stops set to at or below the lower low

Quasimodo Long Signal Pattern Examples:

Quasimodo Long Example #1

Here is another example of the Quasimodo Long example:

Quasimodo Long Example #2

-

Quasimodo Short Signal Pattern Examples:

Quasimodo Short Example #1

Another example of the Quasimodo Short pattern example is given below:

Quasimodo Short Example #2

-

Conclusion:

As we can see from the above, the Quasimodo or Over and Under pattern is a relatively simple pattern, which when used in conjunction with other trading strategies or signals offers a great way to increase the probability of a trade set up.

----------------

WikiFX, the world's No.1 broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

WikiFX Review: Something You Need to Know About Markets4you

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

Currency Calculator