简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Japanese Yen Technical Analysis: AUD/JPY, GBP/JPY, USD/JPY Key Levels

Abstract:JAPANESE YEN, AUD/JPY, GBP/JPY, USD/JPY, CYCLE ANALYSIS – TALKING POINTS:

Cycle analysis suggests the Japanese Yen may be at risk of extended losses against its major counterparts in the coming months.

Ascending Triangle hints at gains for AUD/JPY rates.

Ascending Channel pattern guiding GBP/JPY rates higher.

Key support at 109.00 holding firm for USD/JPY.

The Japanese Yen has faced significant headwinds in recent weeks, as climbing sovereign bond yields put the carry-trade back in vogue. This dynamic looks set to endure over the near-term and may open the door to further losses for JPY. Here are the key levels for AUD/JPY, GBP/JPY and USD/JPY rates.

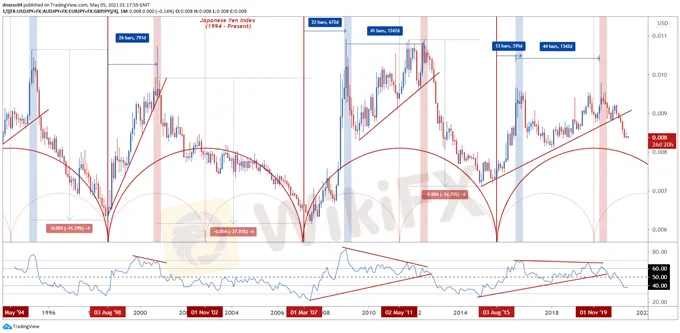

MAJORS-BASED JAPANESE YEN INDEX MONTHLY CHART

The chart above highlights the cyclical pattern displayed by the Japanese Yen over the past 37 years, with the currency largely adhering to what appears to be an 8-and-a-half year rotation. JPY set significant bottoms against its major counterparts in late 1998, early 2007 and late 2015.

After bottoming out, the haven-associated currency then seems to outperform early in the cycle, with key highs posted roughly two years after the 1998 and 2007 lows.

Although the Yen soared to its initial cyclical high just 13 months after the start of the period, the development of price over the last five years looks strikingly similar to the previous bullish cycle.

With that in mind, the convincing break below uptrend support extending from the December 2014 low – combined with the RSI snapping its 73-month uptrend and sliding to its lowest levels in six years – may foreshadow extended losses for JPY in the coming months.

Cycle analysis suggests that the currency could fall an additional 25% from current levels before bottoming out in early 2024.

AUD/JPY DAILY CHART – ASCENDING TRIANGLE IN PLAY

AUD/JPY rates appear poised to break higher in the coming days, as prices continue to consolidate within a bullish Ascending Triangle pattern.

With the RSI and MACD indicator tracking above their respective neutral midpoint, and the moving averages stacked in a bullish formation, the path of least resistance seems higher.

A daily close above triangle resistance and the 85.45 handle probably validates bullish potential and clears a path for the exchange rate to fulfil the patterns implied measured move (88.29).

However, if resistance holds firm, a pullback to the trend-defining 55-EMA (83.32) could be in the offing

GBP/JPY DAILY CHART – ASCENDING CHANNEL GUIDING PRICE HIGHER

The GBP/JPY exchange rates technical outlook also remains overtly bullish, as prices track above all six moving averages and within the confines of an Ascending Channel.

A bullish crossover on the MACD, in tandem with the RSI holding above its neutral midpoint, suggests that bulls are still firmly in charge of the exchange rate.

Gaining a firm foothold above 152.55 on a daily close basis would probably precipitate a retest of the yearly high (153.41), with a convincing push above signalling the resumption of the primary uptrend and bringing the 127.2% Fibonacci (155.08) into the crosshairs.

However, if 152.50 neutralizes near-term buying pressure, a downside push back to the trend-defining 55-EMA (149.58) may eventuate.

USD/JPY DAILY CHART – 109.00 LEVEL CAPPING DOWNSIDE POTENTIAL

USD/JPY rates may also extend recent gains, as buyers drive the exchange rate back above the 109.00 handle.

Bullish MA stacking, and the RSI eyeing a push above 60, suggests that further gains are in the offing in the near term.

Ultimately, a daily close above range resistance at 109.60 – 109.85 is needed to trigger a more impulsive upside move and bring the yearly high (110.97) into focus.

On the other hand, sliding back below the 8-EMA (108.98) may intensify selling pressure and carve a path for the exchange rate to retest range support at 108.40 – 108.60.

==========

WikiFX, a global leading broker inquiry platform!

Use WikiFX to get free trading strategies, scam alerts, and experts experience!

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Market Insights | January 15, 2024

U.S. stocks closed mixed. Dow Jones Industrial Average fell 118 points (-0.31%) to 37,592, S&P 500 gained 3 points (+0.08%) to 4,783, and Nasdaq 100 edged up 12 points (+0.07%) to 16,832.

Introducing Nutchaporn Chaowchuen (Tarn) - AUS Global's New Country Manager for Thailand

AUS Global appoints Ms. Nutchaporn Chaowchuen (Tarn) as Country Manager for Thailand. With expertise in trading and exceptional marketing skills, she is set to drive growth in the Thai market. Her victory in the Axi Psyquation 2019 competition underscores her trading prowess. Excited to lead, she vows to nurture partnerships and deliver top-notch services.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

HFM Introduces New Virtual Analyst

The award-winning broker brings markets closer to its clients with the use of artificial intelligence (AI)

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Why More People Are Trading Online Today?

Broker Comparison: FXTM vs XM

Currency Calculator