简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Breaking News: India Wants Crypto!

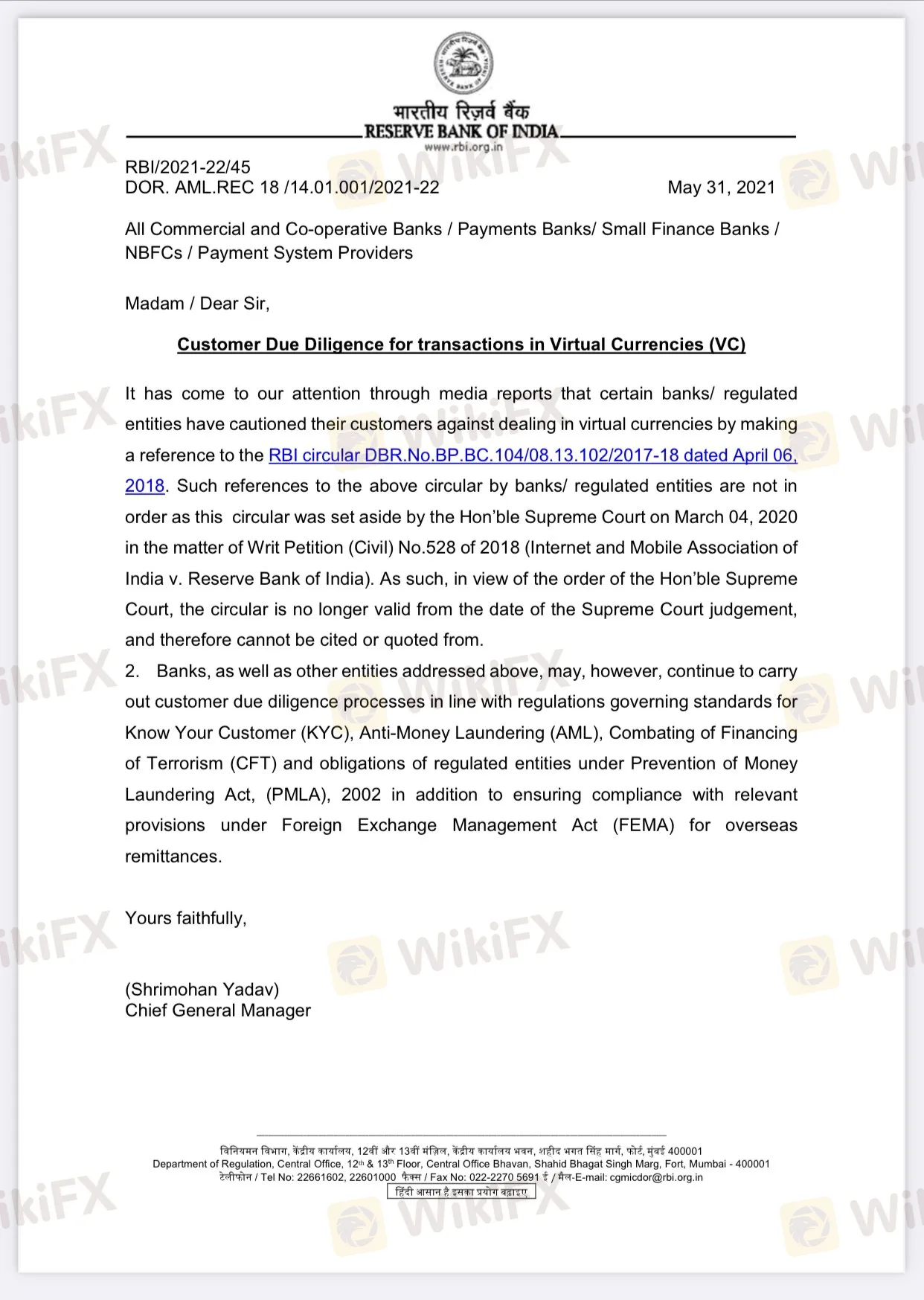

Abstract:RBI tells Indian banks they can't stop people investing In Cryptocurrency.

The Reserve Bank of India has put out a clarification in the face of India's biggest private and public banks respectively sending their customers letters against the trading of virtual currencies wherein they had cited an RBI circular from 2018. That circular, which had prohibited dealing in cryptocurrencies, was later quashed by the Supreme Court. In its new statement issued amid HDFC Bank and SBI's letters to their customers, the RBI has made clear that its 2018 circular no longer stands and must not be cited in such a fashion. It has, however, recommended due-diligence by banks on matters such as money-laundering and KYC which has in the past been cited as a potential ill-use of cryptocurrencies.

Earlier, HDFC Bank Limited and State Bank of India (SBI) had begun sending cautionary emails to their customers against cryptocurrency transactions and warned them of having services curtailed. According to emails sent by the banks to its customers who posted the screenshots on social media, the authorities inquired about the customers transactions involving digital currencies including Bitcoin. HDFC and SBI both cited the 2018 circular from the Reserve Bank of India (RBI) even though it has long since been struck down by the Supreme Court. Similar emails were sent to customers of other organisations including SBI Cards and Payment Services with a warning to lose its services.

According to an email sent by HDFC Bank to Sanat Mehrotra, the private lender said, “We have observed that your account reflects probable virtual currency transactions which arent permitted as per RBI guidelines.” The snapshot of the received mail was posted on Twitter by the crypto investor who argued that “Given crypto being deliberated by lawmakers, is this not harassment?”

“To comply with the regulatory guidelines (RBI vide guidelines DBR.No.BP.BC.104 /08.13.102/2017-18 dated April 06,2018), the Banks are advised to exercise due diligence by closely examining the transactions carried out in the account on an ongoing basis,” the email added.

However, the Supreme Court has already scrapped the central bank circular on cryptocurrencies in March 2020 citing “proportionality” and saying that the RBI failed to show the damage the virtual currencies are doing to the entire financial system.

Emails sent to SBI Card customers

Apart from HDFC, emails have also gone out from SBI Card to its customers saying, “Please note, usage of credit card for transactions on virtual currency merchant platforms may lead to suspension/cancellation of your SBI Credit Card in terms of the Cardholder Agreement.”

Stay tuned for more!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

IG 2025 Most Comprehensive Review

Top Profitable Forex Trading Strategies for New Traders

EXNESS 2025 Most Comprehensive Review

New SEC Chair Paul Atkins Targets Crypto Regulation Reform

ED Exposed US Warned Crypto Scam ”Bit Connect”

Currency Calculator