Overview of CRYPTO FX

Crypto FX is a broker that operates without valid regulation, raising concerns about the oversight of its operations. Within the past three months, there have been multiple complaints lodged against Crypto FX on WikiFX, indicating customer dissatisfaction and potential issues with the broker's services. Traders should be cautious and aware of the associated risks when considering involvement with Crypto FX.

The broker offers a range of market instruments, including forex currency pairs, commodities, precious metals, stock indices, and cryptocurrencies. However, it is important to note that Crypto FX lacks transparency regarding its regulatory information, which increases the potential risk for traders.

Crypto FX provides various account types, each with its own minimum deposit requirement, maximum leverage, and spread/commission structure. Traders should carefully consider these factors based on their trading preferences and available capital.

The broker utilizes the popular MetaTrader 4 (MT4) trading platform, known for its efficient order execution and comprehensive technical analysis tools. However, the available payment methods for Crypto FX are limited to bank transfers and credit cards, which may be inconvenient for individuals who prefer alternative options like e-wallets or cryptocurrencies.

Overall, due to the lack of regulation, customer complaints, and limited payment methods, individuals should exercise caution and carefully evaluate the potential risks before considering Crypto FX as a trading option.

Pros and Cons

CRYPTO FX offers several potential advantages and disadvantages. On the positive side, it provides a range of forex currency pairs for trading, allowing traders to participate in the global foreign exchange market. Additionally, it offers the popular MetaTrader4 (MT4) trading platform, known for its comprehensive tools and efficient order execution. The broker also provides leverage up to 500:1, which allows traders to control larger positions with a smaller amount of capital. Moreover, Crypto FX offers trading opportunities in cryptocurrencies, catering to those interested in the volatile digital asset market. However, it's important to note that the broker lacks valid regulation, which may raise concerns regarding the safety and oversight of its operations. The website being unavailable can also be a drawback, limiting access to necessary information. Furthermore, Crypto FX has limited payment methods, restricted to bank transfers and credit cards, and has received negative reviews and complaints from users, indicating potential issues or dissatisfaction with the broker's services. Traders should carefully consider these factors when evaluating the suitability of Crypto FX for their trading needs.

Is CRYPTO FX Legit?

It is important to note that Crypto FX, the mentioned broker, has been found to lack valid regulation. This means that there are no governing authorities overseeing its operations. As a result, it is crucial to exercise caution and be aware of the associated risks when dealing with this broker.

Additionally, within the past three months, WikiFX, a platform for reviewing brokers, has received a total of four complaints concerning Crypto FX. This indicates a notable level of dissatisfaction or issues raised by customers during that period. It is prudent to take this information into account when considering any involvement with the broker and to carefully assess the potential risks involved.

Market Instruments

FOREX CURRENCY PAIRS: Crypto FX offers a range of forex currency pairs for trading. Traders have the opportunity to engage in the buying and selling of various major, minor, and exotic currency pairs. This allows them to participate in the global foreign exchange market and potentially capitalize on fluctuations in currency values.

COMMODITIES: Crypto FX provides trading opportunities in commodities. Traders can speculate on the price movements of commodities such as crude oil, natural gas, agricultural products, and other raw materials. This enables them to potentially benefit from changes in commodity prices driven by supply and demand dynamics.

PRECIOUS METALS: The platform also offers trading in precious metals like gold, silver, platinum, and palladium. Traders can take positions on these metals, aiming to profit from market fluctuations. Precious metals are often sought after as safe-haven assets and can serve as a hedge against inflation or economic uncertainties.

STOCK INDICES: Crypto FX provides access to trading stock indices. Traders can trade on the performance of major indices such as the S&P 500, FTSE 100, Nikkei 225, and others. This allows them to speculate on the overall direction of stock markets, without the need to trade individual stocks.

CRYPTOCURRENCIES: Crypto FX offers trading opportunities in various cryptocurrencies. Traders can participate in the volatile cryptocurrency market by speculating on the price movements of popular digital currencies such as Bitcoin, Ethereum, Ripple, and more. Cryptocurrency trading provides the potential for high volatility and opportunities for profit, but also carries inherent risks.

Pros and Cons

Account Types

Crypto FX offers a range of account types to accommodate different trading needs.

The first account type is the Micro account, which requires a minimum deposit of $100. It provides a maximum leverage of 1:500, allowing traders to control larger positions with a smaller amount of capital. The spread for this account type starts from 1 pip, which refers to the difference between the bid and ask price.

The second account type offered by Crypto FX is the Standard account. To open a Standard account, a minimum deposit of $500 is required. The maximum leverage available for this account type is 1:300. Similar to the Micro account, the spread for the Standard account starts from 1 pip.

For traders seeking more advanced features, Crypto FX provides the Premium account. This account type requires a higher minimum deposit of $25,000. It offers a maximum leverage of 1:100 and provides a spread starting from 0.6 pip. In addition to the spread, there is a commission of $6 per lot traded.

The highest tier of account offered by Crypto FX is the VIP account. To qualify for a VIP account, a minimum deposit of $100,000 is necessary. The maximum leverage for this account type is also 1:100. The spread for the VIP account starts from 0.2 pip, and similar to the Premium account, there is a commission of $6 per lot traded.

Leverage

Crypto FX provides different leverage options for its clients. The maximum leverage offered by the broker is 1:500 for the Micro account, 1:300 for the Standard account, and 1:100 for both the Premium and VIP accounts. Leverage allows traders to control larger positions in the market with a smaller amount of capital. However, it's important to note that higher leverage also increases the potential risks involved in trading. Traders should carefully consider their risk tolerance and trading strategies before deciding on the appropriate leverage level for their accounts.

Spreads & Commissions

Crypto FX offers varying spreads and commissions based on the chosen account type. The Micro and Standard accounts have spreads starting from 1 pip. The Premium account provides a spread starting from 0.6 pip, along with a $6 commission per lot traded. The VIP account offers the lowest spread starting from 0.2 pip, accompanied by the same $6 commission per lot traded. Traders should carefully consider these factors in relation to their trading strategy and preferences when selecting an account type with Crypto FX.

Account Types

Crypto FX offers different minimum deposit requirements for its various account types. The Micro account requires a minimum deposit of $100, while the Standard account has a higher minimum deposit of $500. For traders looking for more advanced features, the Premium account demands a minimum deposit of $25,000. The highest tier account, the VIP account, necessitates a significant minimum deposit of $100,000. These minimum deposit requirements allow traders to choose an account type based on their available capital and trading preferences.

Trading Platforms

Crypto FX offers the MetaTrader4 (MT4) trading platform to its clients. MT4 is widely recognized as a popular a forex trading solution. It provides users with efficient order execution capabilities and a comprehensive range of technical analysis tools. The platform also supports automated trading, allowing users to implement trading strategies using pre-set rules and algorithms. Furthermore, Crypto FX's mobile app, designed to complement the desktop version, is highly regarded for its functionality and user-friendly interface. Overall, the availability of MetaTrader4 as the trading platform of choice indicates a commitment to providing a robust and widely used solution to traders.

Payment Methods

Crypto FX offers a limited range of payment methods for making transactions. Currently, the available options are limited to bank transfers and credit cards. Customers have the choice to utilize these traditional payment methods when conducting transactions with Crypto FX. It's worth noting that the absence of alternative payment methods, such as e-wallets or cryptocurrencies, may pose certain limitations or inconveniences for individuals who prefer or rely on these options. Therefore, potential users should consider their own preferences and requirements when evaluating the suitability of Crypto FX's payment methods for their needs.

Reviews

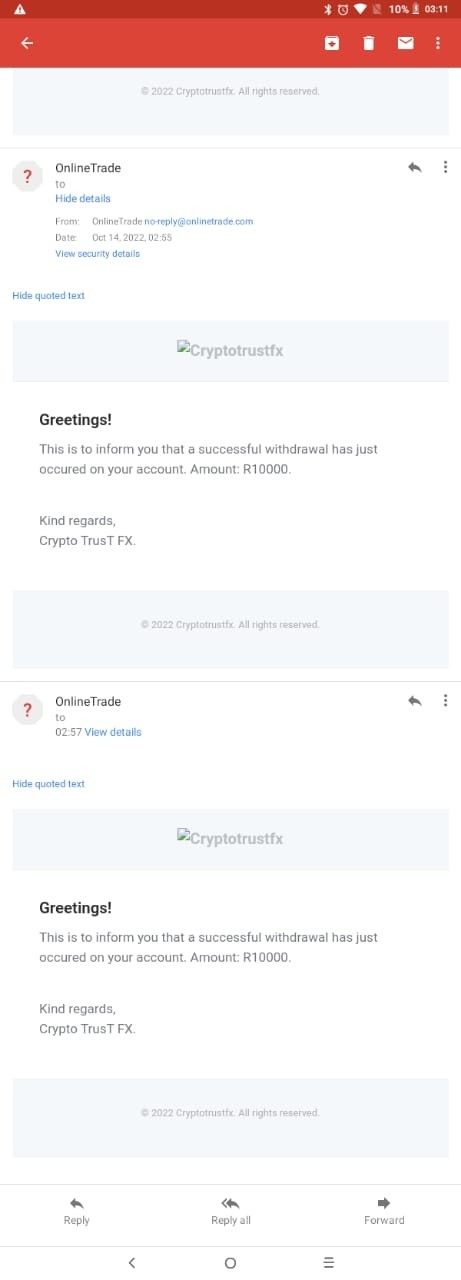

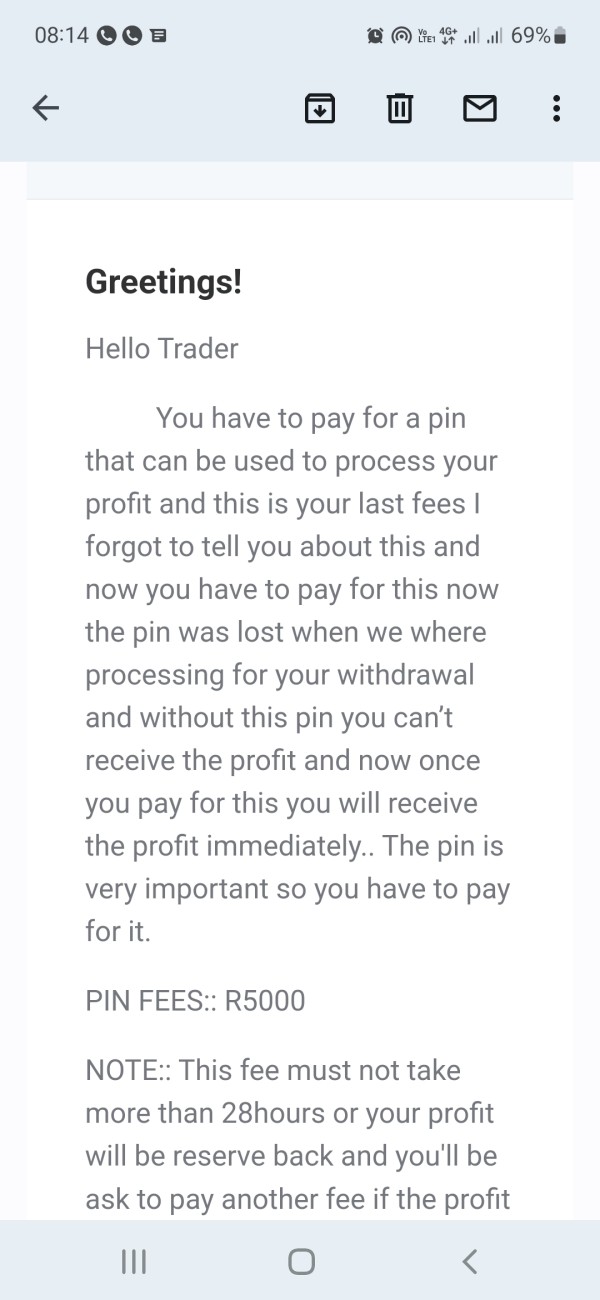

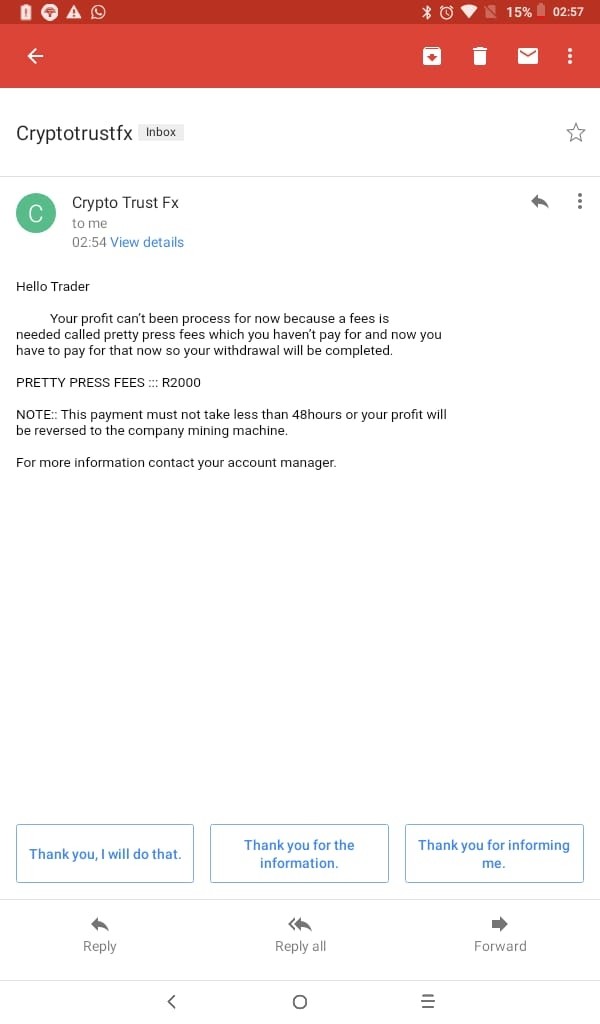

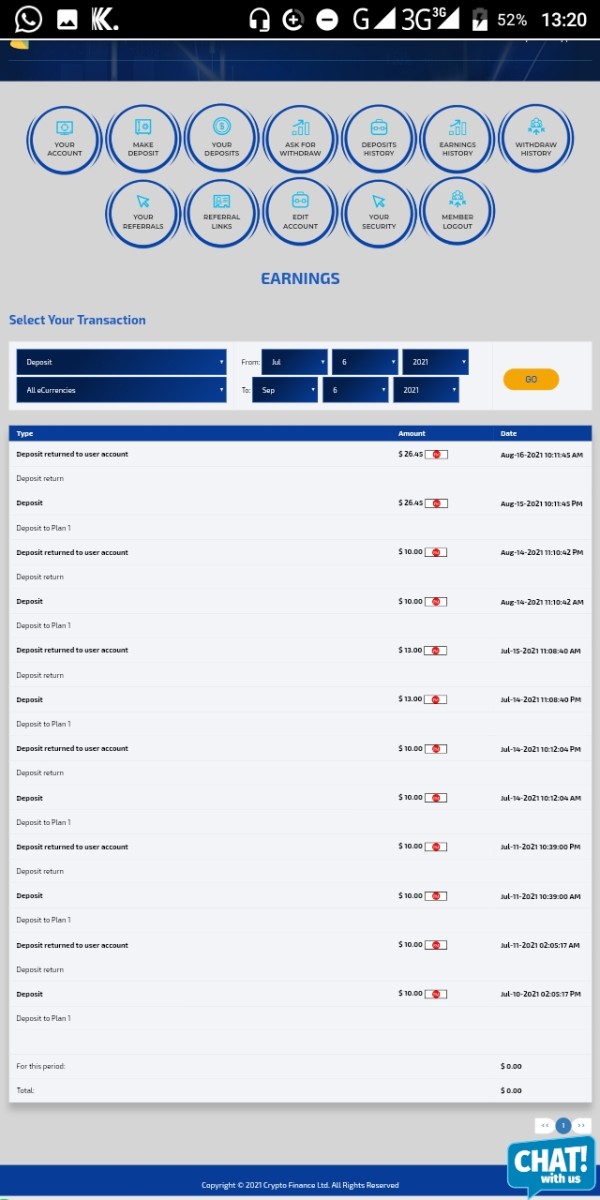

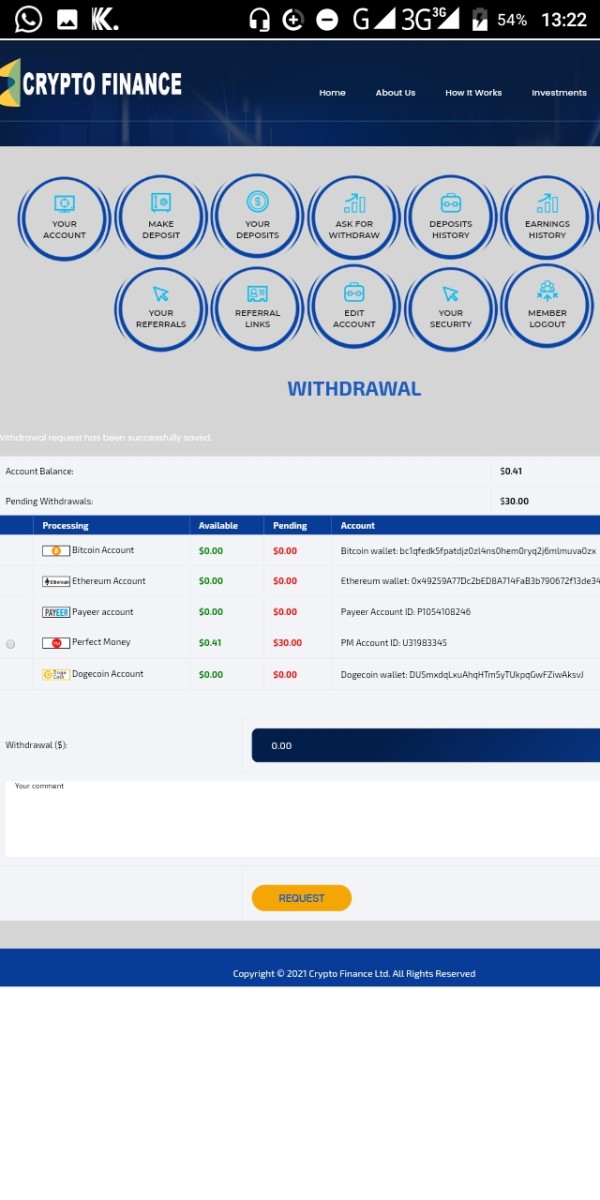

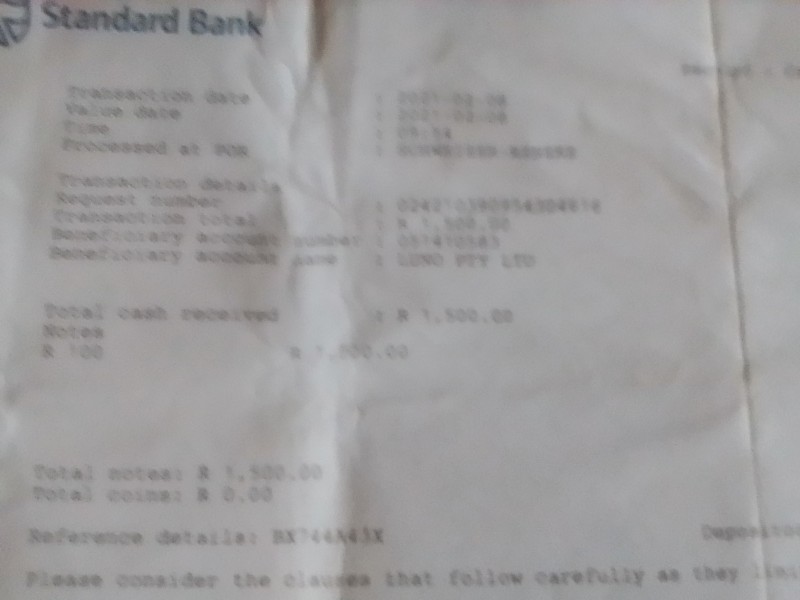

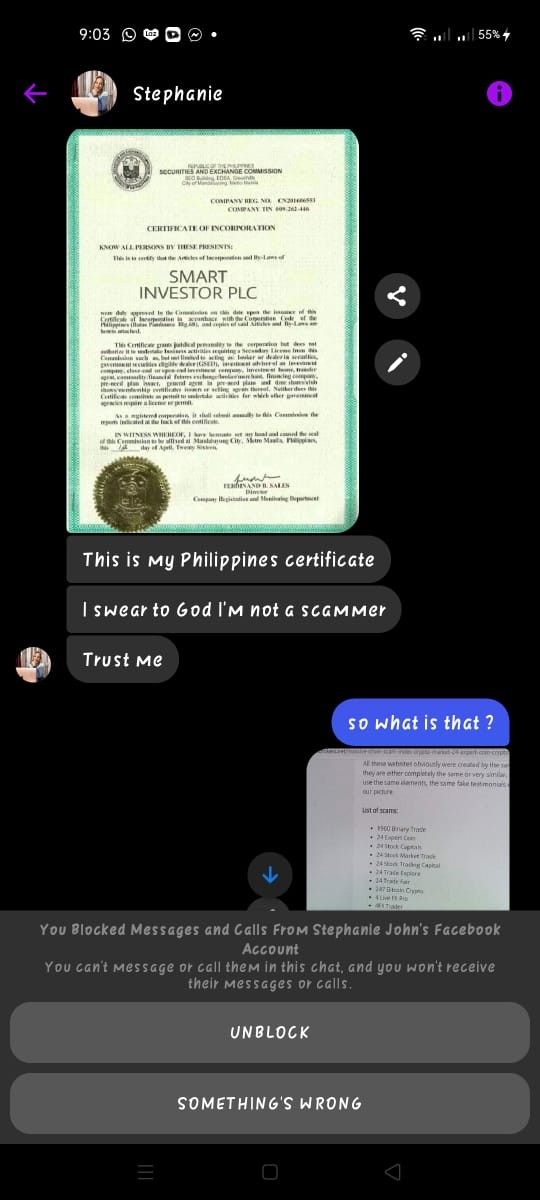

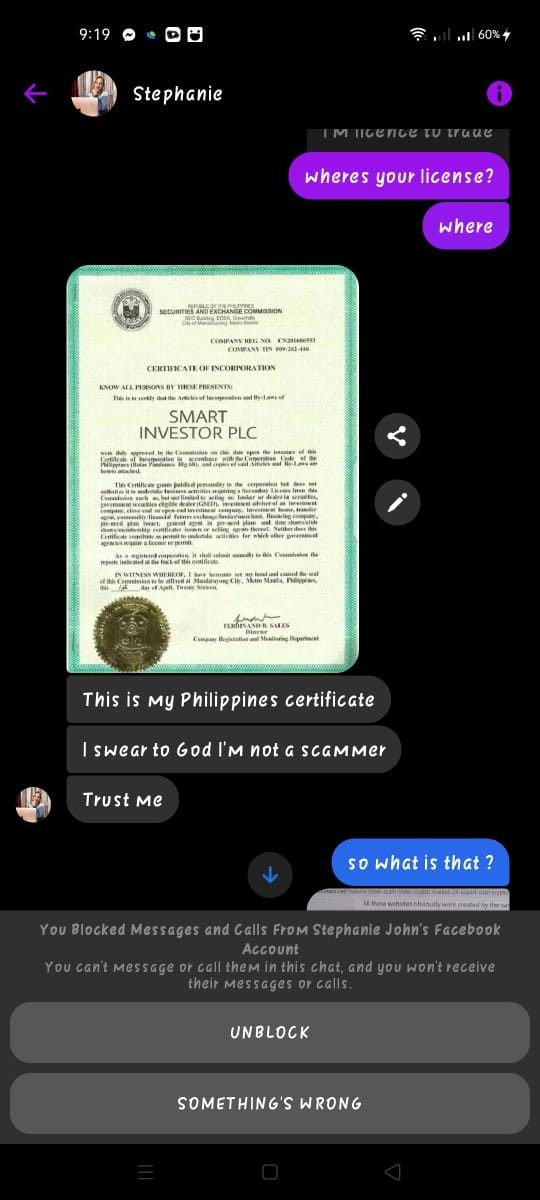

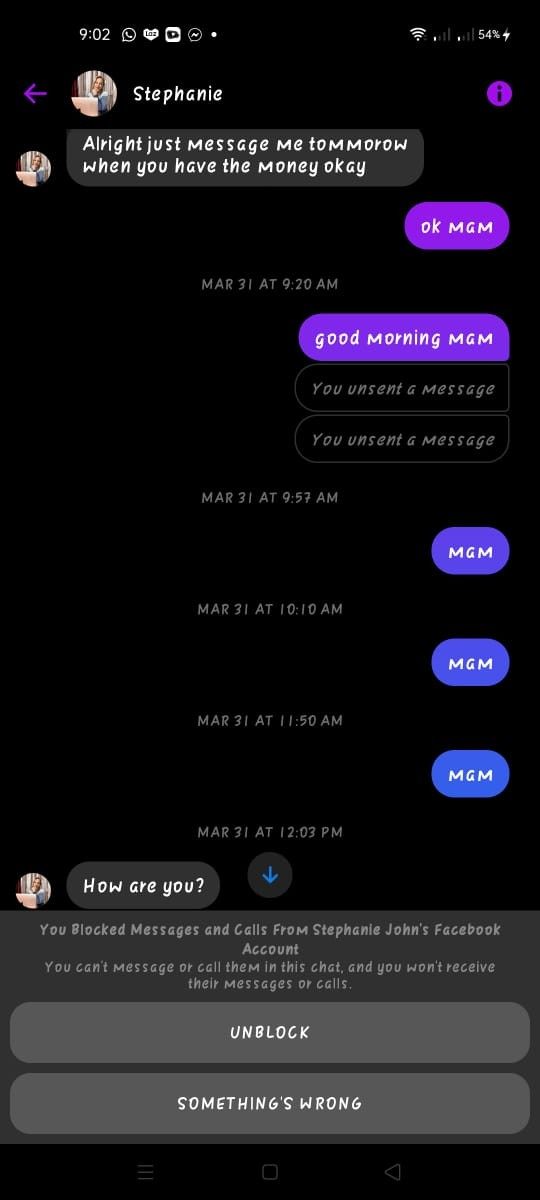

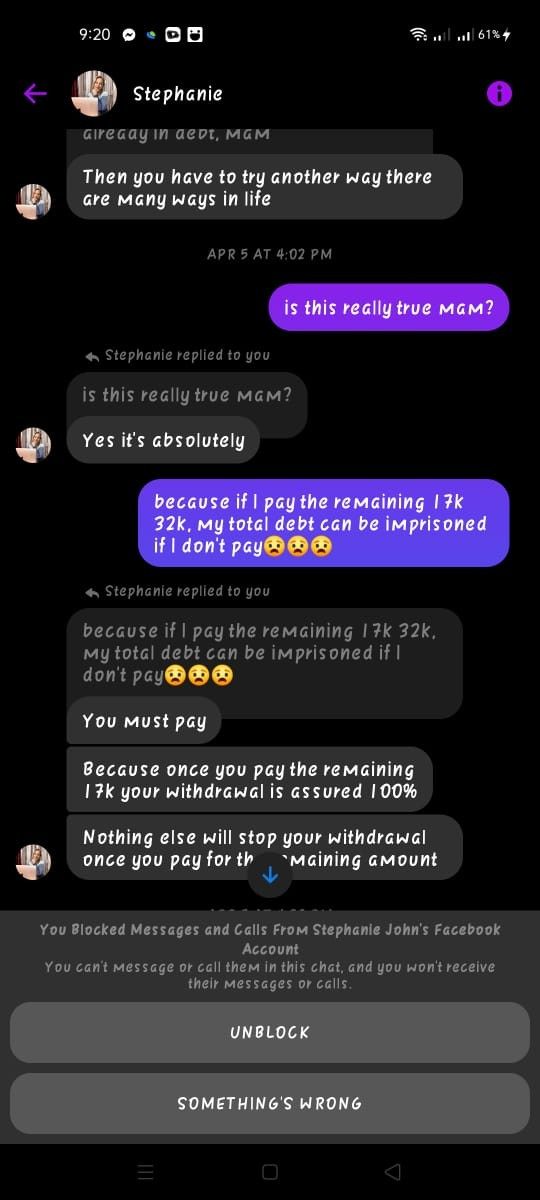

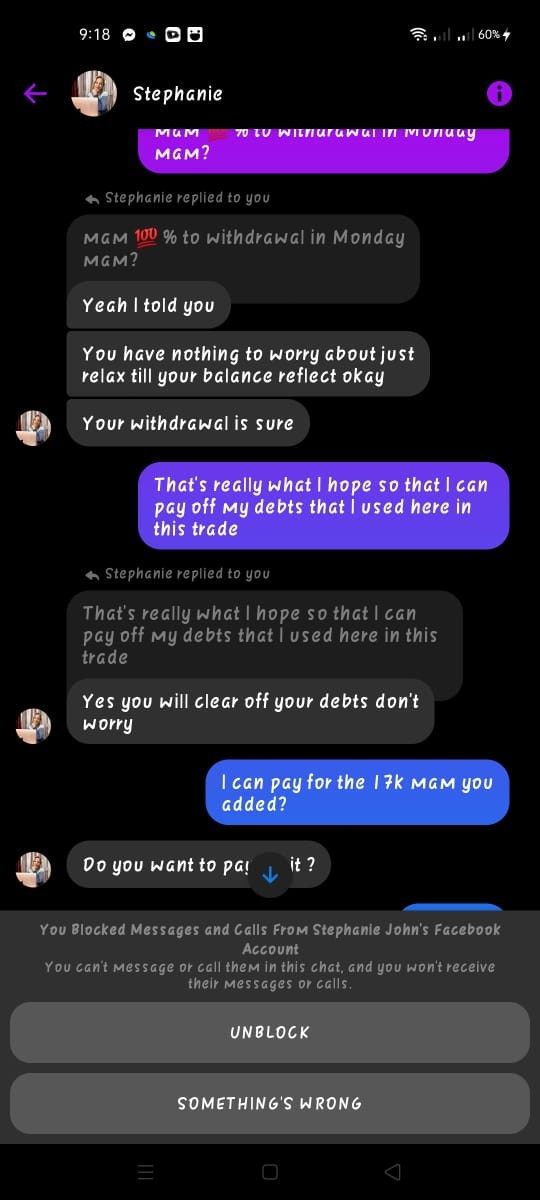

According to the reviews on WikiFX, there have been a total of five exposure cases related to Crypto FX. One user reported being unable to withdraw their funds, stating that they were asked to pay additional fees and encountered difficulties in reversing the withdrawal. Another user claimed to have been scammed, experiencing issues with withdrawing their funds and being blocked from contacting customer support. A third user expressed frustration at being scammed in the past, while another reported a lengthy withdrawal process and a requirement to pay off a debt before being able to earn money. Lastly, a user simply demanded the return of their money from Crypto FX. These reviews indicate various concerns and negative experiences related to the withdrawal process and potential scams associated with Crypto FX.

Conclusion

In conclusion, Crypto FX lacks valid regulation, which means there is no oversight from governing authorities. This lack of regulation poses potential risks to users. Furthermore, there have been several complaints reported on WikiFX regarding issues with withdrawing funds and encountering scams. The limited range of payment methods, restricted to bank transfers and credit cards, may also limit convenience for users who prefer alternative options. It is essential for individuals considering involvement with Crypto FX to exercise caution, thoroughly assess the risks involved, and take into account the negative experiences reported by users before making any decisions.

FAQs

Q: Is Crypto FX regulated?

A: No, Crypto FX currently lacks valid regulation, and there are no governing authorities overseeing its operations. Traders should be aware of the associated risks.

Q: What are the available payment methods with Crypto FX?

A: Crypto FX offers bank transfers and credit cards as the available payment methods. Alternative options such as e-wallets or cryptocurrencies are not currently supported.

Q: What types of market instruments can be traded on Crypto FX?

A: Crypto FX provides trading opportunities in forex currency pairs, commodities, precious metals, stock indices, and cryptocurrencies.

Q: What are the account types offered by Crypto FX?

A: Crypto FX offers Micro, Standard, Premium, and VIP account types, each with different minimum deposit requirements, leverage ratios, and spreads.

Q: What leverage options are available with Crypto FX?

A: Crypto FX provides leverage options of up to 1:500 for the Micro account, 1:300 for the Standard account, and 1:100 for the Premium and VIP accounts.

Q: What are the spreads and commissions with Crypto FX?

A: Spreads start from 1 pip for Micro and Standard accounts, 0.6 pip for the Premium account, and 0.2 pip for the VIP account. There is a $6 commission per lot traded for Premium and VIP accounts.

Q: What is the minimum deposit required to open an account with Crypto FX?

A: The minimum deposit requirements vary based on the account type: $100 for Micro, $500 for Standard, $25,000 for Premium, and $100,000 for VIP.

Q: What trading platform does Crypto FX offer?

A: Crypto FX offers the MetaTrader4 (MT4) trading platform, which is known for its reliability, advanced features, and compatibility with automated trading strategies.

Q: What customer support is available with Crypto FX?

A: Information regarding customer support for Crypto FX is not specified in the provided content.

Q: What are the reviews of Crypto FX on WikiFX?

A: According to WikiFX, there have been five exposure cases related to Crypto FX, with users reporting issues such as withdrawal difficulties, scams, blocked communication, and lengthy withdrawal processes.

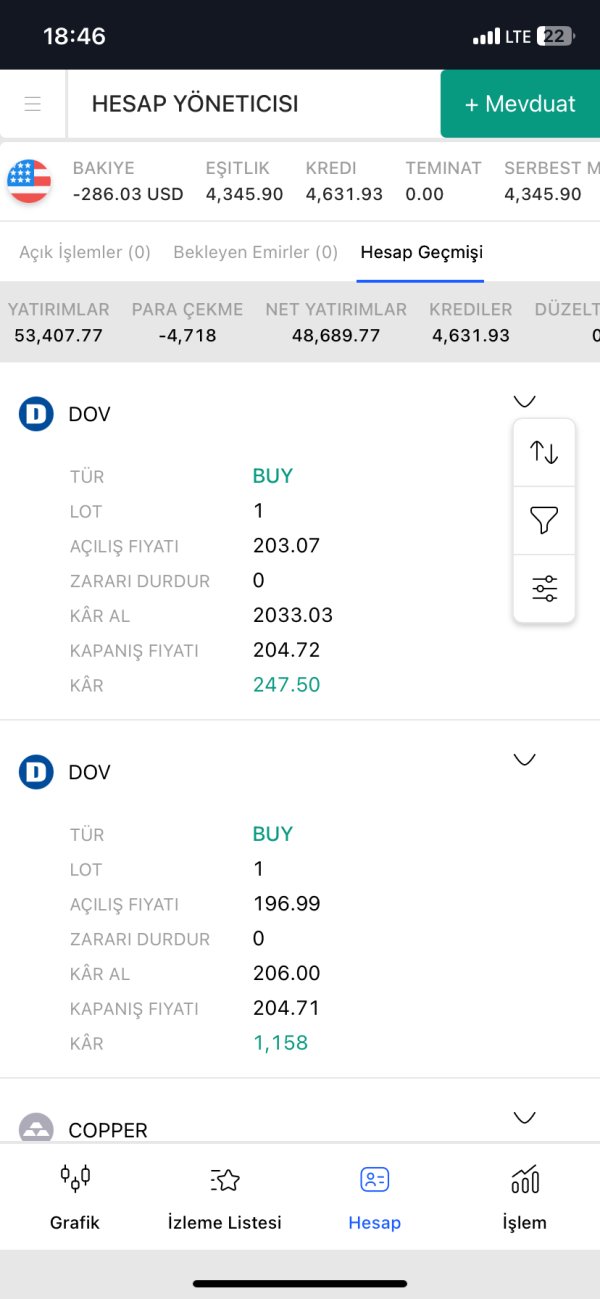

FX2808575732

Turkey

There are many victims of Cryptoxfı scammers, you can't believe what is happening right now, THOSE WHO DO NOT INVEST PLEASE

Exposure

03-02

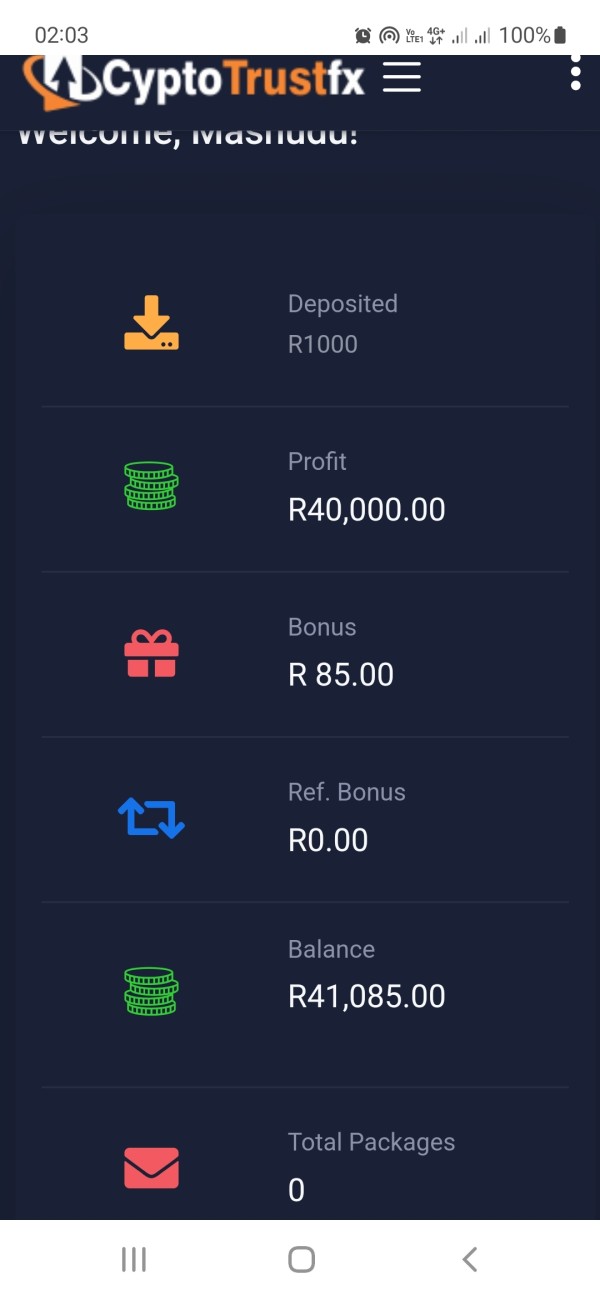

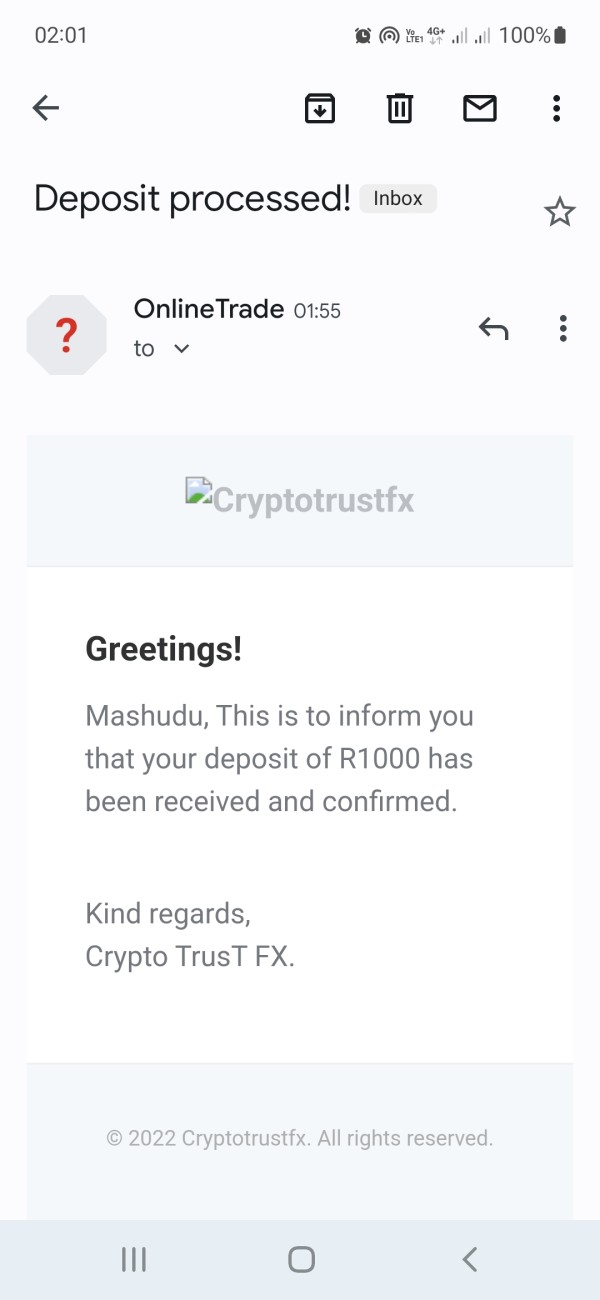

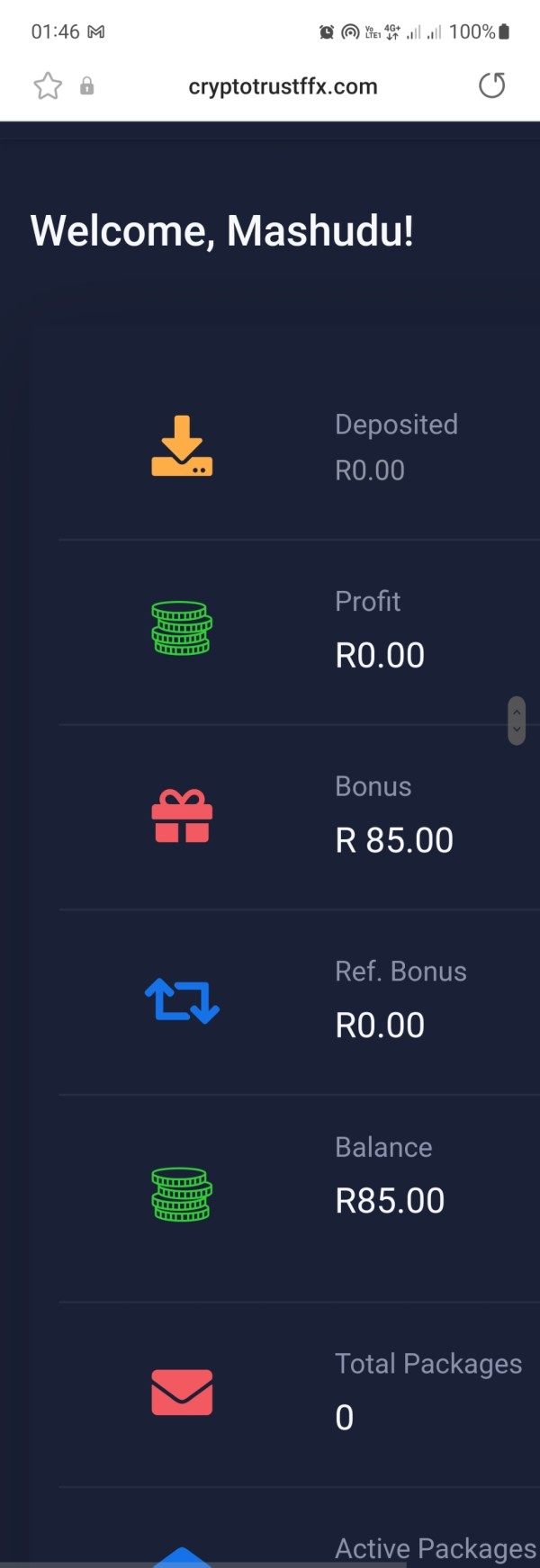

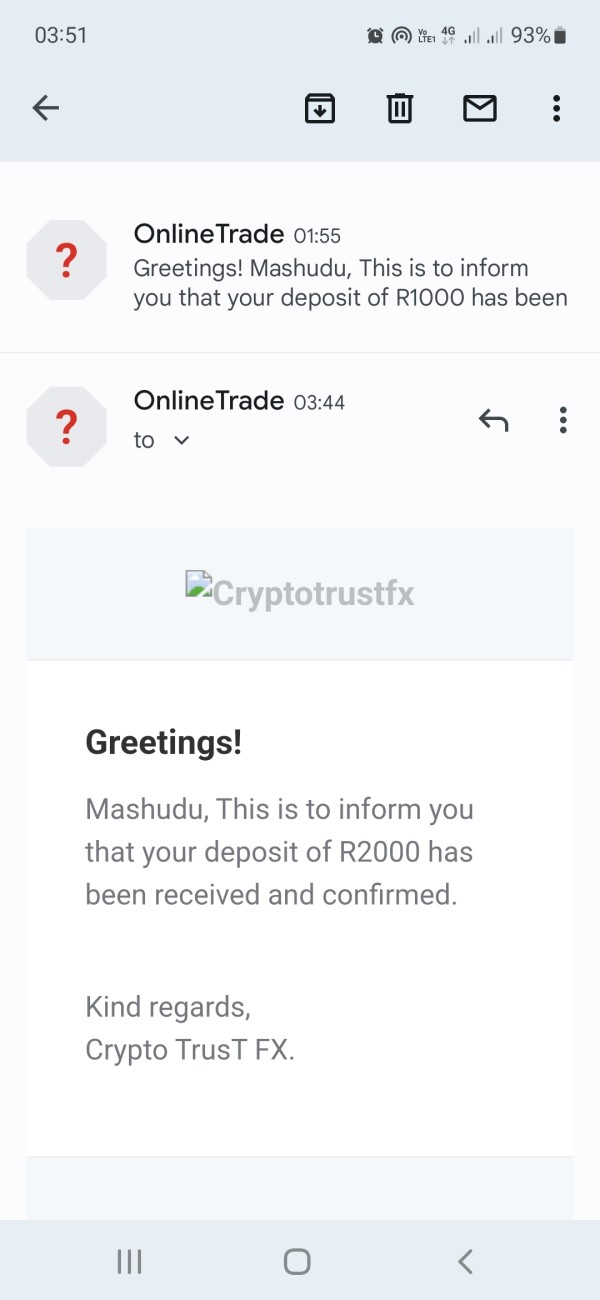

shudukie

South Africa

I invested ZAR 1000 on crypto trust fx with an hour on my account I see already profit [d83d][dcc8] 40000ZAR During withdrawal I was told I must pay ZAR 2000and I paid the amount as I was excited. withing the process of withdrawal I receive message that say I must pay for Pin which is ZAR 5000 I started notice that I was scamed. I didn't pay the amount for pin. I can see the balance. but I can't withdrawal the amount because I didn't pay for Pin. I ask to reverse my 3000ZAR as I can't get my profit .they say it's locked I can't reverse of withdrawal I must pay for Pin

Exposure

2022-10-25

Yuanjin

Nigeria

i was scammed in this platform crypto they ask me to deposit $10 after the $10 i use in investing,i only withdraw $1.5 once but my second withdrawal was stuck i chat customer care they block me from chatting them online. any time i withdraw they will refund it back .... this site is really deceiving and scamming people am a victim

Exposure

2021-09-06

FX2009088705

South Africa

I no longer working that's make me so painful this they scammed me 12500

Exposure

2021-09-03

Rey

Philippines

The withdrawal took several months. It asked me to pay the debt first before earning money.

Exposure

2021-09-01

FX8529612728

Nigeria

Return my money back cropto FX!

Exposure

2020-05-08

小如改名叫昀泽r

Egypt

Customer support team is not responsive even after multiple feedback. Experienced technical glitches many times on the Crypto FX platform, and support team could not provide a responsible explanation.

Neutral

2023-03-02

景雄

Malaysia

Crypto FX is just another shady broker, guys. They ran away so easily without giving back my money. I need to know where I can complain this broker. Guys, do you know?

Neutral

2023-02-16

Yu.s-

United States

While depositing they will give multiple options like crypto, bank transfer etc. Once you requested for withdrawal all stopped. Big scam guys. They will destroy soon by using others' blood money...

Neutral

2022-12-12