简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

British Pound Price Forecast: Reopening Optimism to Drive GBP/USD Higher

Abstract:BRITISH POUND, GBP/USD, UK REOPENING, CORONAVIRUS INFECTIONS, VACCINATION RATES – TALKING POINTS:

Climbing coronavirus case numbers in several Asian nations weighed on risk appetite during APAC trade.

Reopening optimism may drive the British Pound higher against its major counterparts in the near term.

GBP/USD poised to extend gains as price remains constructively positioned above key support.

Equity markets lost ground during Asia-Pacific trade as climbing coronavirus infections in several Asian nations weighed on risk appetite. Australia‘s ASX 200 (-0.22%), Japan’s Nikkei 225 (-0.31%), and China‘s CSI 300 (-0.18%) all slid lower, while Hong Kong’s Hang Seng Index (0.12%) traded marginally higher.

In FX markets, the Japanese Yen fell against its major counterparts as the BoJ retained its dovish monetary policy stance, while the risk-sensitive Australian and Canadian Dollars climbed marginally higher. Gold prices held relatively steady alongside US 10-year Treasury yields, and crude oil rose just under 1%.

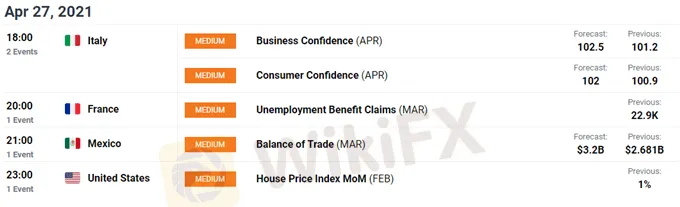

Looking ahead, US housing price index release for February headlines a rather light economic docket, with Mexicos March trade balance figures also on the schedule.

The British Pound may continue to climb higher in the near term, on the back of the nations rapid rollout of coronavirus vaccines, falling infection numbers, and progressive return to economic normality.

Covid-19 case numbers have slid to the lowest levels since September last year, placing the UK on a course to move successfully to the third stage of Prime Minister Boris Johnsons four-stage reopening plan on May 17. This next phase will see indoor hospitality and professional sporting venues reopen to the public.

A string of better-than-expected economic data releases highlight Britains robust recovery and will likely buoy the currency against its major counterparts. Retail sales figures for March substantially exceeded consensus estimates, coming in at 7.2% (estimated 3.5%), alongside strong expansionary preliminary estimates for both manufacturing and services PMI.

With that in mind, a fairly light data calendar in the week ahead may open the door for the local currency to continue riding these positive tailwinds higher.

GBP/USD DAILY CHART – 8-EMA GUIDING PRICE HIGHER

From a technical perspective, the GBP/USD exchange rates outlook remains bullish, as prices track above all six moving averages and remain constructively positioned above key psychological support at 1.3800.

With the RSI and MACD both travelling above their respective neutral midpoints, and an ascending Schiff Pitchfork guiding price higher, the path of least resistance seems skewed to the upside.

A retest of the monthly high (1.4009) looks likely in the near term if the 8-EMA (1.3875) holds firm, with a daily close above needed to bring the yearly high (1.4241) back into the crosshairs.

However, if 1.3800 gives way, a pullback to the 50% Fibonacci (1.3712) could be on the cards.

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Market Insights | January 15, 2024

U.S. stocks closed mixed. Dow Jones Industrial Average fell 118 points (-0.31%) to 37,592, S&P 500 gained 3 points (+0.08%) to 4,783, and Nasdaq 100 edged up 12 points (+0.07%) to 16,832.

Introducing Nutchaporn Chaowchuen (Tarn) - AUS Global's New Country Manager for Thailand

AUS Global appoints Ms. Nutchaporn Chaowchuen (Tarn) as Country Manager for Thailand. With expertise in trading and exceptional marketing skills, she is set to drive growth in the Thai market. Her victory in the Axi Psyquation 2019 competition underscores her trading prowess. Excited to lead, she vows to nurture partnerships and deliver top-notch services.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

HFM Introduces New Virtual Analyst

The award-winning broker brings markets closer to its clients with the use of artificial intelligence (AI)

WikiFX Broker

Latest News

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

What Can Expert Advisors Offer and Risk in Forex Trading?

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

The Most Effective Technical Indicators for Forex Trading

Indian National Scams Rs. 600 Crore with Fake Crypto Website

Lawmakers Push New Crypto ATM Rules to Fight Fraud

2025 WikiFX Forex Rights Protection Day Preview

PH Senator Probes Love Scams Tied to POGOs

Currency Calculator