简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Australian Dollar Pops as the RBA Leaves Taper Plan in Place. Now What?

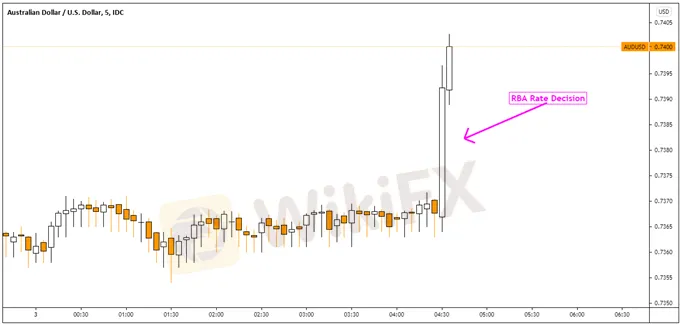

Abstract:AUSTRALIAN DOLLAR, AUD/USD, RBA, NFPS, TECHNICAL ANALYSIS – MARKET ALERT Australian Dollar gains on RBA as central bank leaves taper plan alone Fairly confident outlook in the medium-term overshadows near-term risks AUD/USD testing 20-day Simple Moving Average, watch for a breakout

The Australian Dollar rallied after the Reserve Bank of Australia updated its latest monetary policy announcement in August. As anticipated, the central bank left the benchmark cash rate target at 0.10 percent. What likely drove investors to buy Aussie Dollars was that the RBA left alone its plan to reduce the amount of weekly asset purchases to A$4 billion in September from the current pace of 5b.

Since July‘s interest rate decision, lockdowns across parts of Australia amid the emerging Delta Covid variant have been denting local growth prospects. This was pushing Australian government bond yields lower as traders priced in a more dovish central bank. There were also rising expectations that the central bank could reverse July’s decision to reduce weekly asset purchases later this year given these developments.

ADDITIONAL RBA HIGHLIGHTS (COMMENTARY REPORTED BY BLOOMBERG):Sees Australian economic outlook in the coming months as uncertain

Sees growth at a ‘little over’ 4% in 2022, then around 2.5% over 2023

Will consider economic, health situation towards the policy outlook

The economy is still expected to grow strongly again next year

All things considered, the central bank seemed fairly confident about the economic outlook in the long run. Even though there have been lockdowns, the RBA noted that past experience has shown that the ‘economy bounces back quickly’. GDP is expected to decline in the third quarter. Despite some downward revisions to the outlook, the RBA seems confident in proceeding as normal, offering the Aussie Dollar some relief.

The road ahead arguably remains uncertain. China, Australia‘s largest trading partner, placed millions under a strict lockdown amid rising Covid cases. If growth falters in the world’s second-largest economy, then that pain could be felt in Australia. AUD/USD might find some relief if a softer-than-expected US non-farm payrolls report further tempers Fed tapering bets. But, an outsized miss could induce risk aversion.

AUD/USD RBA REACTION 5-MINUTE CHART

From a technical standpoint, the broader focus for AUD/USD still seems to be pointed to the downside. A bearish crossover between the 50- and 200-day Simple Moving Averages (SMAs) is hinting towards a downward bias. Keep a close eye on the near-term 20-day SMA. A breakout above this line, with confirmation, may open the door to a push higher in the short run. Otherwise, extending under key support at 0.7290 exposes the 78.6% Fibonacci retracement at 0.7209.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Easy Trading Online Awarded “Best Forex Broker - Asia” at Wiki Finance EXPO 2024 Hong Kong

We are thrilled to announce that Easy Trading Online has been awarded the “Best Forex Broker - Asia” at the Wiki Finance EXPO 2024 Hong Kong! This prestigious recognition underscores our commitment to excellence and dedication to providing top-notch services to our clients.

Celebrating Excellence of Easy Trading Online at 2024 FastBull Awards Ceremony

On the evening of April 28, Easy Trading Online proudly received the 'Most Trusted Forex Broker' award at the BrokersView 2024, hosted by Fastbull. This accolade is a testament to our steadfast dedication to providing reliable and superior trading services in the forex and CFD brokerage industry.

Easy Trading Online Shines as Gold Sponsor at BrokersView Expo Dubai 2024

The BrokersView Expo Dubai 2024 is a premier event in the financial industry, bringing together top financial institutions, brokers, and technology providers from around the globe. As the Gold Sponsor of BrokersView Expo Dubai 2024, Easy Trading Online took the opportunity to showcase our latest products, service technologies, and core competitive advantages in the forex trading field.

Easy Trading Online at the Wiki Gala Night

On the 23rd of March, the Easy Trading Online family had the distinguished pleasure of being the Table Sponsor at the prestigious Wiki Gala Night. As we reflect on the event, it’s with a sense of pride and joy that we share the highlights and our takeaways from an evening that was as inspiring as it was splendid.

WikiFX Broker

Latest News

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

SEC Fines Velox Clearing $500,000 for SAR Failures

Global Panic Builds as Forex Shifts into Risk-Off Mode

Shocking! Oil Prices Plunge Below $60

Singapore Authorities Warned Against WeChat, UnionPay, Alipay Impersonation Scams

The Dark Side of Trading Gurus: Are You Following a Fraud?

WikiFX Forex Prediction Challenge

Gold Prices Plunge: How Should Investors Respond?

Currency Calculator