简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Forecast: Busy Week Ahead for IDR, THB, SGD and PHP as NFPs Near

Abstract:US DOLLAR, SINGAPORE DOLLAR, THAI BAHT, INDONESIAN RUPIAH, PHILIPPINE PESO, INDIAN RUPEE, ASEAN, FUNDAMENTAL ANALYSIS – TALKING POINTS

US Dollar weakened against most ASEAN currencies except Singapore Dollar

Focus will be on Fed speak and US non-farm payrolls, ASEAN docket very busy

Indonesia GDP & CPI, Bank of Thailand, Philippine inflation and more are due

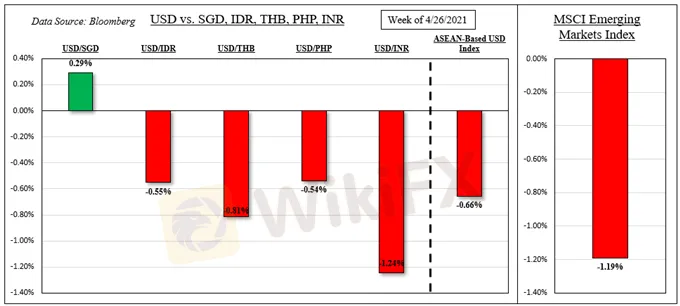

The anti-risk US Dollar finished on a downbeat against most ASEAN currencies this past week with the exception of the Singapore Dollar. This may have been due to more resilience in Thai, Indonesian and Philippine stock markets compared to overall Emerging Market sentiment. The MSCI Emerging Markets Index (EEM) closed -1.19%, weighed down by Chinese benchmark stock indexes. ASEAN currencies can be quite sensitive to overall risk appetite and the direction of capital flows. Month-end rebalancing may have appeared to have the most impact in USD/SGD as the last trading week of April wrapped up.

US DOLLAR, MSCI EMERGING MARKETS INDEX – LAST WEEK‘S PERFORMANCE

A still-dovish Federal Reserve failed to materially boost sentiment given the turnaround in market mood on Friday. But, the central bank’s view to look at near-term inflationary pressures as transitory may keep Treasury yields depressed for the time being. This could keep fears about ASEAN foreign debt repayment woes from taking off. The risk of a rising Greenback may however keep investors on their toes.

Having said that, Federal Reserve Bank of Dallas President Robert Kaplan noted that he is ready to start talking about tapering quantitative easing. But, it should be noted that he is not a voter in this year‘s FOMC. Mr Kaplan will be speaking again next week. This will be in addition to Mary Daly and Charles Evans, presidents of the San Francisco and Chicago branches respectively. They are voters in this year’s committee.

The week will then wrap up with Aprils non-farm payrolls report. Almost 1 million jobs are anticipated to be added, up from 916k prior. The unemployment rate is also expected to decline to 5.7% from 6.0% previously. More attention may be placed on average hourly earnings for further insight into where inflationary pressures could be going in the coming months.

ASEAN, SOUTH ASIA EVENT RISK – BANK OF THAILAND, INDONESIA GDP & CPI, PHILIPPINE INFLATIONThe ASEAN docket is fairly busy ahead. USD/IDR will be eyeing Indonesian CPI data at the start of the week. Then on Wednesday, the Indonesian Rupiah may see some volatility around local first-quarter GDP data. Growth is expected to shrink 0.85% q/q. But, the Bank of Indonesia has close eyes on the exchange rate and may step in should its currency depreciate too swiftly on a disappointing print.

Meanwhile, USD/THB will be awaiting the Bank of Thailand interest rate announcement on Wednesday. The benchmark rate is expected to remain unchanged at 0.50%. While expectations of a cut this year are fairly slim, the BoT is watching its currency closely. A surge in coronavirus cases, particularly in Bangkok, is undermining the nations economic recovery given a fragile tourist industry.

Elsewhere, USD/PHP is eyeing inflation data on Wednesday. CPI is expected to clock in at 4.7% y/y in April, up from 4.5% prior. This is above the Philippine central banks 2 – 4% target range. But, Bangko Sentral ng Pilipinas may look beyond near-term price pressures as a supply shock. USD/SGD has Singapore retail sales to look forward to as well, with transactions to increase 7.1% y/y in March, up from 5.2% prior.

Check out the DailyFX Economic Calendar for ASEAN and global data updates!

On April 30th, the 20-day rolling correlation coefficient between my ASEAN-based US Dollar index and the MSCI Emerging Markets index changed to -0.70 from -0.64 one week ago. Values closer to -1 indicate an increasingly inverse relationship, though it is important to recognize that correlation does not imply causation.

ASEAN-BASED USD INDEX VERSUS EEM AND TREASURY YIELDS – DAILY CHART

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Weekly Fundamental Gold Price Forecast: Hawkish Central Banks a Hurdle

WEEKLY FUNDAMENTAL GOLD PRICE FORECAST: NEUTRAL

Gold Prices at Risk, Eyeing the Fed’s Key Inflation Gauge. Will XAU/USD Clear Support?

GOLD, XAU/USD, TREASURY YIELDS, CORE PCE, TECHNICAL ANALYSIS - TALKING POINTS:

British Pound (GBP) Price Outlook: EUR/GBP Downside Risk as ECB Meets

EUR/GBP PRICE, NEWS AND ANALYSIS:

Dollar Up, Yen Down as Investors Focus on Central Bank Policy Decisions

The dollar was up on Thursday morning in Asia, with the yen and euro on a downward trend ahead of central bank policy decisions in Japan and Europe.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

IG 2025 Most Comprehensive Review

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

Should You Choose Rock-West or Avoid it?

Franklin Templeton Submitted S-1 Filing for Spot Solana ETF to the SEC on February 21

Scam Couple behind NECCORPO Arrested by Thai Authorities

Top Profitable Forex Trading Strategies for New Traders

Currency Calculator